Rogers 2005 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

For the year ended December 31, 2005, the Company recorded compensation expense of approximately

$34.7 million (2004 – $15.1 million), including the Wireless options, related to stock options granted to employees.

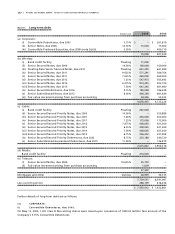

The weighted average estimated fair value at the date of the grant for RCI options granted during 2005 was

$16.09 (2004 – $12.64) per share. No Wireless options were granted in 2004. The fair value of each option granted was

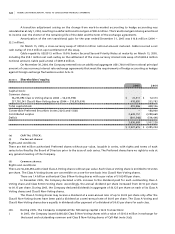

estimated on the date of the grant using the Black-Scholes option pricing model with the following assumptions:

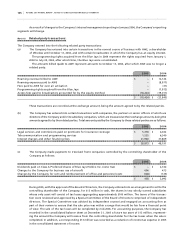

2005 2004

RCI’s risk-free interest rate 4.00% 4.36%

RCI’s dividend yield 0.27% 0.38%

Volatility factor of the future expected market price of RCI’s Class B Non-Voting shares 42.30% 44.81%

Weighted average expected life of the RCI options 5.4 years 6.0 years

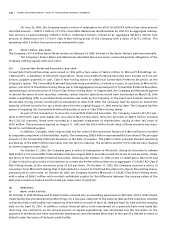

The weighted average estimated fair value at the date of exchange of Wireless options to RCI options was $22.15 per

share. The weighted average estimated fair value at the date of exchange of Call-Net options to RCI options was $19.79

per share. The fair value of each RCI option granted upon exchange and included in the purchase price equations was

estimated at the date of the announcements to acquire the remaining shares of Wireless and Call-Net (note 3). The fair

value of the unvested options which will be amortized to expense was calculated as at the closing date (note 3(b)). The

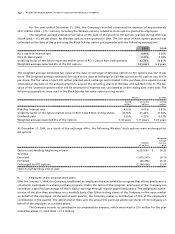

following assumptions were used in the Black-Scholes fair value option pricing model:

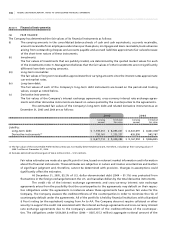

Wireless Call-Net

Vested Unvested Vested

options options options

Risk-free interest rate 4.12% 4.07% 3.91%

Volatility factor of the future market price of RCI’s Class B Non-Voting shares 43.06% 43.26% 31.50%

Dividend yield 0.35% 0.32% 0.27%

Weighted average expected life of the options 5.33 years 5.71 years 5.23 years

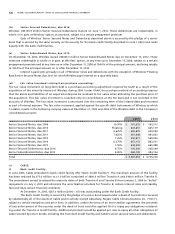

At December 31, 2004, as a result of the exchange offer, the following Wireless’ stock options were exchanged for

RCI options:

Weighted

average

Number exercise

of options price

Options outstanding, beginning of year 4,227,097 $ 24.22

Granted – –

Exercised (1,875,547) 20.70

Forfeited (85,496) 25.31

Exchanged for RCI options (2,266,054) 27.09

Options outstanding, end of year – –

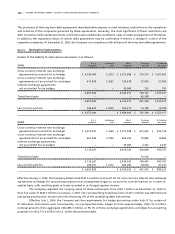

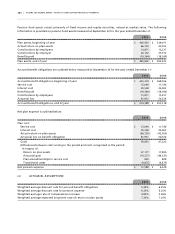

II . E m plo y ee sh a re a cc u mu l ati o n p la n :

Effective January 1, 2004, the Company established an employee share accumulation program that allows employees to

voluntarily participate in a share purchase program. Under the terms of the program, employees of the Company can

contribute a specified percentage of their regular earnings through regular payroll deductions. The designated admin-

istrator of the plan then purchases, on a monthly basis, Class B Non-Voting shares of the Company on the open market

on behalf of the employee. At the end of each quarter, the Company makes a contribution of 25% of the employee’s

contribution in the quarter. The administrator then uses this amount to purchase additional shares of the Company on

behalf of the employee, as outlined above.

The Company records its contribution as compensation expense, which amounted to $3.0 million for the year

ended December 31, 2005 (2004 – $1.2 million).