Reebok 2009 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS Notes 203

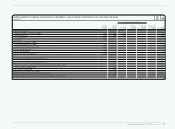

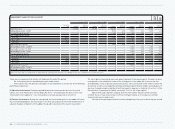

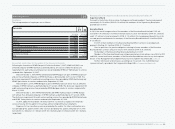

The movements of deferred taxes are as follows:

N

°-

33

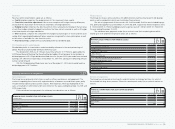

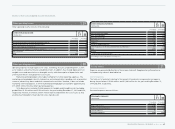

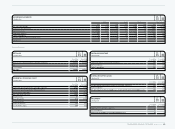

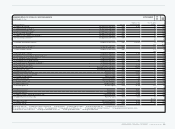

MOVEMENT OF DEFERRED TAXES

€ IN MILLIONS

2009 2008

Deferred tax assets, net as at January 1 (119) (135)

Deferred tax income 43 71

Change in consolidated companies ( see Note 4) 1 ) — (9)

Change in deferred taxes on assets classified as held-for-sale ( see Note 3) 2 ) (3) 3

Change in deferred taxes attributable to effective portion of qualifying hedging

instruments recorded in equity( see Note 28) 46 (41)

Currency translation differences 6 (5)

Change in deferred taxes attributable to actuarial gains and losses recorded

in equity ( see Note 23) 6 (3)

Deferred tax assets, net as at December 31 (21) (119)

1) Relates to the acquisition of Ashworth, Inc. and Textronics, Inc. for the year ending December 31, 2008.

2) Relates to the disposal group Gekko Brands, LLC which was classified as Held-for-Sale for the year ending

December 31, 2008 and sold in March 2009.

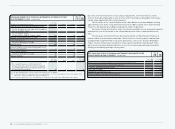

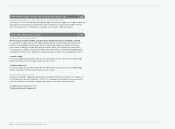

Gross Group deferred tax assets and liabilities before valuation allowances and appropriate

offsettings are attributable to the items detailed in the table below:

N

°-

33

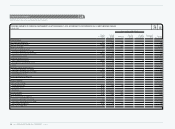

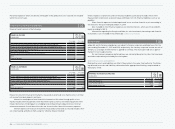

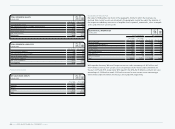

DEFERRED TAXES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Non-current assets 129 88

Current assets 87 100

Accrued liabilities and provisions 132 140

Accumulated tax loss carry-forwards 78 91

Deferred tax assets 426 419

Non-current assets 420 444

Current assets 25 45

Accrued liabilities and provisions 2 49

Deferred tax liabilities 447 538

Deferred tax assets, net (21) (119)

Deferred tax assets are recognised only to the extent that the realisation of the related benefit is

probable. For the assessment of probability, in addition to past performance and the respective

prospects for the foreseeable future, appropriate tax structuring measures are also taken into

consideration.

Deferred tax assets for which the realisation of the related tax benefits is not probable increased

on a currency-neutral basis, and after taking into account the resolution of foreign tax disputes

from € 212 million to € 297 million for the year ending December 31, 2009. These amounts

mainly relate to tax losses carried forward and unused foreign tax credits of the US tax group.

The remaining unrecognised deferred tax assets relate to companies operating in markets

where the realisation of the related tax benefit is not considered probable.

The Group does not recognise deferred tax liabilities for unremitted earnings of non- German

subsidiaries to the extent that they are expected to be permanently invested in international

operations. These earnings, the amount of which cannot be practicably computed, could become

subject to additional tax if they were remitted as dividends or if the Group were to sell its share-

holdings in the subsidiaries.

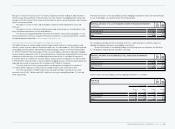

Tax expenses Tax expenses

Tax expenses are split as follows:

N

°-

33

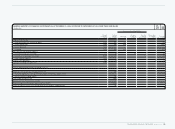

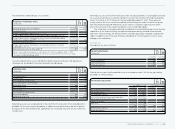

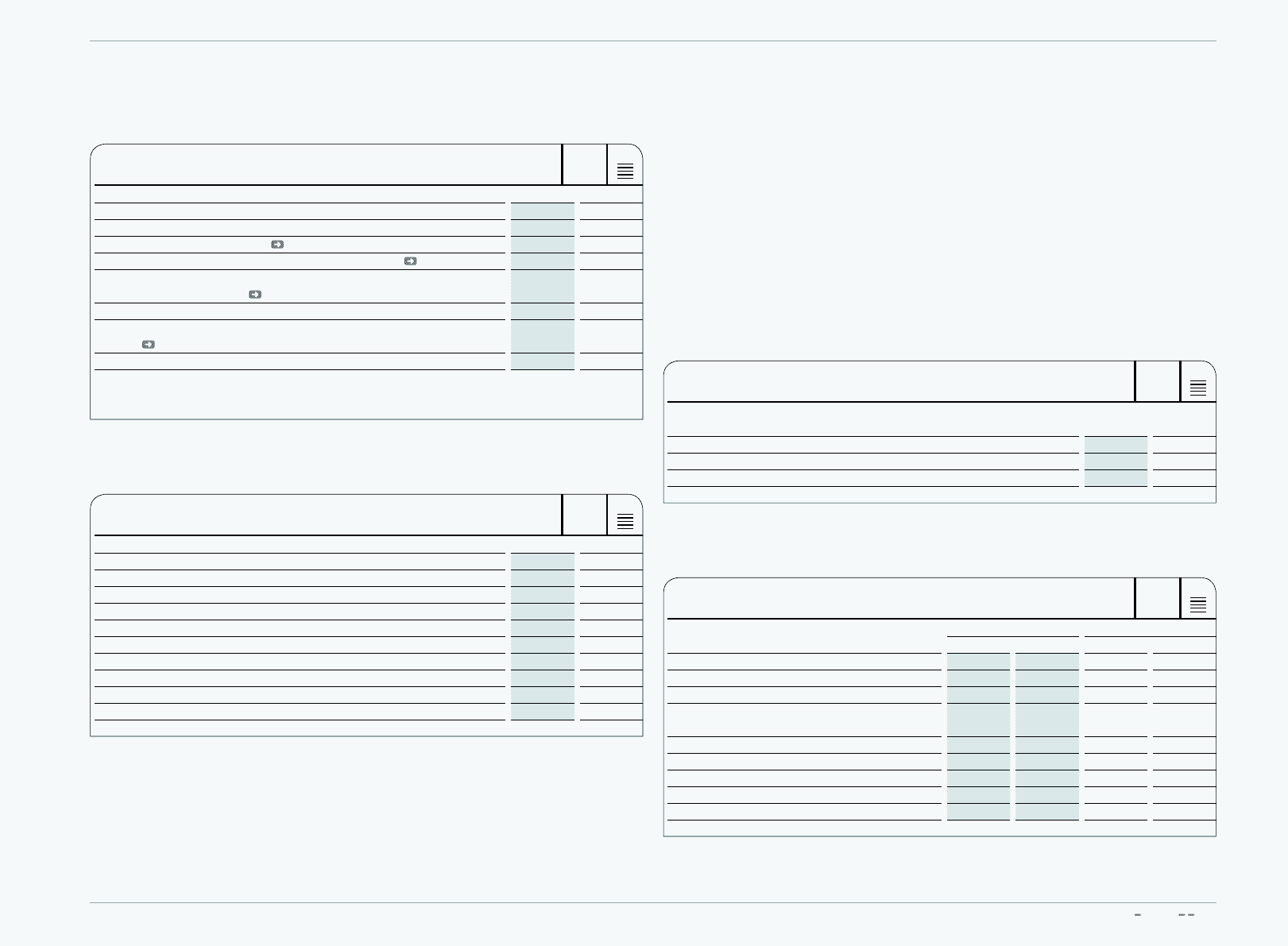

INCOME TAX EXPENSES

€ IN MILLIONS

Year ending

Dec. 31, 2009 Year ending

Dec. 31, 2008

Current tax expenses 156 331

Deferred tax (income) (43) (71)

Income tax expenses 113 260

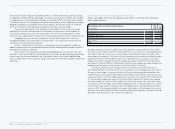

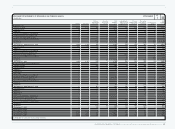

The effective tax rate of the Group differs from an assumed tax rate of 30% for the year ending

December 31, 2009 as follows:

N

°-

33

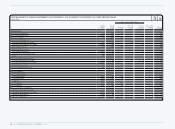

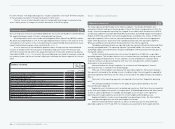

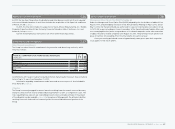

TAX RATE RECONCILIATION

Year ending Dec. 31, 2009 Year ending Dec. 31, 2008

€ in millions in % € in millions in %

Expected income tax expenses 108 30.0 271 30.0

Tax rate differentials (94) (26.1) (72) (7.9)

Non-deductible expenses (36) (10.1) 45 4.9

Losses for which benefits were not recognisable

and changes in valuation allowances 119 33.2 2 0.2

Changes in tax rates 4 1.1 10.1

Other, net 1 0.3 1 0.1

102 28.3 248 27.4

Withholding tax expenses 11 3.1 12 1.4

Income tax expenses 113 31.5 260 28.8