Rogers 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

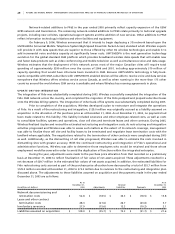

27 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

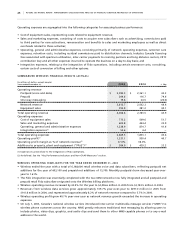

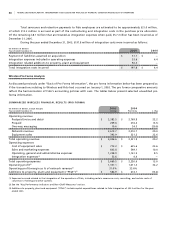

WI R E LE S S N ET W O RK RE V EN U E ( A CT U AL )

Network revenue of $3,612.7 million accounted for 90.2% of total Wireless revenues in 2005, and increased 44.4% from

2004. This increase was driven by the acquisition of Fido’s subscriber base on November 9, 2004, the continued growth in

Wireless’ subscriber base, and the increases in both postpaid and prepaid average monthly revenue per user (“ARPU”).

Net additions of postpaid voice and data subscribers were 603,100 for 2005 compared to 446,100 in 2004.

Prepaid subscriber net additions were 15,700 for 2005 compared to 32,500 in 2004. Wireless ended the year with a total of

6,168,000 retail wireless voice and data subscribers.

Postpaid voice and data ARPU was $63.56 for the year ended 2005, a 6.8% increase compared to 2004. ARPU has

continued to benefit from higher data and roaming revenues and an increase in the penetration of optional services.

As Canada’s only GSM/GPRS/EDGE provider, Wireless expects to continue to experience increases in outbound roaming

revenues from Wireless’ subscribers travelling outside of Canada, as well as strong growth in inbound roaming revenues

from travelers to Canada who utilize Wireless’ network.

Data revenue grew by 109.7% year-over-year, to $297.0 million for the year ended December 31, 2005. Data

revenue represented approximately 8.2% of total network revenue in 2005 compared to 5.7% in 2004, reflecting the

continued rapid growth of Blackberry, SMS and MMS, downloadable ring tones, music, games, and other wireless data

services and applications.

Prepaid ARPU was $13.20 in 2005, an increase of $1.32 compared to 2004. This increase was primarily a result of

the acquisition of Fido’s higher ARPU prepaid subscriber base.

Monthly postpaid voice and data subscriber churn decreased to 1.61% in 2005, from 1.81% in 2004, as a result

of Wireless’ proactive and targeted customer retention activities as well as from the increased network density and

coverage quality resulting from the integration of the Fido GSM network.

Monthly prepaid churn increased to 3.54% in 2005 from 2.94% in 2004. Eliminating the impact of the change in

Fido’s deactivation policy, churn increased from 3.39% in 2004 to 3.64% in 2005.

One-way messaging (paging) subscriber churn for the year decreased to 2.43% for 2005. One-way messaging

ARPU decreased by 1.7% during the year. With 166,300 paging subscribers, Wireless continues to view paging as a prof-

itable but mature business segment, and recognizes that churn will likely continue at relatively high rates as one-way

messaging subscribers increasingly migrate to two-way messaging and converged voice and data services.

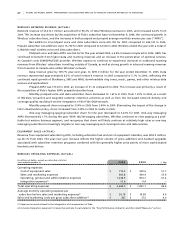

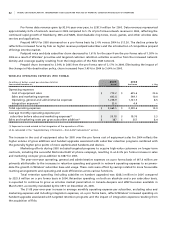

EQ U I PM E NT SA L E S ( AC T UA L )

Revenue from equipment sales during 2005, including activation fees and net of equipment subsidies, was $393.9 million,

up 40.1% from 2004. The year-over-year increase reflects the higher volume of gross additions and handset upgrades

associated with subscriber retention programs combined with the generally higher price points of more sophisticated

handsets and devices.

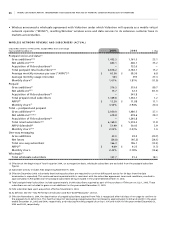

WI R E LE S S O PE R A TI N G E XP E N SE S ( A CT U A L)

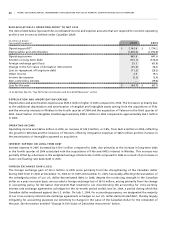

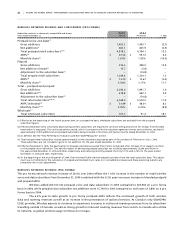

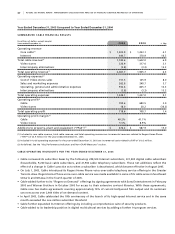

(In millions of dollars, except per subscriber statistics)

Years ended December 31, 2 0 0 5 2 0 0 4 % Chg

Operating expenses

Cost of equipment sales $ 773.2 $ 509.6 51.7

Sales and marketing expenses 603.8 444.4 35.9

Operating, general and administrative expenses 1,238.9 874.7 41.6

Integration expenses(1) 53.6 4.4 –

Total operating expenses $ 2,669.5 $ 1,833.1 45.6

Average monthly operating expense per

subscriber before sales and marketing expenses(2) $ 20.78 $ 18.99 9.4

Sales and marketing costs per gross subscriber addition(2) $ 387 $ 372 4.0

(1) Expenses incurred related to the integration of the operations of Fido.

(2) Includes integration expenses for respective periods; As calculated in the “Key Performance Indicators and Non-GAAP Measures” section.