Rogers 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

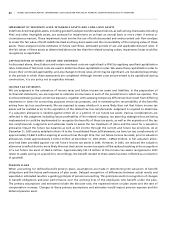

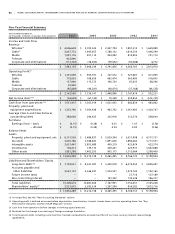

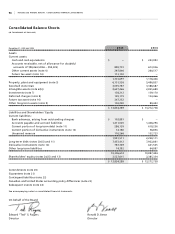

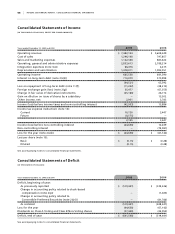

90 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

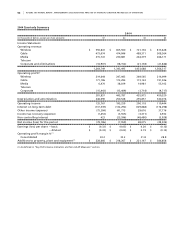

Five-Year Financial Summary

Years ended December 31,

(In thousands of dollars, except per share amounts) 2005 2004 2003 2 0 0 2 2001

Income and Cash Flow

Revenue

Wireless(1) $ 4,006,658 $ 2,783,525 $ 2,207,794 $ 1,891,514 $ 1,640,889

Cable(1) 2,067,733 1,945,655 1,788,122 1,614,554 1,446,599

Media 1,097,176 957,112 854,992 810,805 721,710

Telecom 423,890 – – – –

Corporate and eliminations (113,303) (78,043) (59,052) (50,088) 4,772

$ 7,482,154 $ 5,608,249 $ 4,791,856 $ 4,266,785 $ 3,813,970

Operating Profit(2)

Wireless $ 1,337,049 $ 950,391 $ 727,572 $ 527,687 $ 411,945

Cable 718,603 708,659 663,474 563,480 516,805

Media 127,846 115,372 106,724 87,635 68,306

Telecom 45,940 – – – –

Corporate and eliminations (85,869) (40,281) (48,874) (37,188) (44,535)

$ 2,143,569 $ 1,734,141 $ 1,448,896 $ 1,141,614 $ 952,521

Net Income (loss)(1)(4) $ (44,658) $ (67,142) $ 79,358 $ 259,854 $ (515,721)

Cash flow from operations(1)(3) $ 1,551,415 $ 1,305,019 $ 1,031,043 $ 682,839 $ 483,862

Property, plant and

equipment expenditures $ 1,353,796 $ 1,054,938 $ 963,742 $ 1,261,983 $ 1,420,747

Average Class A and Class B shares

outstanding (000s) 288,668 240,435 225,918 213,570 208,644

Per Share

Earnings (loss) – basic $ (0.15) $ (0.28) $ 0.35 $ 1.05 $ (2.56)

– diluted $ (0.15) (0.28) 0.34 0.83 (2.56)

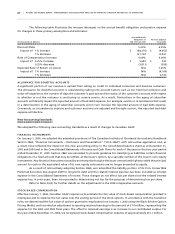

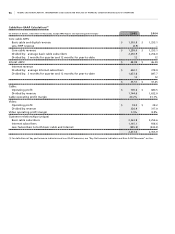

Balance Sheet

Assets

Property, plant and equipment, net $ 6,151,526 $ 5,486,837 $ 5,039,304 $ 5,051,998 $ 4,717,731

Goodwill 3,035,786 3,388,687 1,891,636 1,892,060 1,711,551

Intangible assets 2,627,467 2,855,689 400,219 423,674 423,374

Investments 138,212 139,170 229,221 223,937 1,047,888

Other assets 1,881,298 1,402,355 905,115 1,115,064 1,298,400

$ 13,834,289 $ 13,272,738 $ 8,465,495 $ 8,706,733 $ 9,198,944

Liabilities and Shareholders’ Equity

Long-term debt(1)(5) $ 7,739,551 $ 8,541,097 $ 5,440,018 $ 6,319,454 $ 5,809,497

Accounts payable and

other liabilities 2,567,123 2,346,307 1,534,541 1,272,745 1,192,165

Future income taxes – – – 27,716 137,189

Non-controlling interest – – 193,342 132,536 186,377

Total liabilities 10,306,674 10,887,404 7,167,901 7,752,451 7,325,228

Shareholders’ equity(1) 3,527,615 2,385,334 1,297,594 954,282 1,873,716

$ 13,834,289 $ 13,272,738 $ 8,465,495 $ 8,706,733 $ 9,198,944

(1) As reclassified. See the “New Accounting Standards” section.

(2) Operating profit is defined as income before depreciation, amortization, interest, income taxes, and non-operating items. See “Key

Performance Indicators and Non-GAAP Measures” section.

(3) Cash flow from operations before changes in working capital amounts.

(4) Restated for the change in accounting of foreign exchange translation.

(5) Total long-term debt, including current portion, has been reclassified to exclude the effect of our cross-currency interest rate exchange

agreements.