Rogers 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

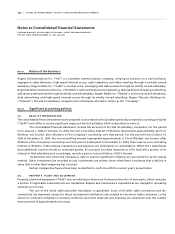

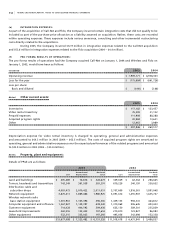

108 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

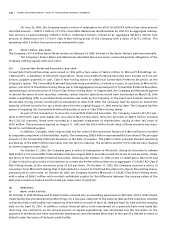

interim and annual financial statements commencing in 2007. Earlier adoption is permitted. The new standards will

require presentation of a separate statement of comprehensive income. Derivative financial instruments will be recorded

in the balance sheet at fair value and the changes in fair value of derivatives designated as cash flow hedges will

be reported in comprehensive income. The existing hedging principles of AcG-13 will be substantially unchanged. The

Company is assessing the impact of these new standards.

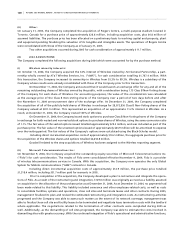

Note 3. Business combinations:

(a ) 2 00 5 AC Q UI S IT I O NS :

The Company has completed the following acquisitions during the year which were accounted for by the purchase

method:

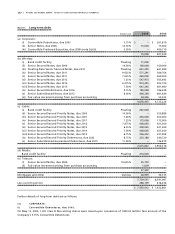

(i ) Ca l l- N et Ent e rp r is e s I n c. :

On July 1, 2005, the Company acquired 100% of Call-Net Enterprises Inc. (“Call-Net”) in a share-for-share transaction

(the “Call-Net Acquisition”). Call-Net, primarily through its wholly owned subsidiary Sprint Canada Inc., is a Canadian

integrated communications solutions provider of home phone, wireless, long distance and Internet access services to

households, and local, long distance, toll free, enhanced voice, data and Internet access services to businesses across

Canada. The operations of Call-Net were consolidated with those of the Company as of July 1, 2005.

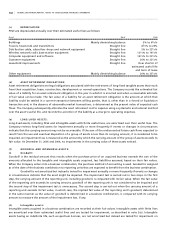

Under the terms of the arrangement, holders of common shares and Class B Non-Voting shares of Call-Net

received a fixed exchange ratio of one Class B Non-Voting share of the Company for each 4.25 common shares and/

or Class B Non-Voting shares of Call-Net held by them. All outstanding options to purchase Call-Net shares vested

immediately prior to the Call-Net acquisition. In addition, each holder of outstanding Call-Net options received fully-

vested options of the Company using the same 4.25 exchange ratio. As a result, 8.5 million Class B Non-Voting shares and

0.4 million options were issued as consideration. The Class B Non-Voting shares issued were valued at the average market

price over the period two days before and two days after the May 11, 2005 announcement date of the transaction. This

resulted in share consideration valued at $316.0 million. The options issued as consideration were valued at $8.5 million

using the Black-Scholes model.

Also under the terms of the arrangement, the only outstanding preferred share of Call-Net was deemed to

be redeemed by Call-Net for $1.00, being the redemption price thereof. Subsequently, Call-Net was renamed Rogers

Telecom Holdings Inc. and Sprint Canada Inc. was renamed Rogers Telecom Inc.

Prior to completion of the acquisition, the Company began to develop a plan to restructure and integrate

the operations of Call-Net. As a result of the restructuring and integration, a liability of $3.7 million was recorded in

the acquisition balance sheet of Call-Net for severance and other employee related costs. Including direct incremental

acquisition costs of approximately $4.0 million, the aggregate purchase price for the acquisition of Call-Net shares and

options totalled $328.5 million.

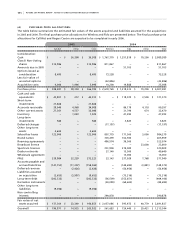

The allocation of the purchase price is preliminary and subject to finalization of the restructuring and inte-

gration plan. The allocation of the purchase price reflects management’s best estimate at the date of preparing these

financial statements. The purchase price allocation is expected to be finalized by early 2006.

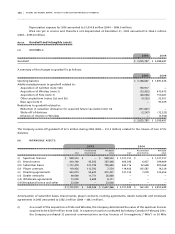

The Call-Net subscriber bases acquired is being amortized over its weighted average estimated useful life of

29 months. A change in the fair value of the Call-Net subscriber bases of $10.0 million acquired would have impacted

depreciation and amortization expense and net income by $2.1 million for the year ended December 31, 2005. An increase

in the weighted average useful life of six months would have reduced depreciation and amortization expense and

decreased the loss for the year by approximately $4.3 million for the year ended December 31, 2005. A decrease in the

weighted average useful life of six months would have increased depreciation and amortization expense and increased

the loss for the year by approximately $6.6 million for the year ended December 31, 2005.

As at December 31, 2005, the purchase price allocation was adjusted upon revisions of the valuation of the intan-

gible assets acquired and for a severance accrual. Amortization will be adjusted on a prospective basis over the estimated

remaining useful life of the intangible assets. This will result in an increase in amortization expense of $7.6 million, on an

annualized basis, over the remaining useful life relative to that originally determined under the preliminary valuation.

Goodwill related to the Call-Net Acquisition has been assigned to the Telecom reporting segment.