Rogers 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

AN I NC R EA S E I N P A PE R P R I CE S , P RI N T IN G C O STS OR PO S TAG E C O UL D AD V ER S EL Y AF F EC T M E D IA ’ S R ES U L TS OF

OP E R AT I ON S

A significant portion of Publishing’s operating expenses consists of paper, printing and postage expenses. Paper is

Publishing’s single largest raw material expense, representing approximately 8.4% of Publishing’s operating expenses

in 2005. Publishing depends upon outside suppliers for all of its paper supplies, holds relatively small quantities of paper

in stock itself, and is unable to control paper prices, which can fluctuate considerably. Moreover, Publishing is generally

unable to pass paper cost increases on to customers. Printing costs represented approximately 9.2% of Publishing’s

operating expenses in 2005. Publishing relies on third parties for all of its printing services. In addition, Publishing relies

on the Canadian Postal Service to distribute a large percentage of its publications. A material increase in paper prices,

printing costs or postage expenses to Publishing could have a material adverse effect on Media’s business, results of

operations or financial condition.

CH A N GE S I N R E G UL A TO R Y P O LI C IE S M A Y A D VE R SEL Y A F FE C T M E DI A ’S BUS I NE S S

The CRTC will review the Commercial Radio Policy of 1998, in 2006. CRTC regulatory processes have also been initiated to

develop policy frameworks for the licensing and distribution of high-definition pay and specialty services as well as the

transition or migration of specialty services from analog to digital.

The cable and telecommunications industries in Canada generally promote the easing or elimination of foreign

ownership restrictions. If successful, the easing or elimination of such ownership restrictions may cause or require integrated

communications companies to establish a separate ownership structure for their broadcasting content entities.

TA R I FF IN C RE A S ES CO U LD A DV E RS E LY A FF E CT MED I A’ S R E SUL T S O F O PER A TI O NS

Copyright liability pressures continue to affect radio services. If fees were to increase, such increases could adversely

affect Media’s results of operations.

PR E S SU R ES RE G A RD I NG CH A N NE L P L AC E M EN T C O ULD NE G AT I VEL Y I M PA C T T H E T IE R ST A TU S O F CE R TA I N O F

ME D I A’ S C H AN N E LS

Pressures regarding the favourable channel placement of The Shopping Channel and Sportsnet below the first cable

tier will likely continue to exist. Unfavourable channel placement could negatively affect the results of The Shopping

Channel and Sportsnet.

IN T R OD U CT I ON O F N EW TE C H NO L OG Y

The deployment of PVRs could influence Media’s capability to generate television advertising revenues as viewers are

provided with the opportunity to ignore advertising aired on the television networks. Although it is still too early to

determine its impact, the emergence of subscriber-based satellite and digital radio products could change radio audience

listening habits and negatively impact the results of Media’s radio stations.

5 . A C C O U N T I N G P O L I C I E S A N D N O N - G A A P M E A S U R E S

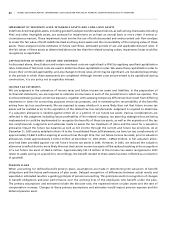

Key Performance Indicators and Non-GAAP Measures

We measure the success of our strategies using a number of key performance indicators, which are outlined below. The

following key performance indicators are not measurements in accordance with Canadian or U.S. GAAP and should not

be considered as an alternative to net income or any other measure of performance under Canadian or U.S. GAAP.

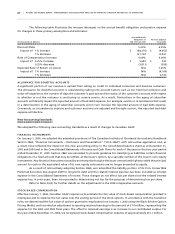

SU B S CR I BE R C O U NT S

We determine the number of subscribers to our services based on active subscribers. A wireless subscriber is represented

by each identifiable telephone number. A cable subscriber is represented by a dwelling unit. In the case of multiple units

in one dwelling, such as an apartment building, each tenant with cable service, whether invoiced individually or having

services included in his or her rent, is counted as one subscriber. Commercial or institutional units, such as hospitals or

hotels, are each considered to be one subscriber. When subscribers are deactivated, either voluntarily or involuntarily

for non-payment, they are considered to be deactivations in the period the services are discontinued. Wireless prepaid

subscribers are considered active for a period of 180 days from the date of their last revenue-generating usage.