Rogers 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

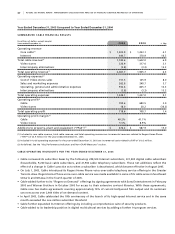

47 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

revenue across all other Media properties. This increase also included $78.9 million contributed by the Toronto Blue Jays,

whose prior year results were consolidated from July 31, 2004 onwards. $23.7 million of the increase over last year is a

result of the acquisition of Rogers Centre on January 31, 2005.

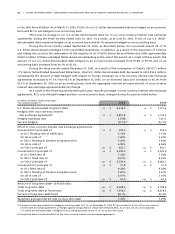

ME D I A O PE R AT I N G E XP E NS E S

Operating expenses for 2005 increased by $127.9 million from 2004. Of this increase, $111.7 million is due to the consolidation

of the Toronto Blue Jays from July 31, 2004, and as a result of the acquisition of Rogers Centre on January 31, 2005. The

launch of three radio stations in the Maritimes and OMNI.10 in Vancouver generated costs of $5.3 million associated with

these new businesses. Finally, higher sales volume led to the required increase of costs of goods sold on The Shopping

Channel, partially offset by cost reductions in Publishing of $10.5 million.

ME D I A O PE R AT I N G P RO F IT

Operating profit for 2005 increased $12.4 million over 2004, and operating profit margin was 11.6% compared to 12.1%

in 2004. Sports Entertainment’s operating loss increased in 2005 by $4.5 million over 2004. The launch of new radio sta-

tions and OMNI.10 also adversely impacted operating profit and margin, however, organic growth was generated across

all of Media’s divisions.

AD D I TI O NS TO M ED I A P P& E

Total additions to Media’s PP&E in 2005 were $39.6 million, compared to $20.3 million in 2004. The increase in 2005 was

primarily due to enhancements at the Rogers Centre, completion of the new Maritime radio stations and investment in

high-definition TV broadcast equipment.

C H A N G E S T O F U T U R E S E G M E N T R E P O R T I N G A S S O C I A T E D W I T H I N T E R N A L R E O R G A N I Z A T I O N

As discussed above, we completed a reorganization whereby Cable acquired substantially all of the operating subsidiaries

of Telecom. Telecom had previously been a separate operating segment of RCI. As a result of this reorganization, the

businesses formerly conducted by Telecom are now conducted by Cable. As a result of the changes to management’s

reporting, our reporting segments will change.

3 . F I N A N C I N G A N D R I S K M A N A G E M E N T

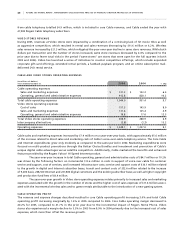

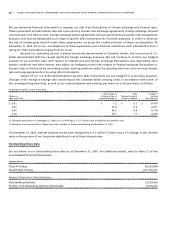

Consolidated Liquidity and Capital Resources

OP E R AT I ON S

For the year ended December 31, 2005, cash generated from operations before changes in non-cash operating items,

which is calculated by adjusting to remove the effect of all non-cash items from net income, increased to $1,551.4 million

from $1,305.0 million in 2004. The $246.4 million increase is primarily the result of the increase in operating profit of

$409.4 million, partially offset by the $134.1 million increase in interest expense.

Taking into account the changes in non-cash working capital items for the year ended December 31, 2005, cash

generated from operations was $1,227.4 million, compared to $1,242.9 million in 2004.

The cash flow generated from operations of $1,227.4 million, together with the following items, resulted in

total net funds of approximately $1,985.7 million raised in the year ended December 31, 2005:

• Aggregate net drawdowns of $612.0 million under bank credit facilities;

• Receipt of $100.3 million from the issuance of Class B Non-Voting shares under the exercise of employee stock

options;

• Addition of $43.8 million of cash on hand at Telecom on July 1, 2005; and

• Net proceeds of $2.2 million from the sale of investments.