Reebok 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 TO OUR SHAREHOLDERS Our Share

1) In April 2009, Management as at December 31, 2009.

1) At year-end 2009.

Source: Bloomberg.

N

°-

06

N

°-

07

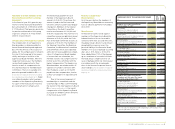

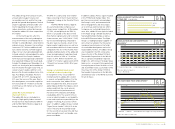

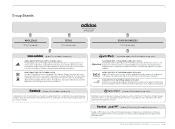

SHAREHOLDER STRUCTURE 1 )

RECOMMENDATION SPLIT 1 )

<1% Rest of the world

10% Germany

26% North America

3% Management

24% Sell

22% Hold

29% Other, undisclosed

holdings

31% Rest of Europe

54% Buy

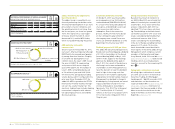

adidas AG historically outperforms adidas AG historically outperforms

benchmark indices benchmark indices

The adidas Group is committed to con-

tinuously enhancing shareholder value.

The long-term development of our share

price reflects investor confidence and

the growth potential of our Group. Over

the last ten years, our share has gained

103%. This represents a clear outper-

formance of both the DAX-30, which

decreased 14%, and the MSCI Index,

which increased 58% during the period.

ADR performs in line with ADR performs in line with

common stockcommon stock

Since its launch on December 30, 2004,

our Level 1 American Depositary Receipt

(ADR) facility has enjoyed great popular-

ity among American investors. Roughly

in line with the development of our

common stock, the Level 1 ADR closed

the year at US $27.15, representing

an increase of 40% versus the prior

year (2008: US $19.35). The number of

Level 1 ADRs outstanding decreased

to 5.4 million at year-end 2009 (2008:

8.9 million). The average daily trading

volume decreased 33% compared to the

prior year. Since November 2007, the

adidas AG ADR is quoted on the OTCQX

International Premier market, the high-

est over-the-counter market tier. This

electronic trading forum includes leading

international companies with substan-

tial operating businesses and credible

disclosure policies.

Convertible bond fully convertedConvertible bond fully converted

On October 8, 2009, we announced the

early redemption of our € 400 million

convertible bond (ISIN DE0009038968).

As a result of the favourable adidas AG

share price, all bondholders exercised

their conversion rights before

redemption. Due to the conversion

process, 15,684,274 new shares based

on the Contingent Capital 2003/II of

the company were issued. These new

shares are entitled to dividends as of the

beginning of the financial year 2009.

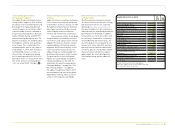

Dividend proposal of € 0.35 per shareDividend proposal of € 0.35 per share

The adidas AG Executive and Supervisory

Boards will recommend paying a dividend

of € 0.35 to shareholders at the Annual

General Meeting (AGM) on May 6, 2010

(2008: € 0.50). Subject to the meeting’s

approval, the dividend will be paid on

May 7, 2010. As a result of the decline in

the Group’s net income attributable to

shareholders in 2009, Management has

taken the decision to lower the dividend

level. In light of the strong cash flow

generation in 2009 and the significantly

reduced level of net borrowings, however,

Management has decided to change its

dividend policy. Going forward, we intend

to pay out between 20 and 40% of net

income attributable to shareholders

(previously: 15 to 25%). The total payout

of € 73 million (2008: € 97 million)

reflects an increase of our payout ratio to

30% of net income compared to 15% in

the prior year.

Strong international investor baseStrong international investor base

Based on the amount of invitations to

our AGM in May 2009, we estimate that

adidas AG currently has around 60,000

shareholders. In our latest ownership

analysis conducted in April 2009, we

identified 71% of our shares outstand-

ing. Shareholdings in the North Ameri-

can market account for 26% of our total

shares outstanding. Identified German

institutional investors hold 10% of

shares outstanding. The shareholdings

in the rest of Europe excluding Germany

amount to 31%, while 1% of institu-

tional shareholders were identified in

other regions of the world. adidas Group

Management, which comprises current

members of the Executive and Super-

visory Boards, holds 3% in total see Cor-

porate Governance Report, p. 33. Undisclosed

holdings, which also include private

investors, account for the remaining 29%

see 06.

Voting rights notifications receivedVoting rights notifications received

All voting rights notifications in accord-

ance with § 21 section 1 of the German

Securities Trading Act (Wertpapier-

handelsgesetz – WpHG) received in 2009

and thereafter can be viewed on our

corporate website www.adidas-Group.com/

voting_rights_ notifications. Information on

investments that have exceeded or fallen

below a certain threshold can also be

found in the Notes section of this Annual

Report see Note 26, p. 189.

N

°-

05

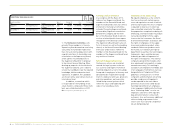

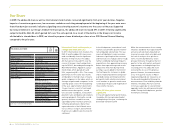

HISTORICAL PERFORMANCE OF ADIDAS AG SHARE 1 )

AND IMPORTANT INDICES AT YEAR-END 2009 IN %

1 year 3 years 5 years 10 years since IPO

adidas AG 39 0 27 103 335

DAX-30 24 (10) 40 (14) 170

MSCI World Textiles,

Apparel & Luxury Goods 53 (4) 33 58 137

1) Source: Bloomberg.