Rogers 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

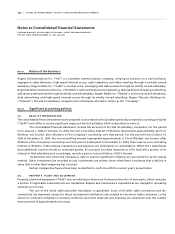

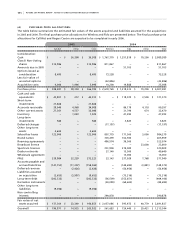

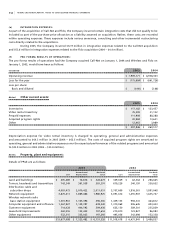

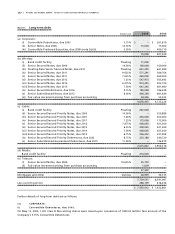

(d ) PU R CH A S E P RI C E A L LO C AT I ONS :

The table below summarizes the estimated fair values of the assets acquired and liabilities assumed for the acquisitions

in 2005 and 2004. The final purchase price allocations for Wireless and Fido are presented below. The final purchase price

allocations for Call-Net and Rogers Centre are expected to be completed in early 2006.

2005 2 0 0 4

Call-Net Other Total Wireless Fido Other Total

Consideration:

Cash $ – $ 36,308 $ 36,308 $ 1,767,370 $ 1,251,819 $ 70,200 $ 3,089,389

Class B Non-Voting

shares 315,986 – 315,986 811,867 – – 811,867

Amounts due in 2005 – – – – 51,705 – 51,705

Options issued as

consideration 8,495 – 8,495 73,228 – – 73,228

Less fair value of

unvested options – – – (43,896) – – (43,896)

Acquisition costs 4,000 1,996 5,996 10,200 14,888 – 25,088

Purchase price $ 328,481 $ 38,304 $ 366,785 $ 2,618,769 $ 1,318,412 $ 70,200 $ 4,007,381

Cash and cash

equivalents $ 43,801 $ 212 $ 44,013 $ – $ 118,070 $ 3,500 $ 121,570

Short-term

investments 21,666 – 21,666 – – – –

Accounts receivable 29,040 4,968 34,008 – 86,179 4,118 90,297

Other current assets 27,561 4,537 32,098 – 31,796 674 32,470

Inventory – 1,023 1,023 – 47,292 – 47,292

Long-term

investments 584 – 584 – 3,823 – 3,823

Deferred charges – – – (17,197) – – (17,197)

Other long-term

assets 4,604 – 4,604 – – – –

Subscriber bases 123,000 – 123,000 807,779 171,500 5,000 984,279

Brand names – – – 303,459 102,500 – 405,959

Roaming agreements – – – 486,574 36,500 – 523,074

Broadcast licence – – – – – 23,600 23,600

Spectrum licences – – – 201,909 319,000 – 520,909

Dealer networks – – – 27,140 13,500 – 40,640

Wholesale agreement – – – – 13,000 – 13,000

PP&E 339,984 32,239 372,223 33,143 337,029 7,768 377,940

Accounts payable and

accrued liabilities (147,153) (11,207) (158,360) – (144,692) (3,881) (148,573)

Deferred revenue – (2,426) (2,426) – (50,956) – (50,956)

Liabilities assumed

on acquisition (3,655) (5,997) (9,652) – (73,316) – (73,316)

Long-term debt (292,532) – (292,532) (56,509) (352,651) – (409,160)

Derivative instruments – – – (20,090) (64,602) – (84,692)

Other long-term

liabilities (9,396) – (9,396) – – – –

Non-controlling

interest – – – 290,878 – – 290,878

Fair value of net

assets acquired $ 137,504 $ 23,349 $ 160,853 $ 2,057,086 $ 593,972 $ 40,779 $ 2,691,837

Goodwill $ 190,977 $ 14,955 $ 205,932 $ 561,683 $ 724,440 $ 29,421 $ 1,315,544