Rogers 2005 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

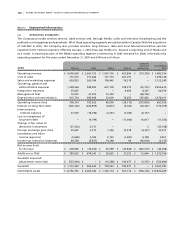

128 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In addition, employees of Wireless were able to participate in Wireless’ employee share accumulation plan

until December 31, 2004. The terms were the same as the RCI plan, except the designated administrator of the plan

purchased Class B Restricted Voting shares of Wireless on the open market on behalf of the employee. On December 31,

2004, as a result of the Company’s acquisition of 100% of the outstanding Class B Restricted Voting shares of Wireless,

Wireless employees had the option of using their contributions and Wireless’ contributions to purchase RCI Class B Non-

Voting shares, or to have their contributions refunded.

II I . Res t ri c te d sh a re un i t p l an :

During 2004, the Company established a restricted share unit plan which enables employees, officers and directors

of the Company to participate in the growth and development of the Company by providing such persons with the

opportunity, through restricted share units, to acquire a proprietary interest in the Company. Under the terms of the

plan, restricted share units are issued to the participant and the units issued vest over a period not to exceed three years

from the grant date.

On the vesting date, the Company, at its option, shall redeem all of the participants’ restricted share units in

cash or by issuing one Class B Non-Voting share for each restricted share unit. The Company has reserved 2,000,000 Class B

Non-Voting shares for issuance under this plan.

At December 31, 2005, 297,767 (2004 – 50,916) restricted share units were outstanding. These restricted share

units vest at the end of three years from the grant date. The Company records compensation expense equally over the

vesting period, taking into account fluctuations in the market price of the Class B Non-Voting shares of the Company.

Compensation expense for the year ended December 31, 2005 related to these restricted units was $4.3 million (2004 –

$0.3 million).

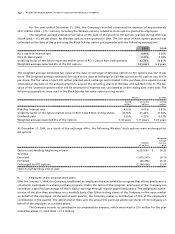

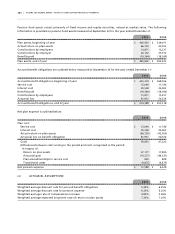

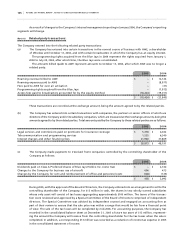

Note 14. Income taxes:

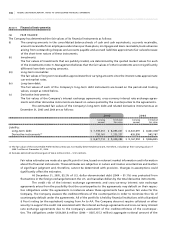

The income tax effects of temporary differences that give rise to significant portions of future income tax assets and

liabilities are as follows:

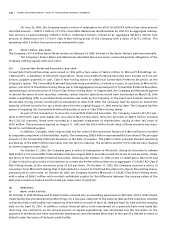

2005 2004

Future income tax assets:

Non-capital income tax loss carryforwards $ 1,393,897 $ 1,219,699

Deductions relating to long-term debt and other transactions denominated

in foreign currencies 86,491 98,523

Investments 58,890 64,081

Other deductible differences 149,825 172,759

Property, plant and equipment and inventory 86,755 –

Total future income tax assets 1,775,858 1,555,062

Less valuation allowance 617,838 696,833

1,158,020 858,229

Future income tax liabilities:

Property, plant and equipment and inventory – (35,309)

Goodwill and intangible assets (679,556) (795,603)

Other taxable differences (18,062) (27,317)

Total future income tax liabilities (697,618) (858,229)

Net future income tax asset 460,402 –

Less current portion (113,150) –

$ 347,252 $ –

In assessing the realizability of future income tax assets, management considers whether it is more likely than not that

some portion or all of the future income tax assets will be realized. The ultimate realization of future income tax assets

is dependent upon the generation of future taxable income during the years in which the temporary differences are

deductible. Management considers the scheduled reversals of future income tax liabilities, the character of the income

tax assets and the tax planning strategies in place in making this assessment. To the extent that management believes