Rogers 2005 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

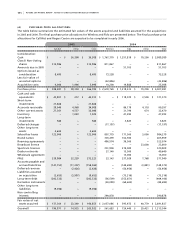

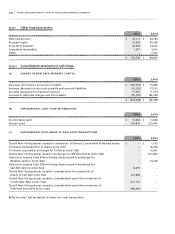

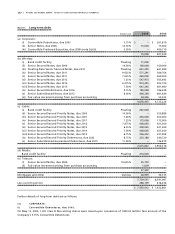

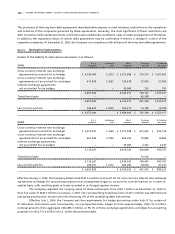

114 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

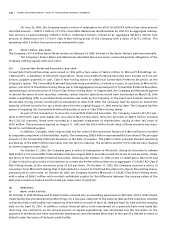

each, in the 1.9 gigahertz (“GHz”) band in various regions across Canada at a cost of $396.8 million, including

costs of acquisition. During 2005, the Company acquired spectrum in various licence areas for an aggregate

cost of $4.8 million (2004 – $6.1 million). These amounts have been recorded as spectrum licences. The Company

has determined that these licences have indefinite lives for accounting purposes and are therefore not being

amortized.

(ii) The Fido brand names were acquired in 2004 as a result of the acquisition of Fido (note 3(b)). The fair value of

the brand names was determined to be $102.5 million and is being amortized straight-line over five years. The

Rogers brand names were acquired in 2004 as a result of the acquisition of 100% of Wireless (note 3(b)). The fair

value of the portion of the brand names acquired was determined to be $303.5 million and is being amortized

straight-line over 20 years.

(iii) The subscriber bases were acquired as a result of the acquisitions of Fido and Wireless in 2004 (note 3(b)) and

the acquisition of Call-Net in 2005 (note 3(a)). The fair value of the customer base for Fido is being amortized

straight-line over 2.25 years, the fair value of the customer base for Wireless is being amortized straight-line

over a weighted average of 4.6 years and the fair value of the customer base for Call-Net is being amortized

straight-line over a weighted average period of 2.4 years.

(iv) Player contracts are related to the value of contracts associated with the Toronto Blue Jays Baseball Club

(“Blue Jays”) and are being amortized straight-line over five years.

(v) Roaming agreements are related to the value of roaming contracts associated with Fido and Wireless

(note 3(b)). These agreements are being amortized straight-line over 12 years.

(vi) The dealer networks were acquired in 2004 as a result of the acquisitions of Fido and Wireless (note 3(b)). The

dealer networks are being amortized straight-line over four years.

(vii) Wholesale agreements are related to the value of contracts acquired as part of the Fido acquisition (note 3(b)).

These agreements are being amortized straight-line over a period of 38 months.

(viii) The broadcast licence was acquired as part of the acquisition of the remaining 20% of Sportsnet (note 3(b)).

The broadcast licence has an indefinite life and is therefore not being amortized.

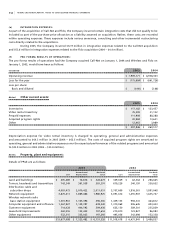

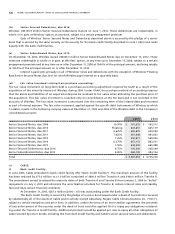

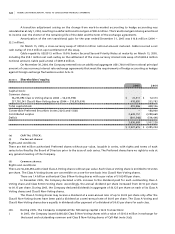

Note 7. Investments:

2005 2004

Quoted Quoted

market Book market Book

Number Description value value value value

Investments accounted for

by the equity method $ 9,047 $ 9,348

Investments accounted for

by the cost method,

net of write-downs:

Publicly traded companies:

Cogeco Cable Inc. Subordinate

6,595,675 Voting

(2004 – 6,595,675) Common $ 161,594 68,884 $ 169,179 68,884

Cogeco Inc. Subordinate

3,399,800 Voting

(2004 – 3,399,800) Common 81,595 44,438 76,190 44,438

Other publicly traded

companies 11,998 2,845 23,772 3,551

255,187 116,167 269,141 116,873

Private companies 12,998 12,949

$ 138,212 $ 139,170