Rogers 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

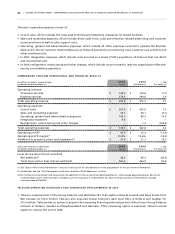

$1.5 million, net of the adjustment to the fair value of debt on acquisition of $16.0 million, was recorded. As a result,

$25.7 million (approximately US$22.0 million) aggregate principal amount of these Notes remained outstanding and

those were subsequently redeemed in January 2006. The funding for this redemption was advanced to Telecom from RCI

as intercompany debt.

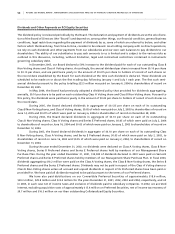

In October 2005, subsequent to our issuance to Microsoft Corporation (“Microsoft”) of our intention to redeem

the $600 million aggregate face amount of 5½% Convertible Preferred Securities due August 2009, we received notice

that Microsoft had elected to convert these securities and we issued 17,142,857 Class B Non-Voting shares to Microsoft

on October 24, 2005 at the exercise price of $35 per share.

In December 2005, Cable redeemed all of the outstanding US$113.7 million aggregate principal amount of its

11% Senior Subordinated Guaranteed Debentures due 2015 at a redemption premium of 5.50% for a total of $140.9 million

(US$119.9 million).

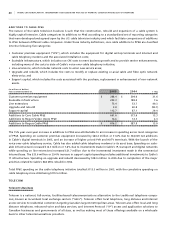

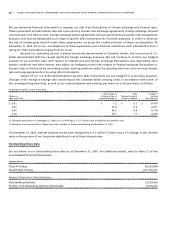

CO V E NA N T C OM P L IA N CE

All of the Rogers companies are currently in compliance with all of the covenants under their respective debt instru-

ments, and we expect to remain in compliance with all of these covenants. Based on our most restrictive debt covenants

at December 31, 2005, we could have borrowed approximately $1.69 billion of additional secured long-term debt under

existing credit facilities, in addition to the $612.0 million outstanding at December 31, 2005.

20 0 6 C A SH RE Q U IR E ME N TS

We expect that Wireless will generate a net cash surplus in 2006 from cash generated from operations. Wireless intends

to use the cash surplus to repay its $160.0 million 10.50% Senior Secured Notes that mature in June 2006 and the

$22.2 million mortgage that matures on July 2, 2006. We also expect Wireless to make distributions to RCI.

We expect that Cable, including the operations of Telecom, will generate a net cash shortfall in 2006. We

expect that Cable will have sufficient capital resources to satisfy its cash funding requirements in 2006, taking into

account cash from operations, the amount available under its $1,000.0 million bank credit facility and intercompany

advances from RCI.

We expect that Media will generate a net cash surplus in 2006 and that Media has sufficient capital resources to

satisfy its cash funding requirements in 2006, taking into account cash from operations and the amount available under

its $600.0 million bank credit facility.

We believe that, on an unconsolidated basis, RCI will have, taking into account interest income and repayments

of intercompany advances, together with the receipt of management fees paid by the operating subsidiaries and the

regular monthly distribution of $6.0 million from Cable and investments from cash on hand, sufficient capital resources

to satisfy its cash funding requirements in 2006.

In the event that we or any of our operating subsidiaries do require additional funding, we believe that any

such funding requirements would be satisfied by issuing additional debt financing, which may include the restructuring

of existing bank credit facilities or issuing public or private debt at any of the operating subsidiaries, or at RCI or issuing

equity of RCI, all depending on market conditions. In addition, we or one of our subsidiaries may refinance a portion of

existing debt subject to market conditions and other factors. There is no assurance that this will or can be done.

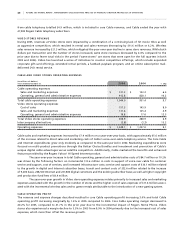

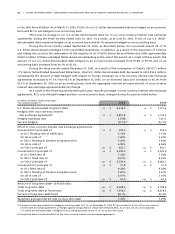

RE Q U IR E D P RI N C IP A L R EP A Y ME N TS

At December 31, 2005, the required repayments on all long-term debt in the next five years totalled $1,992.9 million.

The required repayments in 2006 consist mainly of Wireless’ $160.0 million 10.50% Senior Secured Notes, Wireless’

$22.2 million mortgage and RCI’s $75.0 million Senior Secured Notes. In 2007, Cable’s $450.0 million 7.60% Senior Secured

Second Priority Notes mature. Essentially, all of the remaining required repayments are in 2010 and consist of Wireless’

$641.2 million (US$550.0 million) Floating Rate Senior Secured Notes together with an aggregate $612.0 million outstanding

under bank credit facilities, all of which mature in 2010.

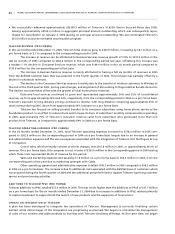

CR E D IT RA T IN G S

Since November 8, 2004, Moody’s Investors Service rated RCI’s public senior unsecured debt B3 with a Corporate Family

Rating of Ba3. The ratings for the senior secured and senior subordinated public debt of each of Cable and Wireless

were Ba3 and B2, respectively. All ratings had a stable outlook. On October 31, 2005, Moody’s placed all of the Rogers’