Rogers 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

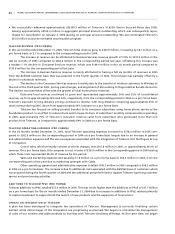

centralizing the management of the sales and services of Telecom and Cable’s circuit-switched and voice-over-cable

residential telephony offerings. Matters still to be finalized include the integration of various networks, customer

billing and administrative functions. Integration is expected to continue through 2006. During the six months ended

December 31, 2005, Telecom incurred integration expenses of $4.6 million. In addition, corporate operating expenses

included integration expenses of $8.3 million related to Telecom. These integration costs consisted primarily of costs

associated with integration consulting, customer communications, rebranding, and systems integrations.

As discussed above, in January 2006, RCI completed a reorganization whereby Cable acquired substantially all

of the operating subsidiaries of Telecom. Telecom had previously been a separate operating segment of RCI. As a result

of this reorganization, the businesses formerly conducted by Telecom are now conducted by Cable.

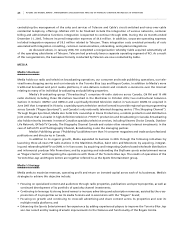

M E D I A

Media’s Business

Media holds our radio and television broadcasting operations, our consumer and trade publishing operations, our tele-

vised home shopping service and our interests in the Toronto Blue Jays and Rogers Centre. In addition to Media’s more

traditional broadcast and print media platforms, it also delivers content and conducts e-commerce over the Internet

relating to many of its individual broadcasting and publishing properties.

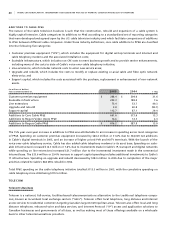

Media’s Broadcasting group (“Broadcasting”) comprises 46 radio stations across Canada, (36 FM and 10 AM

radio stations) including three FM stations launched in the Maritimes in October 2005; two multicultural television

stations in Ontario (OMNI.1 and OMNI.2) and a spiritually-themed television station in Vancouver (OMNI.10) acquired in

June 2005 that is repeated in Victoria; a specialty sports television service licenced to provide regional sports programming

across Canada (“Rogers Sportsnet”); and Canada’s only nationally televised shopping service (“The Shopping Channel”).

Through Rogers Sportsnet, Media also holds 50% ownership in Dome Productions, a mobile production and distribution

joint venture that is a leader in high-definition television (“HDTV”) production and broadcasting in Canada. Broadcasting

also holds minority interests in several Canadian specialty television services, including Viewers Choice Canada, Outdoor

Life Network, G4TechTV Canada, The Biography Channel Canada and certain other minority interest investments. In the

case of G4TechTV and The Biography Channel, Broadcasting is also the managing partner.

Media’s Publishing group (“Publishing”) publishes more than 70 consumer magazines and trade and professional

publications and directories in Canada.

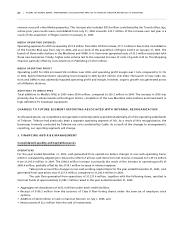

In addition to its organic growth, Media expanded its business in 2005 through the following initiatives: by

launching three all-news FM radio stations in the Maritimes (Halifax, Saint John and Moncton); by acquiring, integrat-

ing and rebranding NOWTV as OMNI.10 in Vancouver; by acquiring and integrating Quebec based wholesale distribution

and infomercial producer Mix Promotions; and by acquiring and rebranding the SkyDome sports entertainment venue

as “Rogers Centre” and integrating the operations with those of the Toronto Blue Jays. The results of operations of the

Toronto Blue Jays and Rogers Centre are together referred to as the Sports Entertainment group.

Media’s Strategy

Media seeks to maximize revenues, operating profit and return on invested capital across each of its businesses. Media’s

strategies to achieve this objective include:

• Focusing on specialized content and audiences through radio properties, publications and sports properties, as well as

continued development of its portfolio of specialty channel investments;

• Continuing to leverage its strong brand names to increase advertising and subscription revenues, assisted by the cross-

promotion of its properties across its media formats and in association with the “Rogers” brand;

• Focusing on growth and continuing to cross-sell advertising and share content across its properties and over its

multiple media platforms; and

• Enhancing the Sports Entertainment fan experience by adding experienced players to improve the Toronto Blue Jays

win-loss record and by making dramatic improvements to the features and functionality of the Rogers Centre.