Rogers 2005 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

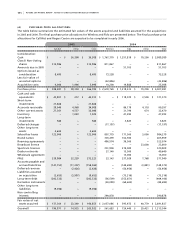

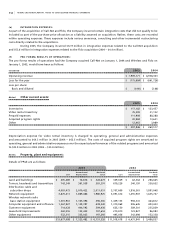

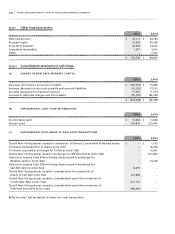

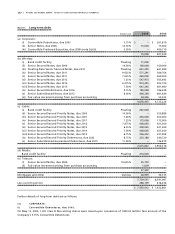

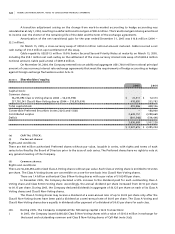

Note 9. Other long-term assets:

2005 2004

Deferred pension $ 32,111 $ 24,184

Program rights 23,420 45,188

Long-term deposits 46,392 14,072

Long-term receivables 1,307 3,632

Other – 2,367

$ 103,230 $ 89,443

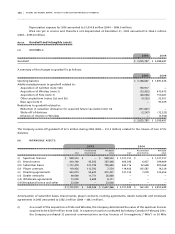

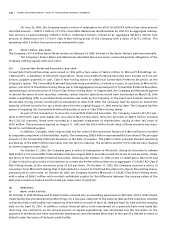

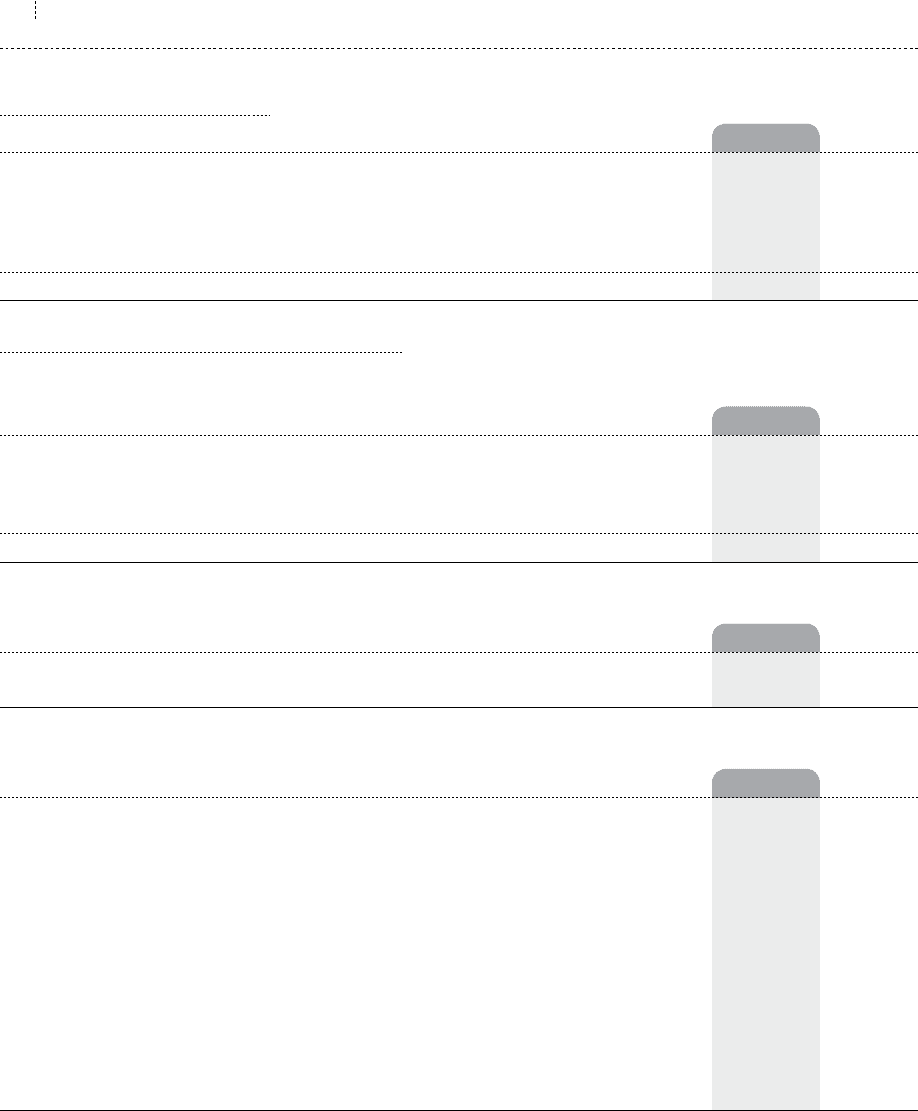

Note 10. Consolidated statements of cash flows:

(a ) C HA N G E I N N ON - C AS H W O RK I N G C AP I TA L :

2005 2004

Decrease (increase) in accounts receivable $ (182,756) $ 15,496

Increase (decrease) in accounts payable and accrued liabilities

(61,532) 13,525

Increase (decrease) in unearned revenue 15,463 (1,811)

Increase in deferred charges and other assets (95,183) (89,300)

$ (324,008) $ (62,090)

(b ) SU P PL E M EN T AL CAS H F L OW INF O RM A TI O N:

2005 2004

Income taxes paid $ 15,662 $ 13,446

Interest paid 705,816 523,061

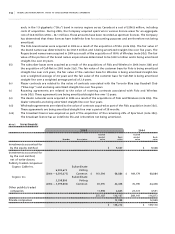

(c ) S U PPL E ME N TA L DI S CL O SU R E O F N O N- C A SH TR A NS A C TI O NS :

2005 2004

Class B Non-Voting shares issued on conversion of Series E Convertible Preferred shares $ – $ 1,752

CCI shares exchanged for CI shares (note 7(b)) – (6,874)

CCI shares acquired in exchange for CI shares (note 7(b)) – 15,801

Class B Non-Voting shares issued in exchange for Wireless shares (note 3(b)) – 811,867

Options to acquire Class B Non-Voting shares issued in exchange for

Wireless options (note 3(b)) – 73,228

Options to acquire Class B Non-Voting shares Issued in exchange for

Call-Net options (note 3(a)) 8,495 –

Class B Non-Voting shares issued in consideration for acquisition of

shares of Call-Net (note 3(a)) 315,986 –

Class B Non-Voting shares issued in consideration upon the conversion of

convertible debt (note 11(a)) 271,197 –

Class B Non-Voting shares issued in consideration upon the conversion of

Preferred Securities (note 11(a)) 696,494 –

Refer to note 13(a) for details of other non-cash transactions.