Rogers 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

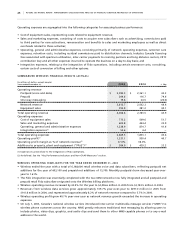

28 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

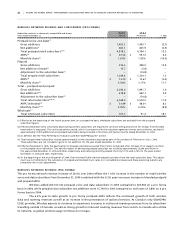

The acquisition of Fido accounted for approximately 61.6% of the increase in Wireless operating expenses for the year

ended December 31, 2005. Since Fido was acquired on November 9, 2004, the prior year only includes Fido financial

results for 53 days.

Cost of equipment sales increased by $263.6 million in 2005 compared to 2004. 43.3% of the year-over-year

increase is due to the acquisition of Fido. In addition, the increase reflects the growing volume of gross additions and

handset upgrades associated with subscriber retention programs combined with generally higher price points of more

sophisticated handsets and devices.

Sales and marketing expenses increased by $159.4 million in 2005 compared to 2004. The majority of the increase,

approximately 71.0%, is due to the acquisition of Fido, which increased gross additions, compared to the prior year.

Wireless’ marketing efforts during 2005 included targeted programs to acquire high-value customers on longer-term

contracts, including the successful Motorola RAZR V3 phone campaign, resulting in increases in the sales and marketing

costs per gross addition. The increase in sales and marketing expenses also reflects the increase in the number of gross

additions in the year.

Operating, general and administrative expenses increased by $364.2 million in 2005 compared to 2004. The

increase is a result of the acquisition of Fido, which accounted for 70.9% of the increase, along with increases in retention

spending and growth in network operating expenses to accommodate the growth in Wireless’ subscriber base and

usage. These increased costs were offset by savings related to more favourable roaming arrangements and operating

and scale efficiencies across various functions.

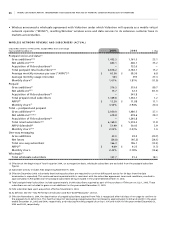

Total retention spending (including subsidies on handset upgrades) was $288.3 million for the year ended 2005

compared to $199.3 million in 2004. Retention spending, on both an absolute and a per subscriber basis, is expected

to continue to grow as wireless market penetration in Canada deepens and WNP becomes available in March 2007, as

recently mandated by the CRTC on December 20, 2005.

Wireless incurred $53.6 million during the year for integration expenses associated with the Fido acquisition.

These integration expenses have been recorded within operating expenses. See the section below entitled “Update

on Fido Integration” for more details on integration costs incurred, including those costs recorded within PP&E

expenditures and as part of the purchase accounting.

The $1.79 year-over-year increase in average monthly operating expense per subscriber, excluding sales and

marketing expenses and including management fees and integration expenses, reflects Wireless’ increased spending on

handset upgrades associated with targeted retention programs and the impact of integration expenses resulting from

the acquisition of Fido.

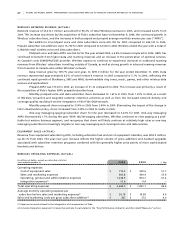

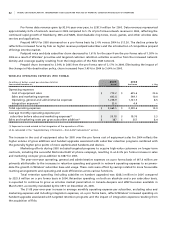

WI R E LE S S O PE R A TI N G P RO F I T ( AC T UA L )

Operating profit grew by $386.7 million, or 40.7%, to $1,337.1 million in 2005 from $950.4 million in 2004, due to network

revenue growth of 44.4%, offset by the growth in operating expenses.

AD D I TI O NS TO W IR E LE S S P P &E (A C TU A L )

Additions to Wireless PP&E are classified into the following categories:

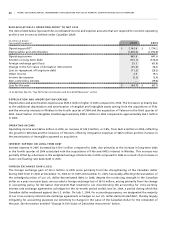

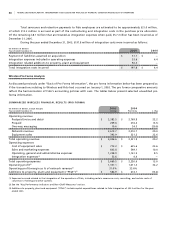

(In millions of dollars)

Years ended December 31, 2 0 0 5 2 0 0 4 % Chg

Additions to PP&E

Network – capacity $ 285.7 $ 222.1 28.6

Network – other 117.2 125.7 (6.8)

Information technology and other 89.5 91.4 (2.1)

Integration of Fido 92.5 – –

Total additions to PP&E $ 584.9 $ 439.2 33.2

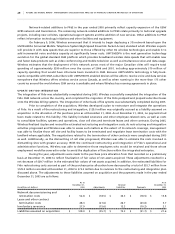

The $584.9 million of additions to PP&E for the year ended December 31, 2005 reflect spending on network capacity

and quality enhancements. Additions to Wireless PP&E in 2005 also include $92.5 million of expenditures related to the

Fido integration.