Rogers 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

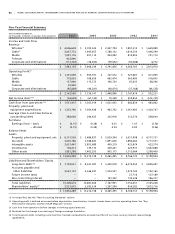

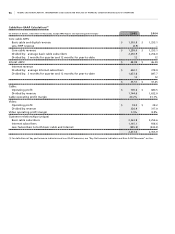

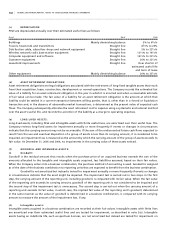

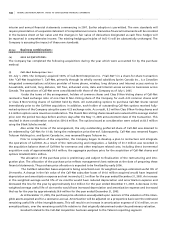

Years ended December 31, 2005 and 2004 2 0 0 5 2 0 0 4

Operating revenue $ 7,482,154 $ 5,608,249

Cost of sales 1,296,148 797,857

Sales and marketing expenses 1,122,348 883,622

Operating, general and administrative expenses 2,853,613 2,188,214

Integration expenses (note 3(e)) 66,476 4,415

Depreciation and amortization 1,478,011 1,092,551

Operating income 665,558 641,590

Interest on long-term debt (note 2(s)(i)) 710,079 575,998

(44,521) 65,592

Loss on repayment of long-term debt (note 11(f)) (11,242) (28,210)

Foreign exchange gain (loss) (note 2(g)) 35,477 (67,555)

Change in fair value of derivative instruments (25,168) 26,774

Gain on dilution on issue of shares by a subsidiary – 15,502

Other income, net 2,951 3,783

Income (loss) before income taxes and non-controlling interest (42,503) 15,886

Income tax expense (reduction) (note 14):

Current 10,730 3,447

Future (8,575) –

2,155 3,447

Income (loss) before non-controlling interest (44,658) 12,439

Non-controlling interest – (79,581)

Loss for the year (note 2(s)(i)) $ (44,658) $ (67,142)

Loss per share (note 15):

Basic $ (0.15) $ (0.28)

Diluted (0.15) (0.28)

See accompanying notes to consolidated financial statements.

99 ROGERS 2005 ANNUAL REPORT . CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statements of Income

(I N TH OU S AN DS O F DOL LA R S, E XC EPT P ER S HA R E AM OU N TS )

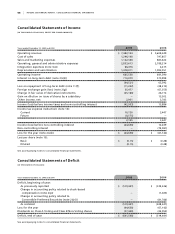

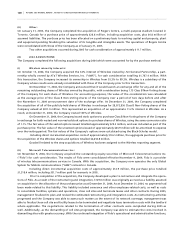

Years ended December 31, 2005 and 2004 2 0 0 5 2 0 0 4

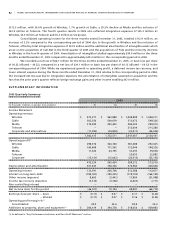

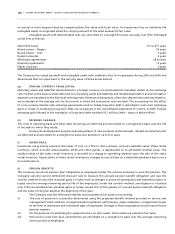

Deficit, beginning of year:

As previously reported $ (519,441) $ (339,436)

Change in accounting policy related to stock-based

compensation (note 2(p)) – (7,025)

Change in accounting policy related to

Convertible Preferred Securities (note 2(s)(i)) – (81,786)

As restated (519,441) (428,247)

Loss for the year (44,658) (67,142)

Dividends on Class A Voting and Class B Non-Voting shares (37,449) (24,052)

Deficit, end of year $ (601,548) $ (519,441)

See accompanying notes to consolidated financial statements.

Consolidated Statements of Deficit

(I N TH OU S AN DS O F DOL LA R S)