Rogers 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

DI S T RI B UT I ON O F W IR E LE S S ’ P RO D UC T S A N D S ERV I CE S

Cable and Wireless have entered into an agreement for the sale of their products and services through the Rogers Video

stores owned by Cable. Wireless pays Cable commissions for new subscriptions equivalent to amounts paid to third-party

distributors.

DI S T RI B UT I ON O F C AB L E’ S PR O DU C TS A ND SE R VIC E S

Wireless has agreed to provide retail field support to Cable and to represent Cable in the promotion and sales of its

business products and services. Under the retail field support agreement, Wireless’ retail sales representatives receive

sales commissions for achieving sales targets with respect to Cable products and services, the cost of which is reimbursed

by Cable to Wireless.

TR A N SM I SS I ON F AC I LI T IE S

Wireless has entered into agreements with Cable to share the construction and operating costs of certain co-located

fibre-optic transmission and microwave facilities. The costs of these facilities are allocated based on usage or ownership,

as applicable. Since there are significant fixed costs associated with these transmission links, Wireless and Cable have

achieved economies of scale by sharing these facilities resulting in reduced capital costs. In addition, Wireless receives

payments from Cable for the use of its data, circuits, data transmission and links. The price of these services is based on

usage or ownership, as applicable.

LO N G D I ST A NC E

In 2005, Telecom began to terminate long distance minutes in both North American and international markets for

Wireless. These transactions are priced at fair value wholesale rates.

AD V E RT I SI N G

Wireless and Cable advertise their products and services through radio stations and other media outlets owned by

Media. They receive a discount from the customary rates of Media. Media has also agreed to compensate Cable for the

placement of Media advertising on one or more of Cable’s television channels.

TR A N SF E R O F T E LE C OM SU B S CR I BE R S T O W I RE L ESS

Rogers Telecom and Fido were subject to an agreement whereby Telecom resold the wireless services of Fido. During

2005, the resale agreement was terminated and Wireless purchased the wireless subscriber base and related working

capital items of Telecom for a cash consideration of $6.5 million.

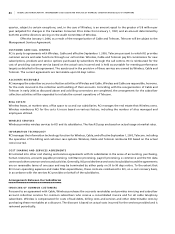

SU M M AR Y O F C H A RG E S F RO M (T O ) R EL A T ED PA R TIE S

We have entered into certain transactions in the normal course of business with certain broadcasters in which we have

an equity interest.

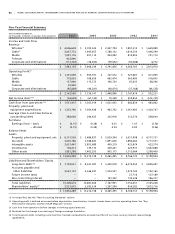

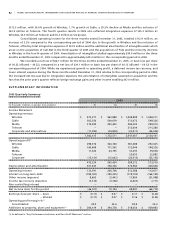

(In millions of dollars)

Years ended December 31, 2005 2004

Roaming revenue billed by AWE(1) $ – $ 12.1

Roaming expenses paid to AWE(1) – (9.0)

Fees Paid to AWE for over-air activation(1) – –

Programming rights acquired from the Blue Jays – (8.0)

Access fees paid to broadcasters accounted for by the equity method

(18.4) (19.0)

$ (18.4) $ (23.9)

(1) Amounts for 2004 are until October 13, 2004.