Rogers 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

the purchase price of the acquisition was $328.5 million. This transaction has been accounted for using the purchase

method and we began to consolidate Telecom’s results of operations with our own effective July 1, 2005. Subsequent to

the acquisition, we changed the name of Call-Net to Rogers Telecom Holdings Inc. Telecom’s results are reported as a

separate segment as discussed in the Telecom section of this MD&A. Refer to “Critical Accounting Estimates – Purchase

Price Allocations” and Note 3 to the Consolidated Financial Statements for more details regarding these transactions.

PU R C HA S E O F R O GE R S W IR E L ES S S H AR E S A N D A CQU I SI T IO N OF FI D O

On September 13, 2004, we announced an agreement with JVII General Partnership (“JVII”), a general partnership wholly

owned by AT&T Wireless Services, Inc., (“AWE”) whereby we agreed to purchase all of JVII’s 27,647,888 Class A Multiple

Voting shares (“Class A shares”) and 20,946,284 Class B Restricted Voting shares (“Class B shares”) of Wireless for a cash

purchase price of $36.37 per share totalling $1,767.4 million. We closed this transaction on October 13, 2004 which had

the effect of increasing our ownership of Wireless from 55.3% at September 30, 2004 to approximately 89.3%.

On September 20, 2004, together with Wireless, we announced an all-cash offer of $35.00 per share to acquire

all of the issued and outstanding equity securities of Fido, Canada’s fourth largest wireless communications provider.

The acquisition of Fido was successfully completed effective November 9, 2004 and made Wireless the largest wireless

operator in Canada and the only Canadian wireless provider operating on the world standard GSM/GPRS/EDGE wireless

technology platform.

On November 11, 2004, we announced an exchange offer to purchase all of the publicly-owned Class B Restricted

Voting shares of Wireless, with the consideration being 1.75 RCI Class B Non-Voting shares for each Wireless Class B share

held. The acquisition was successfully completed effective December 31, 2004, and Wireless became a wholly owned

subsidiary. We issued a total of 28,072,856 RCI Class B Non-Voting shares as consideration in this transaction.

Refer to “Critical Accounting Estimates – Purchase Price Allocations” and Note 3 to the Consolidated Financial

Statements for more details regarding these transactions.

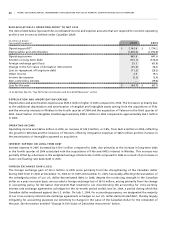

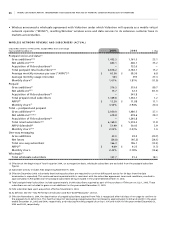

Consolidated Financial and Operating Results

See the sections in this MD&A entitled “Critical Accounting Policies”, “Critical Accounting Estimates” and “New

Accounting Standards” and also the Notes to the Audited Consolidated Financial Statements for a discussion of critical

and new accounting policies and estimates as they relate to the discussion of our operating and financial results below.

We measure the success of our strategies using a number of key performance indicators as outlined in the sec-

tion “Key Performance Indicators and Non-GAAP Measures”. These key performance indicators are not measurements in

accordance with Canadian or U.S. GAAP and should not be considered as alternatives to net income or any other measure

of performance under Canadian or U.S. GAAP.

BA S I S O F P RO F OR M A I NF O R MA T IO N

Certain financial and operating data information in this release has been prepared on a pro forma basis as if the trans-

actions relating to Wireless and Fido, as described herein, had occurred on January 1, 2003, and as if the acquisition of

Telecom as described herein, had occurred on January 1, 2004. Such information is based on our historical financial state-

ments, the historical financial statements of Wireless, Fido, and Telecom, and the accounting for the respective business

combinations.

Although we believe this presentation provides certain relevant contextual and comparative information for

existing operations, the unaudited pro forma consolidated financial and operating data presented in this document is

for illustrative purposes only and does not purport to represent what the results of operations actually would have been

if the transactions had occurred on January 1, 2003, in the case of Wireless and Fido, and on January 1, 2004 in the case of

Telecom, nor does it purport to project the results of operations for any future period.

This pro forma information reflects, among other things, adjustments to Fido and Telecom’s historically

reported financial information to conform to our accounting policies, the impacts of purchase accounting, and the

impact of amortizing the deferred compensation expense arising on the exchange of employee stock options in RWCI into

stock options to acquire Class B Non-Voting shares of RCI. The pro forma adjustments are based upon certain estimates

and assumptions that we believe are reasonable. Accounting policies used in the preparation of these statements are

those disclosed in our 2005 Annual Audited Consolidated Financial Statements and Notes thereto.