Rogers 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain tables in the sections below entitled “Wireless Operating and Financial Results (Pro Forma)”, “Wireless Revenues

and Subscribers (Pro Forma)”, “Telecom Operating and Financial Results (Pro Forma)”, “Telecom Subscribers (Pro Forma)”

present selected unaudited pro forma information.

OP E R AT I NG HI G H LI G HT S A N D S I GN I FI C A NT DE V ELO P ME N TS IN 2 00 5

• Coinciding with the 20th anniversary of Rogers’ launch of wireless services, on July 1, 2005, we introduced Rogers

Home Phone voice-over-cable local telephony service in the Greater Toronto Area and also successfully completed the

acquisition of Call-Net, a national provider of voice and data communications services. We began to centralize the

management of sales of our wireless and cable products to business with Telecom’s business offerings. At the same

time, we also began centralizing the management of the sales and services of Telecom and Cable’s circuit-switched

and voice-over-cable residential telephony offerings.

• On June 30, 2005, we issued a notice of redemption for all of our 5.75% Convertible Debentures due November 26,

2005, at a redemption price per US$1,000 face amount of US$992.28, for an aggregate redemption amount of approxi-

mately US$223.0 million and with a redemption date of August 2, 2005. An aggregate of approximately 7.7 million

RCI Class B Non-Voting shares were issued.

• On October 11, 2005, we issued a notice to Microsoft Corporation (“Microsoft”) of our intention to redeem the

$600 million aggregate principal amount of 5½% Convertible Preferred Securities due August 2009. On October 17, 2005,

we received notice that Microsoft had elected to convert these securities, and, pursuant to this notice of conversion,

we issued 17,142,857 shares of our Class B Non-Voting stock to Microsoft on October 24, 2005 at the exercise price of

$35 per share.

• We, together with Bell Canada, announced a joint venture that will build and manage a Canada-wide wireless broad-

band network utilizing the two companies’ extensive fixed wireless spectrum holdings and existing network of cellular

tower and backhaul assets.

• Our Board of Directors approved a 50% increase in the annual dividend to $0.15 per share, paid semi-annually. We

declared a semi-annual dividend of $0.075 per share on each outstanding RCI Class B Non-Voting share and RCI Class A

Voting share, which was paid on January 6, 2006 to shareholders of record on December 28, 2005.

YE A R E N DE D D E C EM B ER 31 , 20 0 5 C OM P A RE D T O YE A R E ND E D D E CE M BE R 31 , 2 0 04

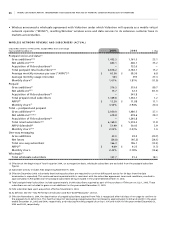

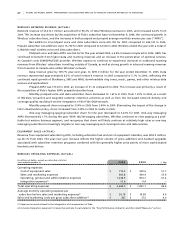

For the year ended December 31, 2005, Wireless, Cable, Telecom, and Media represented 53.5%, 27.6%, 5.7% and 14.7% of

our consolidated revenue, respectively, offset by corporate items and eliminations of (1.5%), and 62.4%, 33.5%, 2.1% and

6.0% of our consolidated operating profit, respectively, offset by corporate items and eliminations of (4.0%). For more

detailed discussions of Wireless, Cable, Telecom, and Media, refer to the respective segment discussions. Our financial

results include the operations of Telecom from the July 1, 2005 date of acquisition and the operations of Fido from the

November 9, 2004 date of acquisition.