Rogers 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

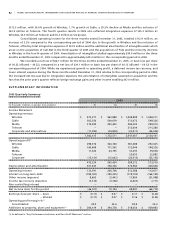

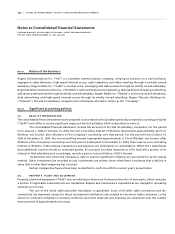

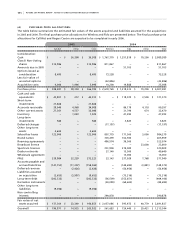

(c ) D E PRE C IA T IO N :

PP&E are depreciated annually over their estimated useful lives as follows:

Asset Basis Rate

Buildings Mainly diminishing balance 5% to 62⁄3%

Towers, head-ends and transmitters Straight line 62⁄3% to 25%

Distribution cable, subscriber drops and network equipment Straight line 5% to 331⁄3%

Wireless network radio base station equipment Straight line 121⁄2% to 141⁄3%

Computer equipment and software Straight line 141⁄3% to 331⁄3%

Customer equipment Straight line 20% to 331⁄3%

Leasehold improvements Straight line Over shorter of

estimated useful life

and term of lease

Other equipment Mainly diminishing balance 20% to 331⁄3%

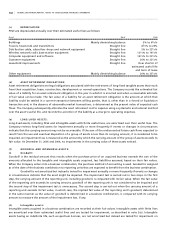

(d ) AS S ET R ET I RE M ENT OB L IG A TIO N S:

Asset retirement obligations are legal obligations associated with the retirement of long-lived tangible assets that result

from their acquisition, lease, construction, development or normal operations. The Company records the estimated fair

value of a liability for an asset retirement obligation in the year in which it is incurred and when a reasonable estimate

of fair value can be made. The fair value of a liability for an asset retirement obligation is the amount at which that

liability could be settled in a current transaction between willing parties, that is, other than in a forced or liquidation

transaction and, in the absence of observable market transactions, is determined as the present value of expected cash

flows. The Company subsequently allocates the asset retirement cost to expense using a systematic and rational method

over the asset’s useful life, and records the accretion of the liability as a charge to operating expenses.

(e ) L ON G - LI V ED AS S E TS :

Long-lived assets, including PP&E and intangible assets with finite useful lives, are amortized over their useful lives. The

Company reviews long-lived assets for impairment annually or more frequently if events or changes in circumstances

indicate that the carrying amount may not be recoverable. If the sum of the undiscounted future cash flows expected to

result from the use and eventual disposition of a group of assets is less than its carrying amount, it is considered to be

impaired. An impairment loss is measured as the amount by which the carrying amount of the group of assets exceeds its

fair value. At December 31, 2005 and 2004, no impairments in the carrying value of these assets existed.

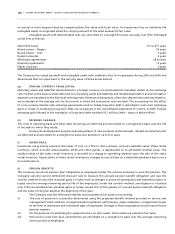

(f ) GO O DW I L L A ND IN T A NG I BL E A S S ET S :

(i ) Go o dw i ll :

Goodwill is the residual amount that results when the purchase price of an acquired business exceeds the sum of the

amounts allocated to the tangible and intangible assets acquired, less liabilities assumed, based on their fair values.

When the Company enters into a business combination, the purchase method of accounting is used. Goodwill is assigned

as of the date of the business combination to reporting units that are expected to benefit from the business combination.

Goodwill is not amortized but instead is tested for impairment annually or more frequently if events or changes

in circumstances indicate that the asset might be impaired. The impairment test is carried out in two steps. In the first

step, the carrying amount of the reporting unit, including goodwill, is compared with its fair value. When the fair value

of the reporting unit exceeds its carrying amount, goodwill of the reporting unit is not considered to be impaired and

the second step of the impairment test is unnecessary. The second step is carried out when the carrying amount of a

reporting unit exceeds its fair value, in which case, the implied fair value of the reporting unit’s goodwill, determined

in the same manner as the value of goodwill is determined in a business combination, is compared with its carrying

amount to measure the amount of the impairment loss, if any.

(i i ) In t a ng i bl e a s s et s :

Intangible assets acquired in a business combination are recorded at their fair values. Intangible assets with finite lives

are amortized over their estimated useful lives and are tested for impairment, as described in note 2(e). Intangible

assets having an indefinite life, such as spectrum licences, are not amortized but instead are tested for impairment on