Rogers 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

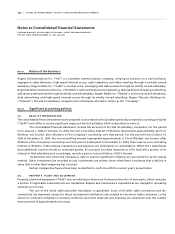

107 ROGERS 2005 ANNUAL REPORT . NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

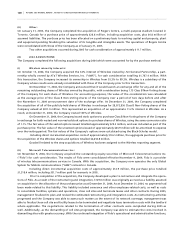

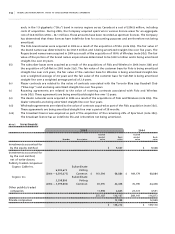

These changes resulted in the following adjustments to the 2004 comparative amounts:

2004

Increase (decrease):

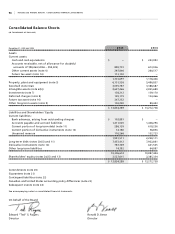

Consolidated balance sheet:

Liabilities:

Long-term debt $ 490,710

Shareholders’ equity:

Convertible Preferred Securities (388,000)

Deficit, beginning of year 81,786

Deficit, end of year 102,710

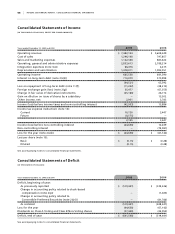

Consolidated statement of income:

Interest on long-term debt 53,924

Loss for the year (53,924)

Consolidated statement of cash flows:

Cash provided by operating activities (33,000)

Cash provided by financing activities 33,000

These changes do not affect loss per share since the related interest expense has, in prior years, been deducted from the

loss for the year in determining loss per share.

(i i ) C o ns o li d at i o n o f v ar i a bl e i n te r e st en t it i e s:

Effective January 1, 2005, the Company adopted Accounting Guideline 15, “Consolidation of Variable Interest Entities”

(“AcG-15”). AcG-15 addresses the application of consolidation principles to certain entities that are subject to control

on a basis other than ownership of voting interests. AcG-15 addresses when an enterprise should include the assets,

liabilities and results of activities of such an entity in its consolidated financial statements. There was no impact to the

consolidated financial statements of the Company as a result of adopting this standard since the Company does not have

an interest in any entities subject to control on a basis other than ownership of voting interests.

(i i i ) A r ra n ge m en t s c o nt a in i n g a l e as e :

CICA Emerging Issues Committee (“EIC”) Abstract 150, Determining whether an Arrangement Contains a Lease (“EIC 150”),

addresses a situation where an entity enters into an arrangement, comprising a transaction that does not take the legal

form of a lease but conveys a right to use a tangible asset in return for a payment or series of payments. EIC 150 was

effective for arrangements entered into or modified after January 1, 2005. There was no impact to the consolidated

financial statements of the Company as a result of the adoption of this new standard since the Company has not entered

into such arrangements.

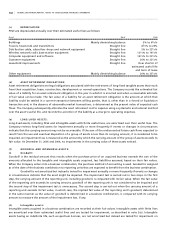

(t ) RE C EN T CA N AD I AN A CC O UN T IN G PR O NO U NC E M EN T S:

(i ) No n -m o ne t ary tr a ns a cti o ns :

In 2005, the CICA issued Handbook Section 3831 Non-monetary transactions (“CICA 3831”), replacing Section 3830,

Non-monetary transactions. CICA 3831 requires that an asset exchanged or transferred in a non-monetary transaction

must be measured at its fair value except when: the transaction lacks commercial substance; the transaction is an

exchange of a product or property held for sale in the ordinary course of business for a product or property to be sold

in the same line of business to facilitate sales to customers other than the parties to the exchange; neither the fair value

of the asset received nor the fair value of the asset given up is reliably measurable; or the transaction is a non-monetary

non-reciprocal transfer to owners that represents a spin-off or other form of restructuring or liquidation. In these cases

the transaction must be measured at the carrying value. The new requirements are effective for transactions occurring

on or after January 1, 2006. The Company does not expect that this new standard will have a material impact on its

consolidated financial statements.

(i i ) Fi n a nc i al In s t ru m en t s:

In 2005, the CICA issued Handbook Section 3855, Financial Instruments – Recognition and Measurement, Handbook

Section 1530, Comprehensive Income, and Handbook Section 3865, Hedges. The new standards will be effective for