Reebok 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

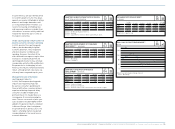

112 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Economic and Sector Development

Group Business Performance

In 2009, the adidas Group results were negatively impacted by a significant slowdown in consumer spending and high levels

of promotional activity due to the adverse macroeconomic climate. Currency-neutral Group sales decreased 6% as a result

of declines in the Wholesale and Other Businesses segments. In euro terms, adidas Group revenues decreased 4% to

€ 10.381 billion from € 10.799 billion in 2008. The Group’s gross margin declined 3.3 percentage points to 45.4% (2008: 48.7%),

mainly impacted by higher input costs, currency devaluation effects as well as higher clearance sales and promotional activity.

Consequently, the Group’s gross profit declined 10% to € 4.712 billion in 2009 versus € 5.256 billion in 2008. The Group’s

operating margin decreased 5.0 percentage points to 4.9% from 9.9% in 2008 due to the lower gross margin as well as higher

other operating expenses as a percentage of sales. The Group’s operating profit declined 53% to € 508 million in 2009 versus

€ 1.070 billion in 2008. The Group’s net income attributable to shareholders decreased 62% to € 245 million from € 642 million

in 2008. Diluted earnings per share decreased 60% to € 1.22 in 2009 versus € 3.07 in 2008.

Economic and Sector

Development

Global economy contracts

Following a sharp slowdown in economic

growth in 2008, the global economy

fell into recession in 2009. Global GDP

decreased 2.2% compared to growth of

1.7% in the prior year. In the first half of

2009, lower industrial and manufactur-

ing output was the main contributor to

declining global GDP resulting in rising

unemployment rates in many regions.

Supported by extensive monetary and

fiscal stimuli, the macroeconomic

environment stabilised in the course

of the second half of the year.

N

°-

01

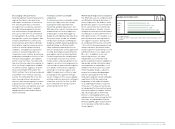

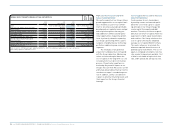

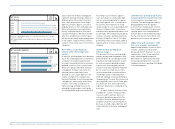

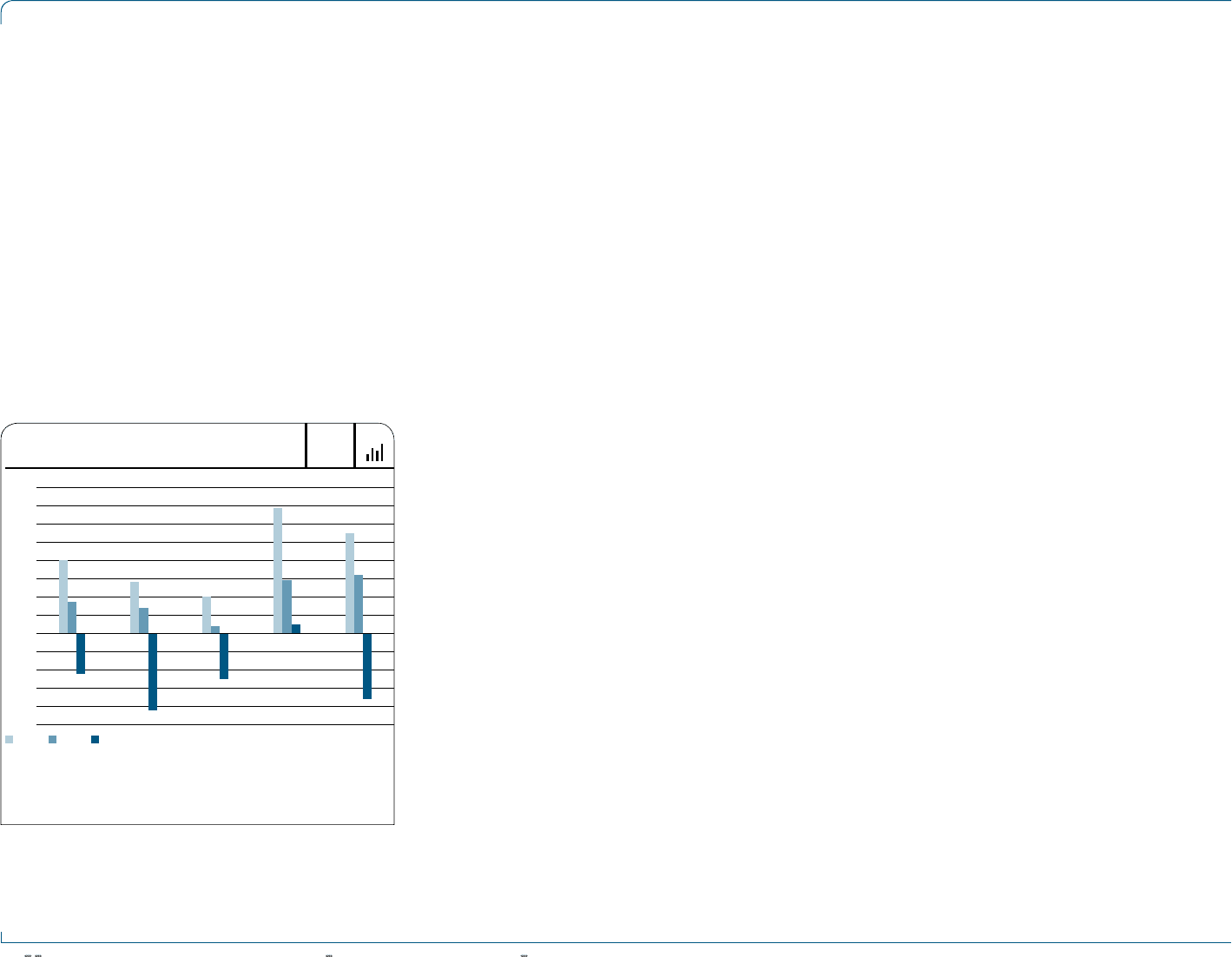

REGIONAL GDP DEVELOPMENT 1 )

IN %

Global Europe USA Asia 2 ) Latin America

6

4

2

0

(2)

(4)

2007 2008 2009

1) Real, percentage change versus prior year; 2008 figures restated compared

to prior year.

2) Asia also includes Japan and Area Pacific.

Source: World Bank, HSBC, Barclay’s Capital.

In Europe, full year GDP decreased by

4.2% (2008: growth of 1.4%). The eco-

nomic contraction was a result of the sig-

nificant downturn in both Western Europe

and the region’s emerging markets. In

Western Europe, GDP declined 3.9%

despite the support of record low interest

rates. This was mainly a result of double-

digit declines in exports and industrial

production, as well as weak private con-

sumption. European emerging markets

declined at a rate similar to Western

Europe, however export- and commodity-

driven economies such as Russia suffered

more extensively than others.

In the USA, the economy contracted

by 2.5% in 2009 (2008: growth of 0.4%).

Strong declines in manufacturing and

industrial output in the first half of the

year were the main contributors to this

development.

Nevertheless, unprecedented monetary

and fiscal policy intervention helped

to stabilise consumer spending as well

as housing and financial markets. As

a result, GDP returned to growth in the

third quarter. Nevertheless, unemploy-

ment rates rose to a 17-year high of

10.5% in December.

In Asia, economic activity remained

most resilient against the recessionary

pressures. Asia’s GDP grew 0.5% in 2009

(2008: 2.9%). GDP growth in China decel-

erated slightly to 8.5%, while Japan’s

economy shrank 5.2%. While developed

Asian countries suffered from the

deter ioration of exports and low levels of

private consumption, developing Asian

countries, in particular China, benefited

from government stimulus in order to

boost domestic demand.