Rogers 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

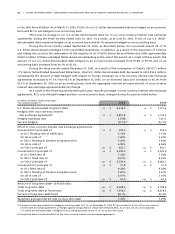

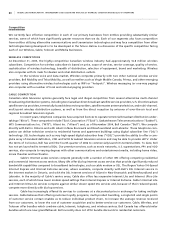

Commitments and Other Contractual Obligations

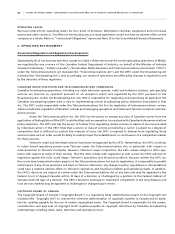

CO N T RA C TU A L O B LI G AT I ON S

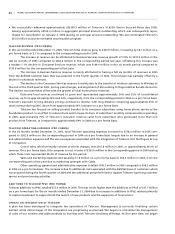

Our material obligations under firm contractual arrangements are summarized below as at December 31, 2005. See also

Notes 20 and 21 to the Consolidated Financial Statements.

Less Than After

(In thousands of dollars) 1 Year 1-3 Years 4-5 Years 5 Years Total

Long-term Debt 260,703 450,000 1,253,245 5,700,720 7,664,668

Derivative Instruments(1) 14,181 17,109 – 689,477 720,767

Mortgages and Capital Leases 25,436 2,083 1,420 – 28,939

Operating Leases 160,142 227,658 151,751 80,191 619,742

Player Contracts 53,981 103,618 64,415 – 222,014

Purchase Obligations(2) 200,065 88,199 36,184 38,062 362,510

Other Long-term Liabilities – 45,450 8,278 20,654 74,382

Total 714,508 934,117 1,515,293 6,529,104 9,693,022

(1) Amounts reflect net disbursements only.

(2) Purchase obligations consist of agreements to purchase goods and services that are enforceable and legally binding and that specify all

significant terms including fixed or minimum quantities to be purchased, price provisions and timing of the transaction. In addition, we incur

expenditures for other items that are volume-dependant. An estimate of what we will spend in 2006 on these items is as follows:

i. Wireless is required to pay annual spectrum licensing and CRTC contribution fees to Industry Canada. We estimate our total payment

obligations to Industry Canada will be approximately $97.8 million in 2006.

ii. Payments to acquire customers in the form of commissions and payments to retain customers in the form of residuals are made pursuant

to contracts with distributors and retailers. Wireless estimates that payments to these distributors and retailers will be approximately

$411.3 million in 2006.

iii. Wireless is required to make payments to other communications providers for interconnection, roaming and other services. Wireless

estimates the total payment obligation to be approximately $100.8 million in 2006.

iv. Wireless estimates its total payments to a major network infrastructure supplier to be approximately $275.2 million in 2006.

v. On September 16, 2005, Wireless announced a joint venture with Bell Canada to build and manage a nationwide fixed wireless broadband

network. The companies will jointly and equally fund the initial network deployment costs estimated at $200 million over a three-year

period.

vi. Based on Cable’s approximately 2.26 million basic cable subscribers as of December 31, 2005, Cable estimates that its total payment

obligation to programming suppliers and MDU building owners in 2006 will be approximately $460.9 million, including amounts payable

to the copyright collectives, the Canadian programming production funds, and expenditures related to our Internet service for Internet

interconnectivity and usage charges and the cable telephony service for interconnection to local and long distance carriers will be

approximately $74.2 million.

vii. Cable estimates that Video will spend approximately $60.0 million in 2006 on the acquisition of DVDs, videocassettes and video games

(as well as non-rental merchandise) for rental or sale in Video stores. In addition, Cable expects to pay an additional amount of approxi-

mately $16.1 million in 2006 to movie studios as part of Cable’s revenue-sharing arrangements with those studios.

Off-Balance Sheet Arrangements

GU A R AN T EE S

As a regular part of our business, we enter into agreements that provide for indemnification and guarantees to counter-

parties in transactions involving business sale and business combination agreements, sales of services and purchases and

development of assets. Due to the nature of these indemnifications, we are unable to make a reasonable estimate of the

maximum potential amount we could be required to pay counterparties. Historically, we have not made any significant

payment under these indemnifications or guarantees. Refer to Note 21 to the Consolidated Financial Statements.

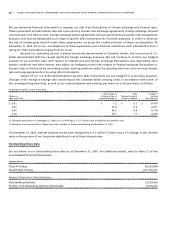

DE R I VA T IV E I N S TR U ME N TS

As previously discussed, we use derivative instruments to manage our exposure to interest rate and foreign currency

risks. We do not use derivative instruments for speculative purposes.