Rogers 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Recent Media Industry Trends

IN C R EA S ED RA D I O/ T V O WN E R SH I P F RA G M EN T AT I ON

In recent years, Canadian radio and television broadcasters have had to operate in increasingly fragmented markets.

Canadian consumers have a growing number of radio and television services available to them, providing them with

an increasing number of different programming formats. In the radio industry, since the introduction of its Commercial

Radio Policy in 1998, the CRTC has licenced more than 75 new radio stations through competitive processes in markets

across Canada. In that time, the CRTC has also licenced a large number of additional new FM stations through AM to FM

station conversions. In 2005, as discussed below, the CRTC licenced two satellite radio providers, both of which began

offering service in Canada in the fourth quarter of 2005. In the television industry, the CRTC has licenced a number of

new, over-the-air television stations and a significant number of new digital services. The new services and the new for-

mats combine to fragment the market for existing radio and television operators.

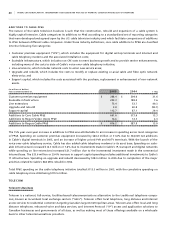

Media Operating and Financial Results

Media’s revenues primarily consist of:

• Advertising revenues;

• Circulation and subscription revenues;

• Retail product sales; and

• Sales of tickets, receipts of league revenue sharing and concession sales associated with our sports businesses.

Media’s operating expenses consist of:

• Cost of sales, which is comprised of the cost of retail product at The Shopping Channel;

• Sales and marketing expenses; and

• Operating, general and administrative expenses, which include programming costs, production expenses, circulation

expenses, player salaries and other back-office support functions.

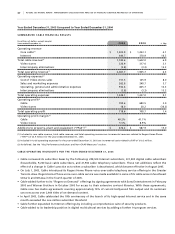

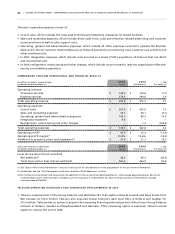

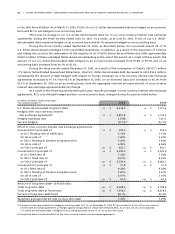

SU M M AR I ZE D M E D IA FI N AN C I AL RE S UL T S

Effective January 1, 2005, ownership and management of Rogers’ sports operations were transferred to Media. As such,

beginning in the first quarter of 2005, the results of operations of the Toronto Blue Jays and Rogers Centre are reported

as part of the Media segment. Prior period results have been reclassified to reflect this change.

(In millions of dollars)

Years ended December 31, 2 0 0 5 2 0 0 4 (1) % Chg

Total operating revenue $ 1,097.2 $ 956.9 14.7

Total operating expenses 969.4 841.5 15.2

Total operating profit(2) $ 127.8 $ 115.4 10.7

Operating profit margin(2) 11.6% 12.1%

Additions to property, plant and equipment(2) 39.6 20.3 95.1

(1) Media’s 2004 results have been restated to include the results of Blue Jays Holdco Inc., which owns the Toronto Blue Jays Baseball Club;

Results of Blue Jay Holdco were previously included in a separate segment of RCI.

(2) As defined. See the “Key Performance Indicators and Non-GAAP Measures”.

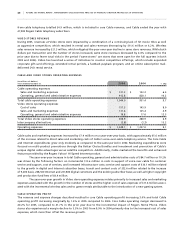

ME D I A O PE R AT I N G R EV E NU E

Revenue growth for 2005 was $140.3 million, an increase of 14.7% over 2004. The revenue increase was due to sales

growth from a variety of sources, including $21.2 million by The Shopping Channel, driven by greater sales of home elec-

tronic devices, $10.9 million from the growth in subscribers and advertising on Rogers Sportsnet and increased advertising