Rogers 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

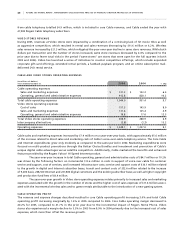

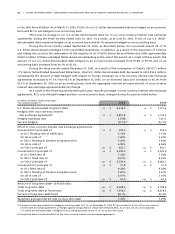

Net funds used during the year ended December 31, 2005 totalled approximately $2,333.6 million, the details of which

include:

• Additions to PP&E of $1,391.7 million, including $37.9 million related changes in non-cash working capital;

• $351.6 million for the repayment at maturity of Cable’s US$291.5 million 10.0% Senior Secured Second Priority Notes;

• $255.4 million, including $17.5 million of premiums and other related expenses, used by Telecom to redeem

US$200.9 million aggregate principal amount of their 10.625% Senior Secured Notes due 2008;

• $140.9 million for the redemption of US$113.7 million of Cable’s 11% Senior Subordinated Guaranteed Debentures,

including a $7.3 million (5.50%) redemption premium;

• An aggregate net cash outlay of $68.6 million for the settlement of two cross-currency interest rate exchange agree-

ments as discussed below in the “Financing” section;

• $51.7 million to fund the exercise of call rights for warrants issued by Fido which was related to the acquisition of Fido

by Wireless;

• An aggregate net $38.1 million for other acquisitions including the $26.6 million acquisition of the Rogers Centre

(formerly the SkyDome) and $9.5 million for the acquisition of the television broadcast operations of NOWTV in

Vancouver, British Columbia;

• Payment of dividends totalling $26.2 million on Class B Non-Voting shares and Class A Voting shares; and

• An aggregate $9.4 million of other uses, consisting of $4.9 million of financing costs and net $4.5 million repayments

of mortgages and leases.

Taking into account the $244.0 million of cash on hand at the beginning of the year, the cash deficiency at December 31,

2005 was $103.9 million.

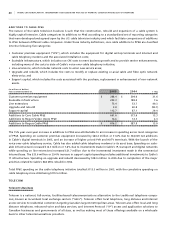

FI N A NC I NG

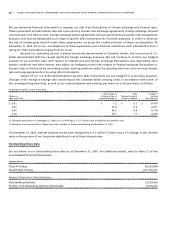

Our long-term debt instruments are described in Note 11 to the Annual Audited Consolidated Financial Statements.

On March 15, 2005, Cable repaid its US$291.5 million 10.0% Senior Secured Second Priority Notes at maturity.

Including the $58.1 million net cash outlay on the settlement of the cross-currency interest rate swap of US$283.4 million

notional amount, Cable paid a total of $409.8 million.

In addition, on March 15, 2005, a cross-currency swap of US$50.0 million notional amount matured. Cable

incurred a net cash outlay of $10.5 million upon settlement of this swap.

In June 2005, we amended Cable’s bank credit facility so that the maximum amount of the facility has been

reduced by $75.0 million to $1.0 billion, comprised of $600.0 million Tranche A and $400.0 million Tranche B. Among

other things, the amendment served to extend the maturity date of both Tranche A and Tranche B to “bullet” repayments

on July 2, 2010 and to eliminate the amortization schedule for Tranche B, reduce interest rates and standby fees, and

relax certain financial covenants.

On May 13, 2005, 1,031 Class B Non-Voting shares were issued upon conversion of US$0.03 million face amount

of 5.75% Convertible Debentures due November 26, 2005. On June 30, 2005, RCI issued a notice of redemption for all

of its US$224.8 million face value amount of 5.75% Convertible Debentures due November 26, 2005 for an aggregate

redemption amount of approximately US$223.0 million. Debenture holders converted an aggregate US$224.5 million

face amount of debentures into 7,715,417 Class B Non-Voting shares of RCI with a value of $271.2 million. The remaining

US$0.3 million face amount was redeemed in cash.

On July 1, 2005, RCI acquired, for 8.5 million Class B Non-Voting shares, 100% of Telecom (formerly Call-Net

Enterprises Inc.).

In August 2005, Telecom terminated its approximately $55 million accounts receivable securitization program.

Telecom used its cash on hand and the proceeds of an intercompany advance from RCI to fund the cancellation of the

securitization program.

In September 2005, we amended Media’s bank credit facility. The maximum amount of the facility has been

increased by $100 million to $600 million. The amendment also served to extend the maturity date by four years to

September 30, 2010, reduce interest rates and standby fees, and relax certain financial covenants.

During the third quarter, Telecom also redeemed $237.9 million (US$200.9 million) aggregate principal amount

of its 10.625% Senior Secured Notes due 2008. Premiums and related expenses aggregated $17.5 million and a loss of