Rogers 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

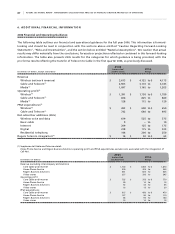

6 . A D D I T I O N A L F I N A N C I A L I N F O R M A T I O N

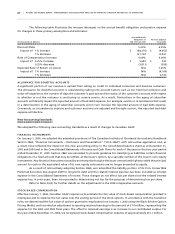

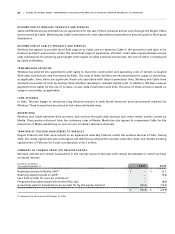

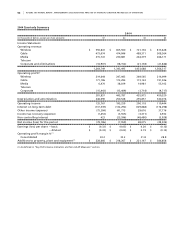

2006 Financial and Operating Guidance

The following table outlines our financial and operational guidance for the full year 2006. This information is forward-

looking and should be read in conjunction with the sections above entitled “Caution Regarding Forward-Looking

Statements”, “Risks and Uncertainties”, and the section below entitled “Material Assumptions”. We caution that actual

results may differ materially from the conclusions, forecasts or projections reflected or contained in this forward-looking

information. The table also presents 2005 results for the categories for which guidance is being provided, with the

pro forma results reflecting the transfer of Telecom to Cable in the first quarter 2006, as previously discussed.

2005

Reclassified 2006

(In millions of dollars, except subscribers) and Pro Forma Range

Revenue

Wireless (network revenue) $ 3,613 $ 4,125 to $ 4,175

Cable and Telecom(1) 2,925 3,110 to 3,185

Media(2) 1,097 1,165 to 1,205

Operating profit(3)

Wireless(4) $ 1,391 $ 1,730 to $ 1,780

Cable and Telecom(1) 834 825 to 860

Media(2) 128 115 to 120

PP&E expenditures(5)

Wireless(4) $ 492 $ 600 to $ 650

Cable and Telecom(1) 742 640 to 695

Net subscriber additions (000s)

Wireless voice and data 619 525 to 575

Basic cable 9 – to 10

Internet 209 125 to 175

Digital 238 175 to 225

Residential telephony 144 200 to 250

Rogers Telecom integration(6) $ 14 $ 50 to $ 65

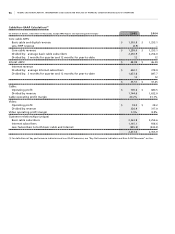

(1) Supplemental Cable and Telecom detail:

Home Phone Service and Rogers Business Solutions operating profit and PP&E expenditures exclude costs associated with the integration of

Call-Net.

2005

Reclassified 2006

(In millions of dollars) and Pro Forma Range

Revenue (excluding intercompany eliminations)

Core Cable and Internet $ 1,740 $ 1,850 to $ 1,870

Home Phone Service 300 325 to 345

Rogers Business Solutions 561 600 to 625

Video stores 327 335 to 345

Operating profit

Core Cable and Internet $ 725 $ 755 to $ 770

Home Phone Service 39 10 to 15

Rogers Business Solutions 52 45 to 55

Video stores 18 15 to 20

PP&E expenditures

Core Cable and Internet $ 515 $ 450 to $ 470

Home Phone Service 127 90 to 110

Rogers Business Solutions 86 90 to 100

Video stores 15 10 to 15