Reebok 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Internal Group Management System

M&A activities focus on long-term

value creation potential

We see the majority of our Group’s future

growth opportunities in our organic busi-

ness. However, as part of our commit-

ment to ensuring sustainable profitable

development we regularly review merger

and acquisition options that may pro-

vide additional commercial and opera-

tional opportunities. Acquisitive growth

focus is primarily related to improving

our Group’s positioning within a sports

category, strengthening our technology

portfolio or addressing new consumer

segments.

The strategies of any potential

acquisition candidate must correspond

with the Group’s direc

tion. Maximising

return on invested capital above the

cost of capital in the

long term is a core

consideration in our decision-making

process. Of particular importance is

evaluating the potential impact on our

Group’s free cash flow. We assess current

and future projected key financial metrics

to evaluate a target’s contribution poten-

tial. In addition, careful consideration

is given to potential financing needs and

their impact on the Group’s financial

leverage.

Cost of capital metric used to measure

investment potential

Creating value for our shareholders

by earning a return on invested capital

above the cost of that capital is a guid-

ing principle of our Group strategy. We

source capital from equity and debt

markets. Therefore, we have a responsi-

bility that our return on capital meets the

expectations of both equity shareholders

and creditors. Our Group calculates the

cost of capital utilising the weighted

average cost of capital (WACC) formula.

This metric allows us to calculate the

minimum required financial returns of

planned capital investments. The cost of

equity is computed utilising the risk-free

rate, market risk premium and beta. Cost

of debt is calculated using the risk-free

rate, credit spread and average tax rate.

N

°-

03

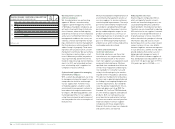

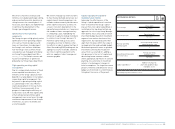

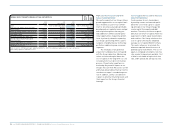

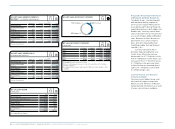

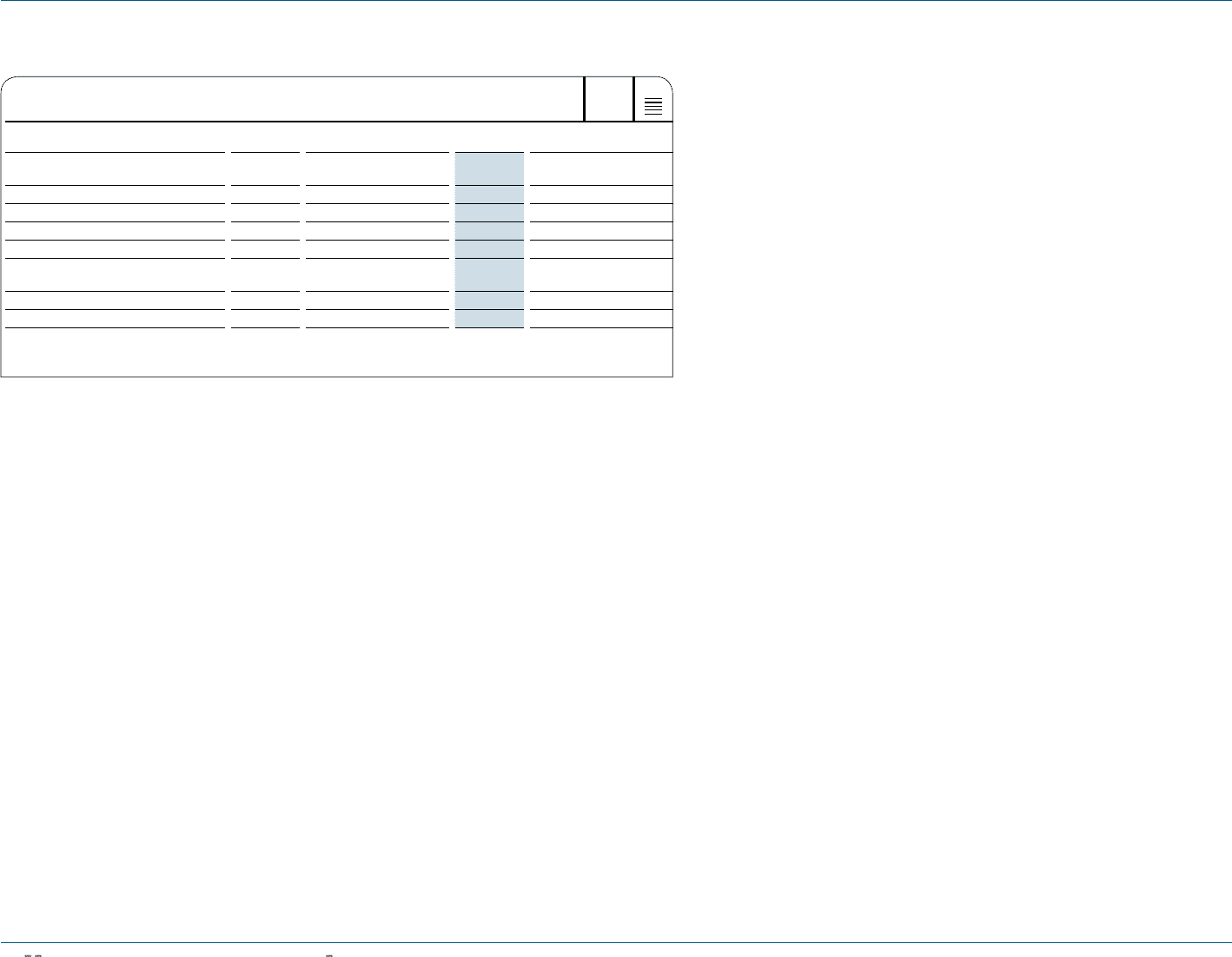

ADIDAS GROUP TARGETS VERSUS ACTUAL KEY METRICS

2008

Actual 2009

Initial outlook 1 )

2009

Actual 2010

Targets

Sales

(year-over-year change, currency-neutral)

9% low- to mid-single-digit

decline (6%) low- to mid-single-digit

increase

Gross margin 48.7% decline 45.4% 46 – 47%

Other operating expenses (in % of sales) 40.5% increase 42.3% moderate decline

Operating margin 9.9% decline 4.9% around 6.5%

(Diluted) earnings per share (in €) 3.07 decline 1.22 1.90 to 2.15

Average operating working capital

(in % of net sales)

24.5% further reduction 24.3% further reduction

Capital expenditure (€ in millions) 2 ) 380 300 – 400 240 300 – 400

Net debt (€ in millions) 2,189 reduction 917 further reduction

1) As stated in the 2008 Annual Report, published on March 4, 2009. The outlook was updated over the course of the year.

2) Excluding acquisitions and finance leases.