Reebok 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Economic and Sector Development 113

N

°-

02

N

°-

03

N

°-

04

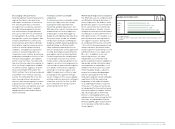

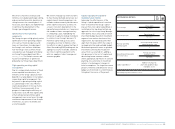

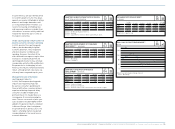

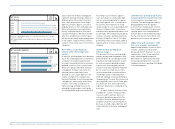

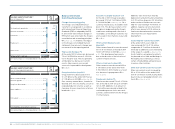

QUARTERLY UNEMPLOYMENT RATE BY REGION

IN % OF TOTAL ACTIVE POPULATION

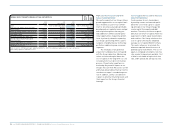

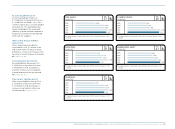

QUARTERLY DEVELOPMENT OF CONSUMER

PRICE INDEX 1) 2) BY REGION

QUARTERLY CONSUMER CONFIDENCE

DEVELOPMENT BY REGION

Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009

USA 1 ) 7.4 8.6 9.5 9.8 10.0

Euro Zone 2 ) 8.2 9.1 9.4 9.8 10.0

Japan 3 ) 4.3 4.8 5.4 5.3 5.1

1) Source: US Bureau of Labour Statistics.

2) Source: Eurostat.

3) Source: Japan Ministry of Internal Affairs and Communications.

Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009

USA 0.1 (0.4) (1.4) (1.3) 2.7

Euro Zone 1.6 0.6 (0.1) (0.3) 0.9

Japan 0.4 (0.3) (1.8) (2.2) (1.7)

1) Source: Bloomberg.

2) Quarter-end figures.

Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009

USA 1 ) 38.6 26.9 49.3 53.4 53.6

Euro Zone 2 ) (31) (34) (25) (16) (19)

Japan 3 ) 26.7 29.6 38.1 40.7 37.9

1) Source: Conference Board.

2) Source: European Commission.

3) Source: Economic and Social Research Institute, Government of Japan.

N

°-

05

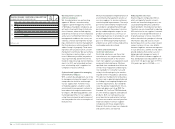

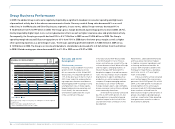

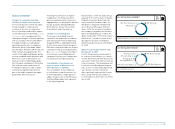

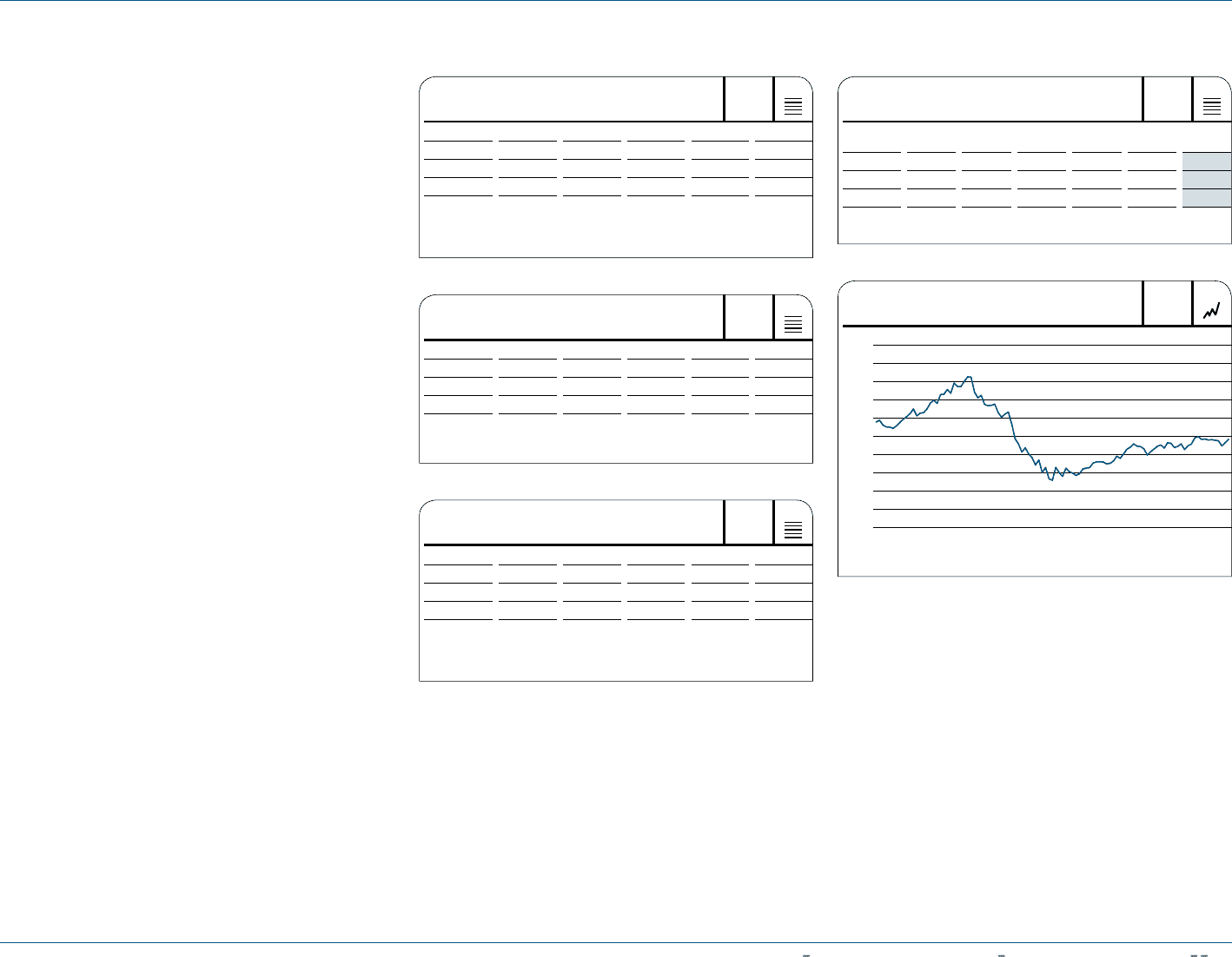

EXCHANGE RATE DEVELOPMENT 1 )

€ 1 EQUALS

Average

rate 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Average

rate 2009

USD 1.4702 1.3308 1.4134 1.4643 1.4406 1.3932

GBP 0.7956 0.9308 0.8521 0.9093 0.8881 0.8912

JPY 152.39 131.17 135.51 131.07 133.16 130.23

1) Spot rates at quarter-end.

N

°-

06

2008 – 2009 OIL PRICE DEVELOPMENT 1 )

IN US $

Jan. 1, 2008 Dec. 31, 2009

160

120

80

40

0

1) West Texas Intermediate Cushing crude oil.

Source: Bloomberg.

In Latin America, full year GDP declined

3.6% (2008: growth of 3.2%). This devel-

opment was mainly attributable to falling

domestic and foreign demand as well

as rising unemployment. However, as a

result of increasing commodity prices

and improving conditions in global finan-

cial markets, economic activity stabilised

towards the end of the year in some of

the region’s economies.

Global sporting goods industry affected

by price-sensitive consumer spending

In 2009, growth of the sporting goods

industry was burdened by the global

economic downturn, which negatively

affected consumer confidence and

spending. However, the extent of the

effect differed from region to region. After

many years of significant growth, the

sporting goods market in Asia softened

considerably, while the USA and Western

Europe were also challenging. In Latin

America, the industry remained relatively

robust, although growth rates were sig-

nificantly lower compared to prior years.

Weak performance of European

sporting goods industry

In 2009, the European sporting goods

industry was negatively impacted

by cautious consumer spending and

financial difficulties some key retailers

experienced during the period. Many

consumers traded off higher price

point purchases for cheaper buys as a

consequence of increasing unemploy-

ment. The non-recurrence of prior year

sales related to the UEFA EURO 2008™

added to the general industry slowdown

in Western Europe. After having been

the growth driver in previous years, the

region’s emerging markets weakened

considerably due to the overall macro-

economic downturn.