Rogers 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

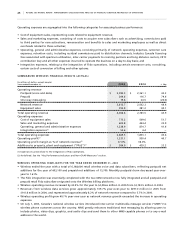

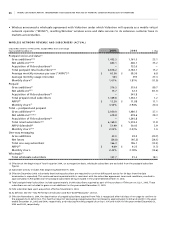

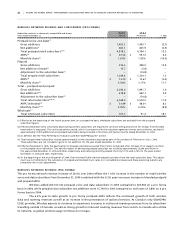

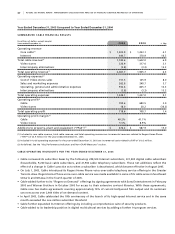

WI R E LE S S N ET W O RK RE V EN U E A N D S UB S C RI B ER S (P R O F OR M A)

(Subscriber statistics in thousands, except ARPU and churn) 20 0 5 2 0 0 4

Years ended December 31, Actual Pro Forma % Chg

Postpaid (voice and data)(1)

Gross additions 1,453.5 1,493.7 (2.7)

Net additions(2) 603.1 605.9 (0.5)

Total postpaid retail subscribers(2)(4) 4,818.2 4,184.1 15.2

ARPU(3) $ 63.56 $ 59.74 6.4

Monthly churn(2) 1.61% 1.93% (16.6)

Prepaid

Gross additions 576.5 498.0 15.8

Net additions (losses)(5) 15.7 (3.8) –

Adjustment to the subscriber base(6) – (74.8) –

Total prepaid retail subscribers 1,349.8 1,334.1 1.2

ARPU(3) $ 13.20 $ 13.67 (3.4)

Monthly churn(5) 3.54% 3.17% 11.7

Total – postpaid and prepaid

Gross additions 2,030.0 1,991.7 1.9

Net additions(2)(5) 618.8 602.1 2.8

Adjustment to the subscriber base(6) – (74.8) –

Total retail subscribers(2)(4)(5) 6,168.0 5,518.2 11.8

ARPU (blended)(3) $ 51.99 $ 48.01 8.3

Monthly churn(2)(5) 2.05% 2.25% (8.9)

Wholesale(1)

Total wholesale subscribers 107.7 91.2 18.1

(1) Effective at the beginning of the fourth quarter 2004, on a prospective basis, wholesale subscribers are excluded from the postpaid

subscriber figures.

(2) Effective December 2004, voluntarily deactivating wireless subscribers are required to continue billing and service for 30 days from the date

termination is requested. This continued service period, which is consistent with the subscriber agreement terms and conditions, resulted in

approximately 15,900 additional net postpaid subscribers being included in the three and twelve months ended December 31, 2004.

(3) As defined. See the “Key Performance Indicators and Non-GAAP Measures” section.

(4) Total postpaid retail subscribers include approximately 31,000 subscribers acquired as part of the purchase of Telecom on July 1, 2005.

These subscribers are not included in gross or net additions for the year ended December 31, 2005.

(5) Effective November 9, 2004, the deactivation of prepaid subscribers acquired from Fido is recognized after 180 days of no usage to conform

to the prepaid churn definition. This had the impact of decreasing prepaid subscriber net losses by approximately 12,000 and 44,000 in

the years ended December 31, 2005 and 2004, respectively, and reducing monthly prepaid churn by 0.10% and 0.28% for the years ended

December 31, 2005 and 2004, respectively.

(6) At the beginning of the second quarter of 2004, Fido removed 74,800 inactive prepaid customers from the retail subscriber base. This adjust-

ment was not reflected in the calculation of prepaid and blended churn rates or in net additions (losses) and these operating statistics are

presented net of such adjustments.

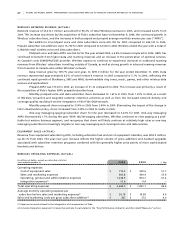

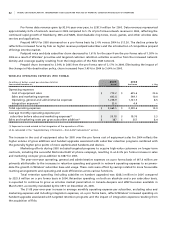

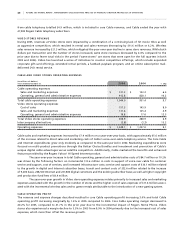

WI R E LE S S N ET W O RK RE V EN U E ( P RO FO R M A)

The pro forma network revenue increase of 20.0% over 2004 reflects the 11.8% increase in the number of retail wireless

voice and data subscribers from December 31, 2004 combined with the 8.3% year-over-year increase in blended postpaid

and prepaid ARPU.

Wireless added 603,100 net postpaid voice and data subscribers in 2005 compared to 605,900 on a pro forma

basis in 2004, while prepaid voice subscriber net additions were 15,700 for 2005 compared to net losses of 3,800 on a pro

forma basis in 2004.

The 6.4% year-to-date growth in pro forma postpaid ARPU reflects the continued growth of both wireless

data and roaming revenues as well as an increase in the penetration of optional services. As Canada’s only GSM/GPRS/

EDGE provider, Wireless expects to continue to experience increases in outbound roaming revenues from its subscribers

travelling outside of Canada, as well as strong growth in inbound roaming revenues from visitors to Canada who utilize

its network, as global wireless usage continues to increase.