Rogers 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

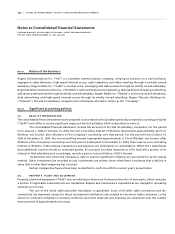

101 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Nature of the business:

Rogers Communications Inc. (“RCI”) is a Canadian communications company, carrying on business on a national basis,

engaged in cable television, high-speed Internet access, cable telephony and video retailing through its wholly owned

subsidiary, Rogers Cable Inc. (“Cable”); wireless voice, messaging and data services through its wholly owned subsidiary,

Rogers Wireless Communications Inc. (“Wireless”); radio and television broadcasting, televised home shopping, publishing,

and sports entertainment through its wholly owned subsidiary, Rogers Media Inc. (“Media”); and circuit-switch telephony,

data networking, and high-speed Internet access through its wholly owned subsidiary, Rogers Telecom Holdings Inc.

(“Telecom”). RCI and its subsidiary companies are collectively referred to herein as the “Company”.

Note 2. Significant accounting policies:

(a ) B AS I S O F P R ES E N TA T IO N :

The consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles

(“GAAP”) and differ in certain significant respects from United States GAAP as described in note 23.

The consolidated financial statements include the accounts of RCI and its subsidiary companies. For the period

from January 1, 2004 to October 13, 2004, the non-controlling interest of Wireless represented approximately 44.7% of

Wireless’ net income, after dilutions of the Company’s ownership over that period. For the period from October 14,

2004 to December 31, 2004, the non-controlling interest represented approximately 11.2% of Wireless’ net income, after

dilutions of the Company’s ownership over that period. Subsequent to December 31, 2004, there was no non-controlling

interest in Wireless. Intercompany transactions and balances are eliminated on consolidation. When RCI’s subsidiaries

issue additional common shares to unrelated parties, RCI accounts for these issuances as if RCI had sold a portion of its

interest in that subsidiary and, accordingly, records a gain or loss on dilution of RCI’s interest.

Investments over which the Company is able to exercise significant influence are accounted for by the equity

method. Other investments are recorded at cost. Investments are written down when there is evidence that a decline in

value that is other than temporary has occurred.

Certain comparative figures have been reclassified to conform with the current year’s presentation.

(b ) PR O PE R T Y, PL A NT A ND EQ U IPM E NT :

Property, plant and equipment (“PP&E”) are recorded at purchase cost. During construction of new assets, direct costs plus

a portion of applicable overhead costs are capitalized. Repairs and maintenance expenditures are charged to operating

expenses as incurred.

The cost of the initial cable subscriber installation is capitalized. Costs of all other cable connections and dis-

connections are expensed, except for direct incremental installation costs related to reconnect Cable customers, to the

extent of reconnect installation revenues. Deferred reconnect revenues and expenses are amortized over the related

service period of approximately four years.

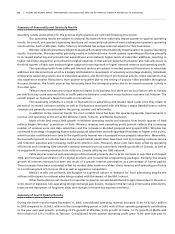

Notes to Consolidated Financial Statements

(T AB ULA R AM OU N TS I N TH O US AN D S OF D OL LA R S, E XC E PT P ER S HAR E AM OU N TS )

FO R TH E YE A RS E ND ED D E CE MBE R 31 , 20 0 5 an d 20 04