Rogers 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

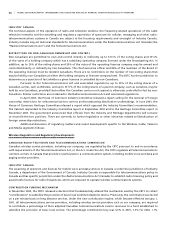

public debt ratings under review for a possible upgrade. On February 17, 2006, Moody’s increased the ratings on all of

the Rogers’ public debt. The Corporate Family Rating was increased to Ba2. The rating for the public senior secured debt

of each of Cable and Wireless was increased to Ba2, while the rating for the senior subordinated public debt at Wireless

was increased to Ba3. All of these ratings have a positive outlook. There are no ratings for RCI senior unsecured debt,

Cable senior subordinated debt or Telecom senior secured debt, since all such debt had been repaid prior to the ratings

revision by Moody’s on February 17, 2006.

On October 27, 2005, Standard & Poor’s Ratings Service revised its outlook on all of the Rogers public debt to

positive from stable. This was the only change in the ratings since they were lowered by Standard & Poor’s on November 8,

2004. RCI’s corporate credit rating is BB, with a rating for public senior unsecured debt of B+. The rating for senior

secured public debt of Cable and Wireless is BB+ and BB respectively, while the rating for senior subordinated debt for

each of Cable and Wireless is B+.

The credit ratings assigned by Fitch Ratings on the Wireless senior secured and senior subordinated public debt

have not changed since November 12, 2004. They are BB+ and BB- respectively, with a stable outlook. On June 10, 2005,

Fitch affirmed the Wireless ratings and initiated coverage of RCI and Cable. Cable’s senior secured and senior subordi-

nated public debt was assigned the same ratings as those of Wireless, while RCI senior unsecured debt was rated BB-.

All ratings have a stable outlook.

Credit ratings are intended to provide investors with an independent measure of credit quality of an issue of

securities. Ratings for debt instruments range from AAA, in the case of S&P and Fitch, or Aaa in the case of Moody’s,

which represent the highest quality of securities rated, to D, in the case of S&P, C, in the case of Moody’s and Substantial

Risk in the case of Fitch, which represent the lowest quality of securities rated.

The credit ratings accorded by the rating agencies are not recommendations to purchase, hold or sell the rated

securities inasmuch as such ratings do not comment as to market price or suitability for a particular investor. There is

no assurance that any rating will remain in effect for any given period of time or that any rating will not be revised or

withdrawn entirely by a rating agency in the future if in its judgment circumstances so warrant.

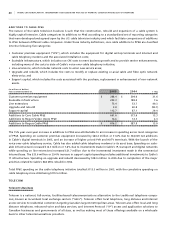

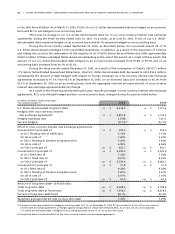

DE F I CI E NC Y O F PE N SI O N P L AN AS S ET S OV E R A CCR U ED OB L IGA T IO N S

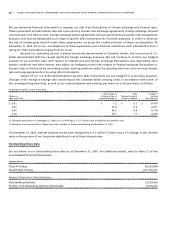

As disclosed in Note 16 to our Consolidated Financial Statements for the years ended December 31, 2005 and 2004, our

pension plans had a deficiency of plan assets over accrued obligations for each of these years. In addition to our regular

contributions, we are making certain minimum monthly special payments to eliminate this deficiency. Effective during

2004, these special payments totalled approximately $7.2 million annually and are expected to continue at this level. Our

total estimated annual funding requirements, which include both our regular contributions and these special payments,

are expected to increase from $20.2 million in 2005 to $31.7 million in 2006, subject to annual adjustments thereafter, due

to various market factors and an increase in plan membership. We are contributing to the plans on this basis. As further

discussed in the section of this MD&A entitled “Critical Accounting Estimates”, changes in factors such as the discount

rate, the rate of compensation increase and the expected return on plan assets can impact the accrued benefit obliga-

tion, pension expense and the deficiency of plan assets over accrued obligations in the future.

Interest Rate and Foreign Exchange Management

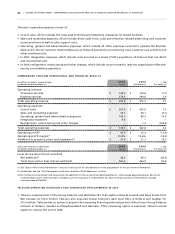

CO N S OL I DA T ED E CO N OM I C H E DG E A N AL Y S IS

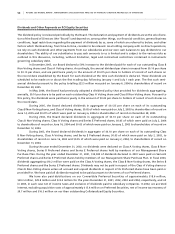

For the purposes of our discussion on the hedged portion of long-term debt, we have used non-GAAP measures in that

we include all cross-currency interest rate exchange agreements (whether or not they qualify as hedges for accounting

purposes) since all such agreements are used for risk management purposes only and designated as a hedge of specific

debt instruments for economic purposes. As a result, the Canadian dollar equivalent of U.S. dollar-denominated long-

term debt reflects the contracted foreign exchange rate for all of our cross-currency interest rate exchange agreements

regardless of qualifications for accounting purposes as a hedge.

As a result of the repayment of US$291.5 million Cable 10% Senior Secured Second Priority Notes due 2005,

together with the maturity of two cross-currency interest rate exchange agreements in the aggregate notional principal

amount of US$333.4 million, there was little change on either an accounting or on an economic basis in the percentage

of our U.S. dollar-denominated debt hedged with cross-currency interest rate exchange agreements from that disclosed