Reebok 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 GROUP MANAGEMENT REPORT – OUR GROUP Research and Development

Active trademark and patent

protection policy

To capitalise on the Group’s R&D achieve-

ments, we seek patent protection for all

our footwear, apparel and hardware inno-

vations. It is an important business policy

for our Group to secure the best available

patent protection for our innovations in

major markets. As we use a wide range

of different technologies in our prod-

ucts, we are not dependent upon any

single technology, or any patent rights

related to any single technology. We also

own a substantial portfolio of registered

trademarks for the Group’s brands and

related proprietary names. As part of our

business policy, we enforce the Group’s

trademarks and patents by monitor-

ing the marketplace for infringements

and taking action to prevent them. This

includes a vigorous anti-counterfeiting

programme. We also have comprehen-

sive processes, and undertake significant

research, to avoid infringement of third-

party intellectual property rights see

Risk and Opportunity Report, p. 140.

R&D expenses increase 6%

In 2009, as in prior years, all R&D costs

were expensed as incurred. adidas

Group R&D expenses increased by 6%

to € 86 million (2008: € 81 million) as a

result of increases at brand adidas from

initiatives relating to the development

of intelligent products.

R&D expenses include expenses for per-

sonnel and administration, but exclude

other costs, for example those associated

with the design aspect of the product

creation process. Personnel expenses

represent the largest portion of R&D

expenses, accounting for more than 50%

of total R&D expenses in 2009. In 2009,

R&D expenses represented 2.0% of total

operating expenses versus 1.9% in the

prior year. R&D expenses as a percentage

of sales remained stable at 0.8% (2008:

0.8%) see Note 2, p. 171.

Highly skilled technical personnel

For all our brands, the success of our

R&D efforts depends on bringing

together a multi-faceted and highly

skilled workforce. At December 31,

2009, 999 people were employed in the

Group’s R&D activities compared to

1,152 employees in 2008 (–13%). This

represents 3% of total Group employ-

ees, unchanged compared to the prior

year (2008: 3%). The R&D departments

for each brand comprise experienced

teams from different areas of expertise.

Employees with a background in mechan-

ical and technical engineering as well as

biomechanics specialise primarily in the

development of performance footwear

with a special focus on reducing stress

on knees and other joints. Experts in

material engineering concentrate on the

development of apparel and footwear

with an emphasis on increasing durability

and flexibility as well as enhancing tem-

perature and moisture management.

Other professional backgrounds include

industrial and graphic design, Finite

Element Analysis, advanced CAD design

and kinesiology. In 2010, we expect the

number of R&D employees to remain

largely unchanged.

Successful commercialisation of

technological innovations

Developing industry-leading technologies

is only one aspect of being an innovation

leader. Even more important is the suc-

cessful commercialisation of those tech-

nological innovations. Also in 2009, the

majority of adidas Group sales were gen-

erated with products newly introduced in

the course of the year. New products tend

to have a higher gross margin compared

to products which are in the market for

more than one season. As a result, newly

launched products contributed over-

proportionately to the Group’s net income

in 2009. We expect this

development to

continue in 2010 as our launch schedule

highlights a full pipeline of innovative

products see Subsequent Events and Out-

look, p. 156.

N

°-

02

N

°-

03

N

°-

04

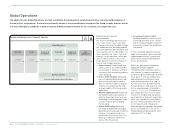

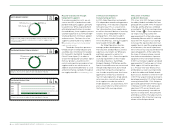

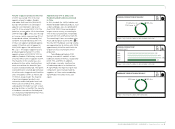

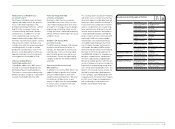

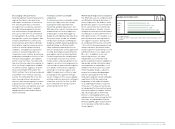

R&D EXPENSES

€ IN MILLIONS

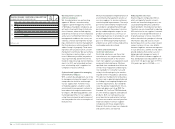

R&D EXPENSES

IN % OF NET SALES

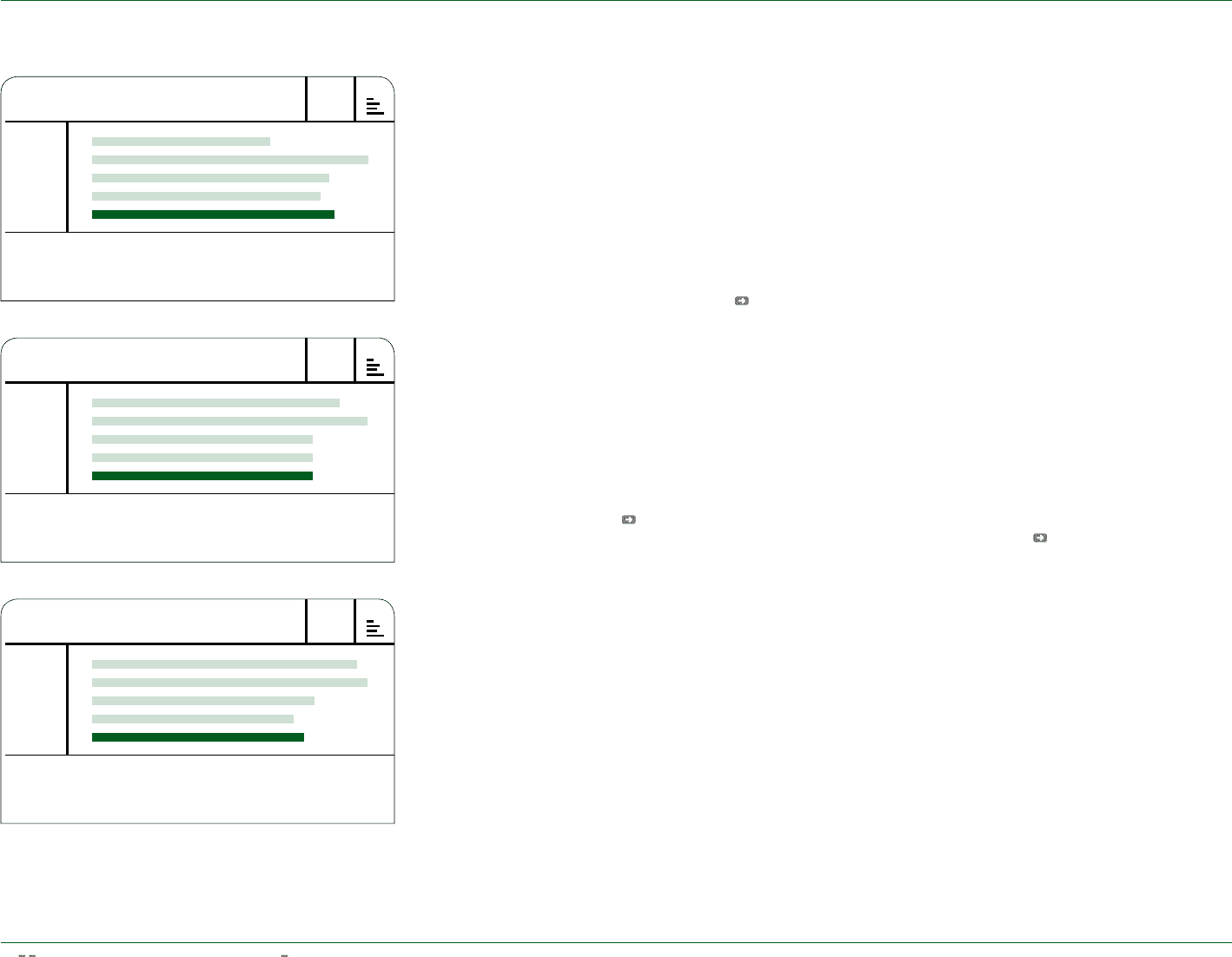

R&D EXPENSES

IN % OF OTHER OPERATING EXPENSES

2005 1 )

2006 2 )

2007

2008

2009

2005 1 )

2006 2 )

2007

2008

2009

2005 1 )

2006 2 )

2007

2008

2009

63

98

84

81

86

0.9

1.0

0.8

0.8

0.8

2.5

2.6

2.1

1.9

2.0

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.