Rogers 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

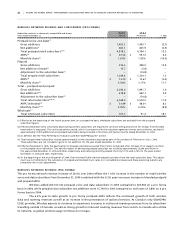

21 ROGERS 2005 ANNUAL REPORT . MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

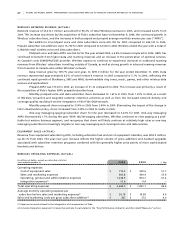

CH A N GE IN FA I R V A LU E O F DE R IV A TI V E I N ST R UME N TS

The loss of $25.2 million in 2005 was a result of the strengthening of the Canadian dollar relative to that of the U.S. dollar

as described above and the resulting change in fair value of our cross-currency interest rate exchange agreements not

accounted for as hedges.

Effective January 1, 2004, in accordance with AcG-13, we determined that we would not record our derivative

instruments, including cross-currency interest rate exchange agreements, as hedges for accounting purposes and

consequently began to account for such derivatives on a mark-to-market basis, with resulting gains or losses recorded in

or charged against income. Accordingly, up to June 30, 2004, we recorded the change in the fair value of our derivative

instruments as either income or expense, depending on the change in the fair value of our cross-currency interest rate

exchange agreements.

Effective July 1, 2004, we met the requirements of AcG-13 to treat certain of our cross-currency interest rate

exchange agreements as hedges for accounting purposes. Hedge accounting was applied prospectively beginning July 1,

2004. The exchange agreements not accounted for as hedges continue to be marked-to-market with their change in fair

value each period either recorded in or charged against income, as appropriate.

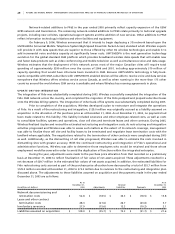

LO S S O N R E PA Y M EN T O F L O N G- T ER M D E B T

In the fourth quarter of 2005, Cable redeemed US$113.7 million of its 11% Senior Subordinated Guaranteed Debentures

due 2015. Cable’s loss on redemption was $9.8 million including the premium on redemption as well as the write-off of

the related deferred financing costs and deferred transitional loss. In addition, we redeemed long-term debt at Telecom

resulting in a loss on repayment of $1.4 million.

During 2004, we redeemed an aggregate US$708.4 million and $300.0 million principal amount of AWE’s Notes

and Debentures and repaid in full a $1,750.0 million bridge credit facility related to the acquisition of AWE’s interest

in Wireless. We paid aggregate prepayment premiums of $49.2 million, and wrote off deferred financing costs of

$19.2 million, offset by a $40.2 million gain on the release of the deferred transition gain related to the cross-currency

interest rate exchange agreements that were unwound during the year, resulting in a loss on the repayment of long-

term debt of $28.2 million.

OT H E R I NC O ME

Other income of $2.9 million in 2005 includes other equity income and losses from investments, gains on the sale of

investments and write-downs required to reflect the other-than-temporary declines in the values of certain investments.

The other income in 2004 includes investment income as well as an $8.9 million gain realized on the exchange of Cogeco

Cable Inc. shares for shares of Cogeco Inc., and a $15.5 million dilution gain associated with stock option exercises at

Wireless, offset by losses on investments accounted for by the equity method.

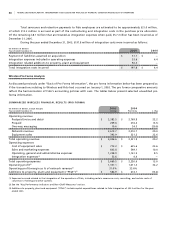

IN C O ME TA X E X P EN S E

The $2.2 million and $3.4 million income tax expenses in 2005 and 2004, respectively consist primarily of the Federal Large

Corporations Tax. In the fourth quarter of 2005, we also determined it is more likely than not that we would realize the

benefit of a portion of our future tax assets, which consist primarily of non-capital loss carryforwards. Accordingly, a

future tax asset of $460.4 million was recognized. Since the majority of the future tax assets recognized relate to income

tax assets of acquired entities, primarily Fido, the benefit was reflected as a reduction of goodwill in the amount of

$451.8 million. The $8.6 million balance of the benefit was recorded as a future income tax reduction in 2005.

NO N - CO N TR O LL I N G I NT E RE S T

Non-controlling interest represents the portion of Wireless’ income attributable to its minority shareholders prior to our

acquisition of AWE’s interest in Wireless on October 13, 2004 and the privatization of Wireless on December 31, 2004.

The non-controlling interest charge of $79.6 million for 2004 represents approximately 44.7% of Wireless’ income from

January 1, 2004 until October 13, 2004 when we completed our purchase of AWE’s 34% ownership interest in Wireless, and

11.2% of Wireless’ income from October 13, 2004 to December 31, 2004, including the dilution effect from the exercise

of Wireless stock options. The non-controlling interest in Wireless was reduced from 11.2% to nil on December 31, 2004

when we acquired the remaining minority interests in Wireless. Reflecting our 100% ownership of Wireless effective

December 31, 2004, the amount of the non-controlling interest in Wireless for 2005 was nil.