Rogers 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

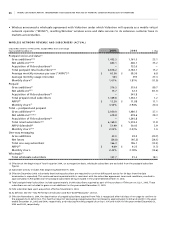

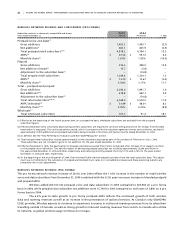

NE T LO S S A ND L OS S P E R S H AR E

We recorded a net loss of $44.7 million in 2005, or a basic loss per share of $0.15 (diluted – $0.15), compared to a net loss

of $67.1 million or basic loss per share of $0.28 (diluted – $0.28) in 2004. This decrease in loss was primarily due to the

growth in operating profit, offset by integration expenses, the amortization of intangibles assumed on acquisition, the

increase in interest on long-term debt associated with our acquisitions, and the fact that 2004 reflects higher foreign

exchange losses, and non-controlling interest of $79.6 million.

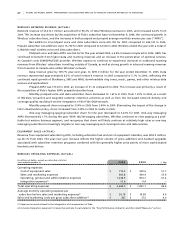

EM P L OY E ES

Remuneration represents a material portion of our expenses. At December 31, 2005, we had approximately 21,000 full-

time equivalent employees (“FTEs”) across all of our operating groups, including our shared services organization and

corporate office, representing an increase of approximately 3,000 from the level at December 31, 2004 primarily due

to an increase of 1,900 employees as a result of the acquisition of Telecom and an increase of 1,200 employees in our

head office and call centres, partially offset by reductions associated with the integration of Fido during the year. Total

remuneration paid to employees (both full- and part-time) in 2005 was approximately $1,220.6 million, an increase of

$220.5 million from $1,000.1 million in 2004.

2 . S E G M E N T R E V I E W

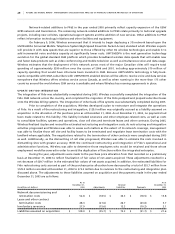

W I R E L E S S

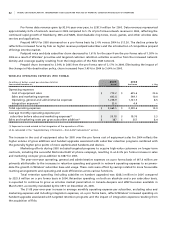

Wireless Business

Wireless is the largest Canadian wireless communications service provider, serving nearly 6.3 million subscribers at

December 31, 2005, including nearly 6.2 million wireless voice and data subscribers. Wireless operates a Global System for

Mobile Communications/General Packet Radio Service (“GSM/GPRS”) network, with Enhanced Data for GSM Evolution

(“EDGE”) technology. Wireless is Canada’s only carrier operating on the world standard GSM/GPRS technology platform.

The GSM/GPRS/EDGE network provides coverage to approximately 94% of Canada’s population. Subscribers to its

wireless services have access to these services across the U.S. through roaming agreements with various wireless operators.

Its subscribers also have access to wireless voice service internationally in over 175 countries and GPRS service interna-

tionally in over 75 countries, including throughout Europe, Asia, Latin America and Africa through roaming agreements

with other GSM wireless providers.

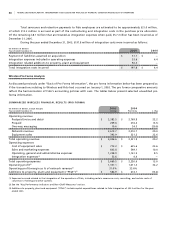

WI R E LE S S P RO D U CT S A N D S E RV I CE S

Wireless offers wireless voice, data and messaging services across Canada. Wireless voice services are available in either

postpaid or prepaid payment options. In addition, the GSM/GPRS/EDGE network provides customers with advanced

high-speed wireless data services, including mobile access to the Internet, wireless e-mail, digital picture and video

transmission, video streaming, music downloading and two-way short messaging service (“SMS”).

WI R E LE S S D IS T R IB U TI O N N E TW O RK

Wireless markets its products and services under both the Rogers Wireless and Fido brands through an extensive nation-

wide distribution network of over 7,000 dealer and retail locations across Canada (excluding the Rogers Video locations),

which include approximately 2,000 locations selling subscriptions to service plans, handsets and prepaid cards and

approximately 5,000 additional locations selling prepaid cards. Wireless’ nationwide distribution network includes an

independent dealer network, Rogers Wireless and Fido stores and kiosks, major retail chains and convenience stores.

Wireless also offers many of its products and services through a retail agreement with Rogers Video, which is a division of

Rogers Cable that has more than 314 locations across Canada, and on the Rogers Wireless and Fido e-business websites.

WI R E LE S S N ET W O RK S

Wireless is a facilities-based carrier operating its wireless networks over a broad, national coverage area with an owned

and leased fibre-optic and microwave transmission infrastructure. The seamless, integrated nature of its networks

enables subscribers to make and receive calls and to activate network features anywhere in Wireless’ coverage area and

in the coverage area of Wireless’ roaming partners as easily as if they were in their home area.