Rogers 2005 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

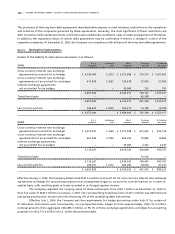

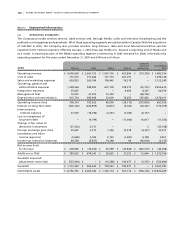

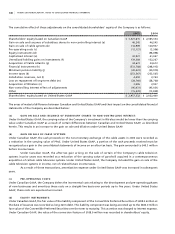

Note 17. Segmented information:

(a ) O PE R A TI N G S EG M E NT S :

The Company provides wireless services, cable services and, through Media, radio and television broadcasting and the

publication of magazines and periodicals. All of these operating segments are substantially in Canada. With the acquisition

of Call-Net in 2005, the Company also provides wireline long distance, data and local telecommunication services

reported in the Telecom segment. Effective January 1, 2005, Blue Jays Holdco Inc. became a reporting unit of Media and

as a result, is reported as part of the Media operating segment commencing in 2005 (restated for 2004). Information by

operating segment for the years ended December 31, 2005 and 2004 are as follows:

Corporate

items and Consolidated

2005 Wireless Cable Media Telecom eliminations Total

Operating revenue $ 4,006,658 $ 2,067,733 $ 1,097,176 $ 423,890 $ (113,303) $ 7,482,154

Cost of sales 773,215 157,466 157,710 207,757 – 1,296,148

Sales and marketing expenses 603,823 262,764 199,442 56,319 – 1,122,348

Operating, general and

administrative expenses 1,238,964 928,900 612,178 109,272 (35,701) 2,853,613

Integration expenses 53,607 – – 4,602 8,267 66,476

Management fees 12,025 41,355 15,322 – (68,702) –

Depreciation and amortization 615,710 483,946 52,019 70,653 255,683 1,478,011

Operating income (loss) 709,314 193,302 60,505 (24,713) (272,850) 665,558

Interest on long-term debt (405,344) (244,859) (8,813) (6,702) (44,361) (710,079)

Intercompany:

Interest expense 37,050 (18,796) (4,337) (5,760) (8,157) –

Loss on repayment of

long-term debt – (9,799) – (17,460) 16,017 (11,242)

Change in fair value of

derivative instruments (27,324) 2,151 – – 5 (25,168)

Foreign exchange gain (loss) 25,697 2,373 1,326 10,418 (4,337) 35,477

Investment and other

income (expense) (5,669) 4,043 2,120 (1,691) 4,148 2,951

Income tax reduction (expense) 84,358 (4,837) 14,298 64 (96,038) (2,155)

Net income (loss)

for the year $ 418,082 $ (76,422) $ 65,099 $ (45,844) $ (405,573) $ (44,658)

Additions to PP&E $ 584,922 $ 676,243 $ 39,635 $ 37,352 $ 15,644 $ 1,353,796

Goodwill acquired/

adjustments (note 6(a)) $ (527,044) $ – $ (14,286) $ 190,977 $ (2,547) $ (352,900)

Goodwill $ 1,212,422 $ 926,445 $ 705,943 $ 190,977 $ – $ 3,035,787

Identifiable assets $ 8,792,781 $ 4,065,782 $ 1,320,774 $ 561,716 $ (906,764) $ 13,834,289