Reebok 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Income Statement 117

In European Emerging Markets, Group

sales decreased 7% on a currency-

neutral basis, primarily due to declines

in Russia as a result of the devaluation

of the Russian rouble against the func-

tional currency, the US dollar, which

could not be offset by price increases.

Sales for the adidas Group in North

America decreased 10% on a currency-

neutral basis due to declines in the USA

and Canada. Sales in Greater China

decreased 16% on a currency-neutral

basis. Revenues in Other Asian Markets

declined 3% primarily as a result of

decreases in Japan. In Latin America,

sales grew 19% on a currency-neutral

basis, with double-digit increases in most

of the region’s major markets, also sup-

ported by the consolidation of new com-

panies in the region see 11.

Currency translation effects had

a mixed impact on regional sales in

euro terms. Group revenues in Western

Europe decreased 8% to € 3.262 bil-

lion in 2009 from € 3.527 billion in

2008. In European Emerging Markets,

sales declined 5% to € 1.122 billion

in 2009 from € 1.179 billion in 2008.

Sales in North America decreased 6%

to € 2.360 billion from € 2.520 billion

in 2008. Revenues in Greater China

decreased 10% to € 967 million in 2009

from € 1.077 billion in 2008. In Other

Asian Markets, sales increased 4% to

€ 1.647 billion versus € 1.585 billion

in the prior year. Revenues in Latin

America grew 13% to € 1.006 billion from

€ 893 million in the prior year see 13.

adidas Group revenues decline in all

product categories

In 2009, currency-neutral Group sales

declined in all product categories.

Currency-neutral footwear sales

decreased 7% during the period. This

development was due to declines

in Wholesale and Other Businesses

which more than offset an increase in

Retail. Apparel sales decreased 4% on

a currency-neutral basis. While sales

increased in Retail and Other Businesses,

revenues declined in Wholesale.

Currency-neutral hardware sales

decreased 6% compared to the prior year

due to declines in Wholesale, Retail and

Other Businesses.

Currency translation effects

positively impacted sales in all prod-

uct categories in euro terms. Footwear

sales in euro terms decreased 6% to

€ 4.642 billion in 2009 (2008: € 4.919 bil-

lion). Apparel sales decreased 2% to

€ 4.663 billion in 2009 from € 4.775 bil-

lion in the prior year. Hardware sales

decreased 3% to € 1.076 billion in 2009

from € 1.105 billion in 2008 see 15.

Cost of sales increases

Cost of sales is defined as the amount we

pay to third parties for expenses associ-

ated with producing and delivering our

products. Own-production expenses are

also included in the Group’s cost of sales.

However, these expenses represent only

a very small portion of total cost of sales.

In 2009, cost of sales was € 5.669 billion,

representing an increase of 2% compared

to € 5.543 billion in 2008. This develop-

ment was due to significant increases

of raw material and labour costs which

more than offset positive effects from the

optimisation of sourcing processes and

efficiency gains within our supply chain.

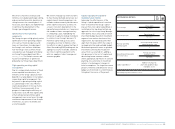

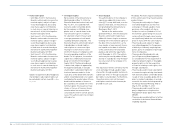

Gross margin negatively impacted

by higher input costs

The gross margin of the adidas Group

decreased 3.3 percentage points to 45.4%

in 2009 (2008: 48.7%) see 16. This

development was mainly due to higher

input costs, currency devaluation effects

as well as higher clearance sales and

promotional activity. Currency devalu-

ation effects were mainly related to

Russia. In this market, sales were nega-

tively impacted by the devaluation of the

Russian rouble against the functional

currency, the US dollar, whereas cost

of goods sold remained largely unaffec-

ted. The vast majority of these costs are

denominated in US dollars. As a result,

gross profit for the adidas Group declined

10% in 2009 to € 4.712 billion versus

€ 5.256 billion in the prior year see

17.

N

°-

1 6

N

°-

1 7

GROSS MARGIN

IN %

GROSS PROFIT

€ IN MILLIONS

2005 1 )

2006 2 )

2007

2008

2009

2005 1 )

2006 2 )

2007

2008

2009

48.2

44.6

47.4

48.7

45.4

3,197

4,495

4,882

5,256

4,712

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

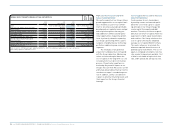

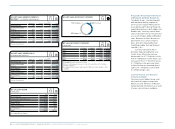

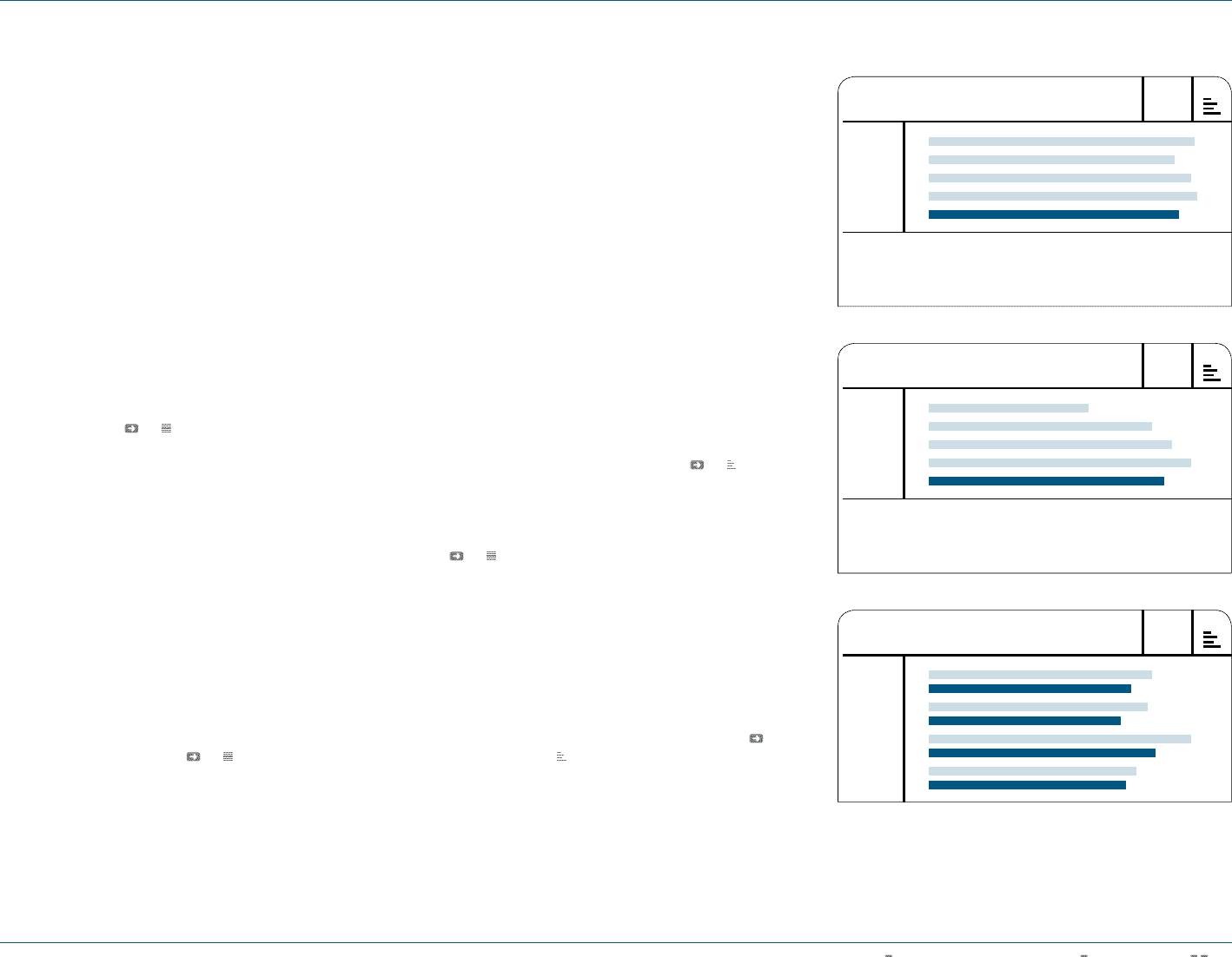

N

°-

1 8

GROSS PROFIT BY QUARTER

€ IN MILLIONS

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

1,288

1,164

1,263

1,105

1,511

1,307

1,194

1,136