Rogers 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

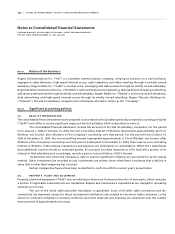

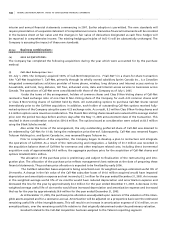

106 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

shares of the Company on the open market on behalf of the employee. At the end of each quarter, the Company

makes a contribution of 25% of the employee’s contribution in the quarter. Certain employees are eligible for a higher

percentage match by the Company. The administrator then uses this amount to purchase additional shares of the Company

on behalf of the employee. The Company records its contribution as compensation expense. The share accumulation

plan is more fully described in note 13.

The Company has a directors’ deferred share unit plan, under which directors of the Company are entitled to

elect to receive their remuneration in deferred share units. Upon resignation as a director, these deferred share units

will be redeemed by the Company not later than December 15 of the year following resignation as a director at the

then-current market price of the Class B Non-Voting shares. Compensation expense is recognized in the amount of the

directors’ remuneration as their services are rendered. The related accrued liability is adjusted to the market price of

the Class B Non-Voting shares at each balance sheet date and the related adjustment is recorded in operating income.

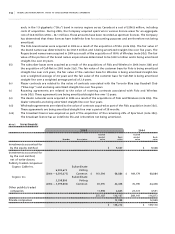

At December 31, 2005, a total of 132,698 (2004 – 160,372) deferred share units were outstanding. At December 31, 2004,

as a result of the acquisition of Wireless, the Company converted 16,517 Wireless deferred share units into 28,905 RCI

deferred share units (note 3(b)).

(q ) EA R NI N G S P ER SHA R E:

The Company uses the treasury stock method for calculating diluted earnings per share. The diluted earnings per share

calculation considers the impact of employee stock options and other potentially dilutive instruments, as described in

note 15.

(r ) US E O F ES T IM A TE S :

The preparation of financial statements requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements

and the reported amounts of revenue and expenses during the year. Actual results could differ from those estimates.

Key areas of estimation, where management has made difficult, complex or subjective judgments, often as a

result of matters that are inherently uncertain, include the allowance for doubtful accounts, the ability to use income tax

loss carryforwards and other future tax assets, capitalization of internal labour and overhead, useful lives of depreciable

assets, discount rates and expected returns on plan assets affecting pension expense and the pension asset and the

recoverability of long-lived assets, goodwill and intangible assets, which require estimates of future cash flows.

For business combinations, key areas of estimation and judgment include the allocation of the purchase price, related

integration and severance costs, as well as the determination of useful lives for amortizable intangible assets acquired,

including subscriber bases, brand names, roaming agreements, dealer network and wholesale agreements.

Significant changes in the assumptions, including those with respect to future business plans and cash flows,

could materially change the recorded amounts.

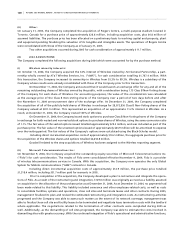

(s ) A D OPT I ON OF NEW AC C OU N T IN G P R ON O U NC E ME N TS :

(i ) Fi n an c ia l in s tr u me n ts – d i sc l osu r e a nd pre s en t at i o n:

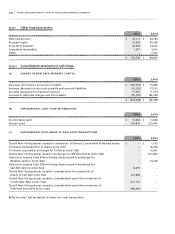

On January 1, 2005, the Company adopted the amended provisions of The Canadian Institute of Chartered Accountants’

(“CICA”) Handbook Section 3860, Financial Instruments – Disclosure and Presentation (“CICA 3860”) with retroactive

application and, as a result, has reflected the impact of this new accounting policy in the consolidated balance sheet

as at December 31, 2005 and 2004 and in the consolidated statements of income and cash flows for each of the years in

the two-year period ended December 31, 2005. CICA 3860 was amended to provide guidance for classifying as liabilities

certain financial obligations of a fixed amount that may be settled, at the issuer’s option, by a variable number of the

issuer’s own equity instruments. Any financial instruments issued by an enterprise that give the issuer unrestricted rights

to settle the principal amount for cash or the equivalent value of its own equity instruments are no longer presented

as equity.

As a result of retroactively adopting CICA 3860, the Company reclassified the liability portion of its Convertible

Preferred Securities to long-term debt and the related interest expense has been included as interest expense in the

consolidated statements of income (notes 11 and 13).