Rogers 2005 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

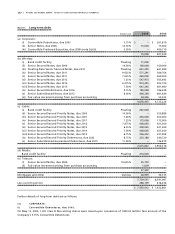

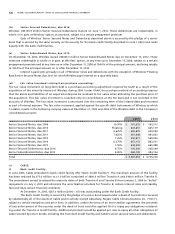

The provisions of the long-term debt agreements described above impose, in most instances, restrictions on the operations

and activities of the companies governed by these agreements. Generally, the most significant of these restrictions are

debt incurrence and maintenance tests, restrictions upon additional investments, sales of assets and payment of dividends.

In addition, the repayment dates of certain debt agreements may be accelerated if there is a change in control of the

respective companies. At December 31, 2005, the Company is in compliance with all terms of the long-term debt agreements.

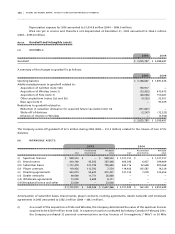

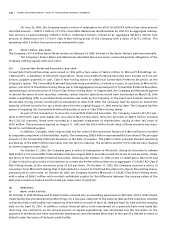

Note 12. Derivative instruments:

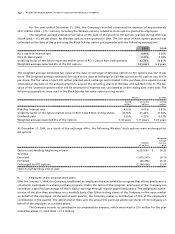

Details of the liability for derivative instruments is as follows:

U.S. $ Exchange Cdn. $ Carrying Estimated

2005 notional rate notional amount fair value

Cross-currency interest rate exchange

agreements accounted for as hedges $ 4,190,000 1.3313 $ 5,577,998 $ 710,275 $ 1,307,451

Cross-currency interest rate exchange

agreements not accounted for as hedges 611,830 1.2021 735,479 27,095 27,095

Interest exchange agreements

not accounted for as hedges – – 30,000 791 791

4,801,830 6,343,477 738,161 1,335,337

Transitional gain – – 63,388 –

4,801,830 6,343,477 801,549 1,335,337

Less current portion 326,830 1.2045 393,672 14,180 14,180

$ 4,475,000 $ 5,949,805 $ 787,369 $ 1,321,157

U.S. $ Exchange Cdn. $ Carrying Estimated

2004 notional rate notional amount fair value

Cross-currency interest rate exchange

agreements accounted for as hedges $ 4,473,437 1.3363 $ 5,977,998 $ 613,667 $ 932,538

Cross-currency interest rate exchange

agreements not accounted for as hedges 661,830 1.2183 806,304 10,882 10,882

Interest exchange agreements

not accounted for as hedges – – 30,000 2,347 2,347

5,135,267 6,814,302 626,896 945,767

Transitional gain – – 73,505 –

5,135,267 6,814,302 700,401 945,767

Less current portion 283,437 1.4112 400,000 58,856 61,530

$ 4,851,830 $ 6,414,302 $ 641,545 $ 884,237

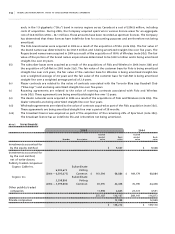

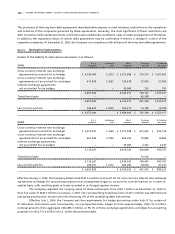

Effective January 1, 2004, the Company determined that it would not account for its cross-currency interest rate exchange

agreements as hedges for accounting purposes and consequently began to account for such derivatives on a mark-to-

market basis, with resulting gains or losses recorded in or charged against income.

The Company adjusted the carrying value of these instruments from $338.1 million at December 31, 2003 to

their fair value of $385.3 million on January 1, 2004. The corresponding transitional loss of $47.2 million was deferred and

was being amortized to income over the remaining life of the underlying debt instruments.

Effective July 1, 2004, the Company met the requirements for hedge accounting under AcG-13 for certain of

its derivative instruments and, consequently, on a prospective basis, began to treat approximately US$2,773.4 million

notional amount of the aggregate US$2,885.3 million, or 96.1% of these exchange agreements, as hedges for accounting

purposes on US$2,773.4 million of U.S. dollar-denominated debt.