Rogers 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

• We successfully redeemed approximately US$200.9 million of Telecom’s 10.625% Senior Secured Notes due 2008,

leaving approximately US$22.0 million in aggregate principal amount outstanding which was subsequently repur-

chased for cancellation on January 3, 2006 leaving no principal amount outstanding. We also terminated Telecom’s

$55.0 million accounts receivable securitization program.

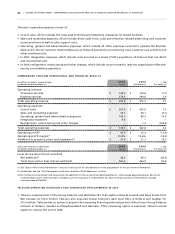

TE L E CO M R E VE N U E ( PR O F O R MA )

In the six months ended December 31, 2005, Telecom total revenue grew to $423.9 million, increasing by $8.7 million on a

pro forma basis, or 2.1% compared to the corresponding period in 2004.

The increase in revenue can be attributed to Business Services revenue growth of 3.9% to $274.9 million in the

last six months of 2005 compared to $264.6 million in the corresponding period last year. Offsetting this increase was

a modest 1.1% decline in Consumer Services revenue, which was $149.0 million in the six month period compared to

$150.6 million for the corresponding period last year.

The increase in Business Services revenue is mainly attributed to having a full six months of revenues in 2005

from the Bell/360 customer base that was acquired in the fourth quarter of 2004. This increase was partially offset by a

decline in wholesale revenues.

The decline in the Consumer Services revenue is mainly due to the transfer of wireless customers to Wireless at

the end of the third quarter 2005, pricing plan changes, and alignment of discounting to Rogers Better Bundle discounts.

The decline was somewhat offset with the growth of local home phone revenues.

Data and local services continued to grow and represented approximately 26% and 30% of consolidated

revenue, up from approximately 25% and 24%, respectively, from the corresponding period in 2004 on a pro forma basis.

Telecom’s exposure to long distance pricing continues to decline, with long distance comprising approximately 43% of

total revenue during 2005, down from approximately 50% last year on a pro forma basis.

Telecom has focused on selling product bundles to its consumer subscribers using home phone service as the

foundation product, in an effort to reduce churn and increase its share of subscribers’ monthly communications spending.

In 2005, approximately 75% of Telecom’s consumer revenue came from subscribers who purchased more than one

product from Telecom, as compared to approximately 69% in 2004 on a pro forma basis.

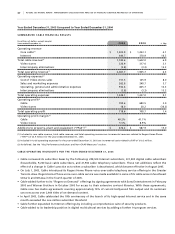

TE L E CO M O P ER A T IN G E X PE N S ES (P R O F O RM A )

In the six months ended December 31, 2005, total Telecom operating expenses increased to $378.0 million in 2005 com-

pared to $362.8 million in the corresponding period in 2004 on a pro forma basis largely due to an increase in general

and administrative expenses and the various expenses associated with the integration of Telecom into the Rogers Group

of Companies.

Cost of sales, which primarily consists of carrier charges, was $207.8 million in 2005, or approximately 49.0% of

revenue. On a pro forma basis, this compares to cost of sales of $205.0 million in the corresponding period in 2004 during

which these costs represented 49.4% of revenue for the period.

Sales and marketing expenses decreased by $1.8 million on a pro forma basis to $56.3 million in 2005, from the

corresponding period last year due to marketing synergies with Cable.

Other operating, general and administrative expenses totalled $109.3 million in 2005 compared to $98.5 million

in 2004 on a pro forma basis. The increase is due to additional costs associated with the Bell/360 base of customers which

was acquired during the fourth quarter of 2004 and the additional personnel hired to support Telecom’s growing customer

service and provisioning activities.

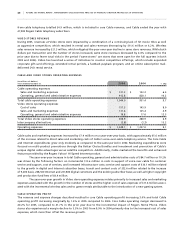

AD D I TI O NS TO T EL E CO M P P & E ( PR O F O R MA )

Telecom additions to PP&E totalled $37.4 million in 2005. This was 18.0% higher than the additions to PP&E of $31.7 million

on a pro forma basis for the six months ended December 31, 2004 due to increases in additions to PP&E related primarily

to capital investment to support both the launch of new products and the expansion of local service.

UP D A TE ON IN T E GR A TI O N O F T E LE C OM

A plan has been developed to integrate the operations of Telecom. Management is currently finalizing certain

matters while initial stages of the integration are progressing as planned. We began to centralize the management

of sales of our wireless and cable products to business with Telecom’s business offerings. At the same time, we began