Rogers 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

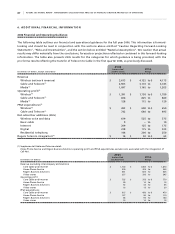

The additions to PP&E before related changes to non-cash working capital represent PP&E that we actually took

title to in the period. Accordingly, for purposes of comparing our PP&E outlays, we believe that additions to PP&E before

related changes to non-cash working capital best reflect our cost of PP&E in a period, and provide a more accurate

determination for period-to-period comparisons.

Critical Accounting Policies

This MD&A is made with reference to our 2005 Audited Consolidated Financial Statements and Notes thereto, which have

been prepared in accordance with Canadian GAAP. The Audit Committee of our Board reviews our accounting policies,

reviews all quarterly and annual filings, and recommends adoption of our annual financial statements to our Board.

For a detailed discussion of our accounting policies, see Note 2 to the Audited Consolidated Financial Statements. In

addition, a discussion of critical accounting estimates and a discussion of new accounting standards adopted by us in

the year ended December 31, 2005 are discussed in the sections “Critical Accounting Estimates” and “New Accounting

Standards”, respectively.

RE V E NU E R E CO G N IT I ON

We consider revenues to be earned as services are performed, provided that ultimate collection is reasonably assured at

the time of performance.

We offer certain products and services as part of multiple deliverable arrangements. We divide multiple

deliverable arrangements into separate units of accounting. Components of multiple deliverable arrangements are

separately accounted for provided the delivered elements have stand-alone value to the customers and the fair value of

any undelivered elements can be objectively and reliably determined. Consideration for these units are then measured

and allocated amongst the accounting units based upon their relative fair values and then our relevant revenue recogni-

tion policies are applied to them. We recognize revenue once persuasive evidence of an arrangement exists, delivery has

occurred or services have been rendered, fees are fixed and determinable and collectibility is reasonably assured.

Revenue is categorized into the following types, the majority of which are recurring in nature on a monthly

basis from ongoing relationships, contractual or otherwise, with our subscribers:

• Monthly subscriber fees in connection with wireless and wireline services, cable, telephony, Internet services, rental of

equipment, network services, and media subscriptions are recorded as revenue on a pro rata basis over the month as

the service is provided;

• Revenue from wireless airtime, roaming, and optional services, pay-per-view and video-on-demand services, video

rentals, and other sales of products are recorded as revenue as the services or products are delivered. Commissions

earned by the Video stores segment in handling transactions of the cable services segment are recorded as charged.

These fees are eliminated on consolidation;

• Revenue from the sale of wireless, cable and telecommunications equipment is recorded when the equipment is

delivered and accepted by the independent dealer or customer. Equipment subsidies provided to new and existing

subscribers are recorded as a reduction of revenues upon activation of the service;

• Installation fees and activation fees charged to subscribers do not meet the criteria as a separate unit of accounting.

As a result, these fees are recorded as part of equipment revenue or, in the case of Cable and Telecom, are deferred

and amortized over the related service period, as appropriate. The related service period for Cable is determined

to be approximately four years, based on subscriber disconnects, transfers of service and moves. Incremental direct

installation costs related to re-connects are deferred to the extent of deferred installation fees and amortized over

the same period as these related installation fees. New connect installation costs are capitalized to property, plant

and equipment and amortized over the useful life of the related assets;

• Revenues from telecommunication services are recognized based on either customer usage as measured by our

switches or by contractual agreement when provided. Where services to certain customers are provisioned through

the use of subcontractor agents, revenue is recognized based on the fees charged to the customer, provided that we

are acting as the principal in the arrangement;

• Advertising revenue is recorded in the period the advertising airs on the Company’s radio or television stations and

the period in which advertising is featured in the Company’s media publications;