Rogers 2005 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

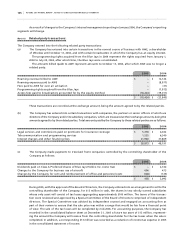

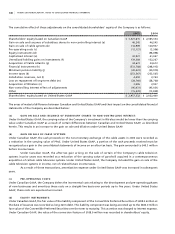

will qualify for certification as a class action. In addition, on December 9, 2004, Wireless was served with a court

order compelling it to produce certain records and other information relevant to an investigation initiated by

the Commissioner of Competition under the misleading advertising provisions of the Competition Act with

respect to its system access fee.

(b) On April 21, 2004, a proceeding was brought against Fido and its subsidiary, Fido Solutions Inc. and others

alleging breach of contract, breach of confidence, misuse of confidential information, breach of a duty of

loyalty, good faith and to avoid a conflict of duty and self-interest, and conspiracy. The plaintiff is seeking

damages in the amount of $160 million. The proceeding is at an early stage. Wireless believes it has good

defences to the claim.

(c) The Company believes that it has adequately provided for income taxes based on all of the information that is

currently available. The calculation of income taxes in many cases, however, requires significant judgment in

interpreting tax rules and regulations. The Company’s tax filings are subject to audits which could materially

change the amount of current and future income tax assets and liabilities, and could, in certain circumstances,

result in the assessment of interest and penalties.

(d) There exist certain other claims and potential claims against the Company, none of which is expected to have a

material adverse effect on the consolidated financial position of the Company.

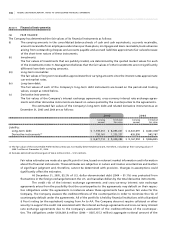

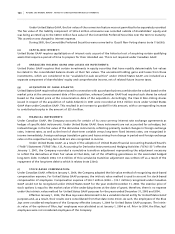

Note 23. Canadian and United States accounting policy differences:

The consolidated financial statements of the Company have been prepared in accordance with GAAP as applied in

Canada. In the following respects, GAAP, as applied in the United States, differs from that applied in Canada.

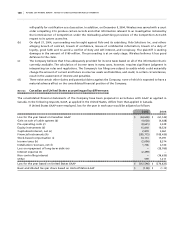

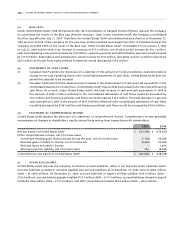

If United States GAAP were employed, loss for the year in each year would be adjusted as follows:

2005 2004

Loss for the year based on Canadian GAAP $ (44,658) $ (67,142)

Gain on sale of cable systems (b) (4,028) (4,028)

Pre-operating costs (c) (8,621) 5,348

Equity instruments (d) 15,818 18,526

Capitalized interest, net (e) 2,879 3,061

Financial instruments (h) (285,775) (188,420)

Stock-based compensation (i) 14,113 15,091

Income taxes (k) (2,090) 8,374

Installation revenues, net (l) 1,706 2,744

Loss on repayment of long-term debt (m) – (28,760)

Interest expense (n) (2,499) –

Non-controlling interest – (36,630)

Other 559 1,211

Loss for the year based on United States GAAP $ (312,596) $ (270,625)

Basic and diluted loss per share based on United States GAAP $ (1.08) $ (1.13)