Rogers 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

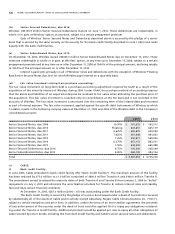

110 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

the Company was able to finalize the list of those employees who would be retained and those whose employment

would be severed in order to avoid the duplication of functions within the integrated enterprise.

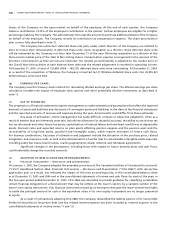

The resulting adjustments to the liabilities assumed on acquisition and payments made against such liabilities

during 2005 are as follows:

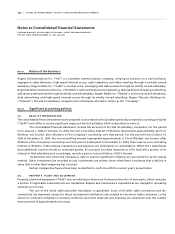

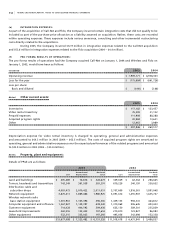

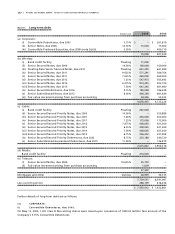

As at As at

December 31, Revised December 31,

2004 Adjustments liabilities Payments 2005

Network decommissioning and restoration costs $ 52,806 $ (18,505) $ 34,301 $ (18,496) $ 15,805

Lease and other contract termination costs 48,329 (21,648) 26,681 (22,997) 3,684

Involuntary severance 27,891 (15,557) 12,334 (10,156) 2,178

$ 129,026 $ (55,710) $ 73,316 $ (51,649) $ 21,667

The remaining liability as at December 31, 2005 will be paid over the course of 2006.

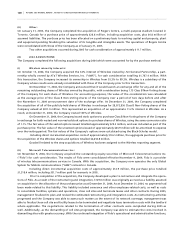

(i i i ) O t he r :

On December 23, 2004, the Company purchased the remaining 20% interest of Rogers Sportsnet for $45 million. The purchase

price was allocated to goodwill on a preliminary basis pending completion of the valuations of the net identifiable

assets acquired. In October 2005, an adjustment was made to allocate $23.6 million of the purchase price to broadcast

licence with an offsetting reduction to goodwill. The broadcast licence has an indefinite life.

On January 2, 2004, the Company acquired 50% of CTV Specialty Television Inc.’s mobile production and distri-

bution business (“Dome Productions”) for cash of $21.3 million, net of cash acquired of $3.5 million. Dome Productions

has been proportionately consolidated with the Company since acquisition of the 50% interest on January 2, 2004.

Goodwill related to the acquisitions of Sportsnet and Dome Productions has been assigned to the Media

reporting segment.

During 2004, the Company had other acquisitions with purchase consideration of $0.4 million.

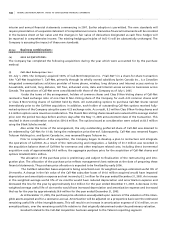

(c ) A D JUS T ME N TS TO P RE L IM I N AR Y P U RC H A SE AL L OC A T IO N S R EL A T ED TO 20 0 4 A C QU I SI T I ON S :

During 2005, the purchase price allocations related to the 2004 acquisitions were adjusted to reflect final valuations of

tangible and intangible assets acquired as well as updated information and estimates related to Fido restructuring and

integration plans. The following table summarizes the adjustments made to the purchase price allocations from those

disclosed at December 31, 2004:

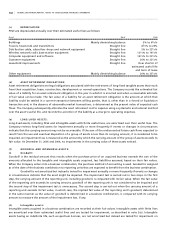

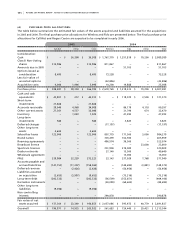

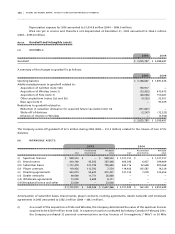

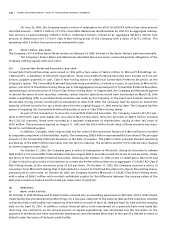

Wireless Fido Other Total

Increase (decrease) in estimated fair value of net assets acquired:

Subscriber bases $ 15,263 $ 31,500 $ – $ 46,763

Brand names 903 2,500 941 4,344

Roaming agreements (10,160) 1,500 – (8,660)

Dealer networks 27,140 13,500 – 40,640

Wholesale agreements – 13,000 – 13,000

Spectrum licences (1,768) (91,600) – (93,368)

Broadcast licence – – 23,600 23,600

PP&E 1,020 5,590 – 6,610

Deferred revenue – (5,654) – (5,654)

32,398 (29,664) 24,541 27,275

Decrease in liabilities assumed on acquisition – 55,710 – 55,710

Decrease (increase) in acquisition costs 1,078 – (63) 1,015

Adjustment to fair value of unvested options 20,456 – – 20,456

Decrease in goodwill $ 53,932 $ 26,046 $ 24,478 $ 104,456