Reebok 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS Notes 189

N

°-

23

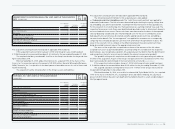

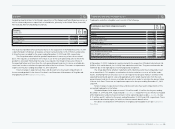

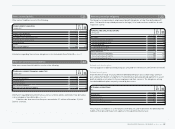

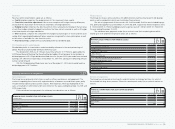

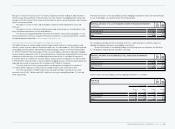

CONSTITUTION OF PLAN ASSETS

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Equity instruments 19 15

Bonds 13 11

Real estate 1 1

Pension plan reinsurance 19 16

Other assets 9 10

Fair value of plan assets 61 53

N

°-

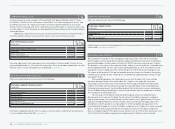

23

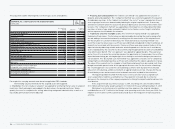

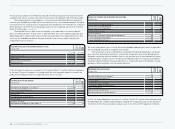

HISTORICAL DEVELOPMENT

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008 Dec. 31, 2007 Dec. 31, 2006 Dec. 31, 2005

Present value of defined benefit obligation 207 172 171 170 131

Fair value of plan assets 61 53 60 46 —

Thereof: defined benefit assets (2) (5) (4) (2) —

Deficit in plan 148 124 115 126 131

Experience adjustments arising

on the plan liabilities (3) 2 (1) 4 1

Experience adjustments arising

on the plan assets 3 (8) 4 — —

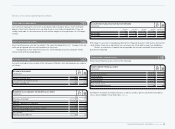

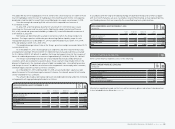

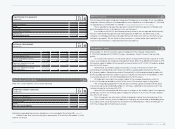

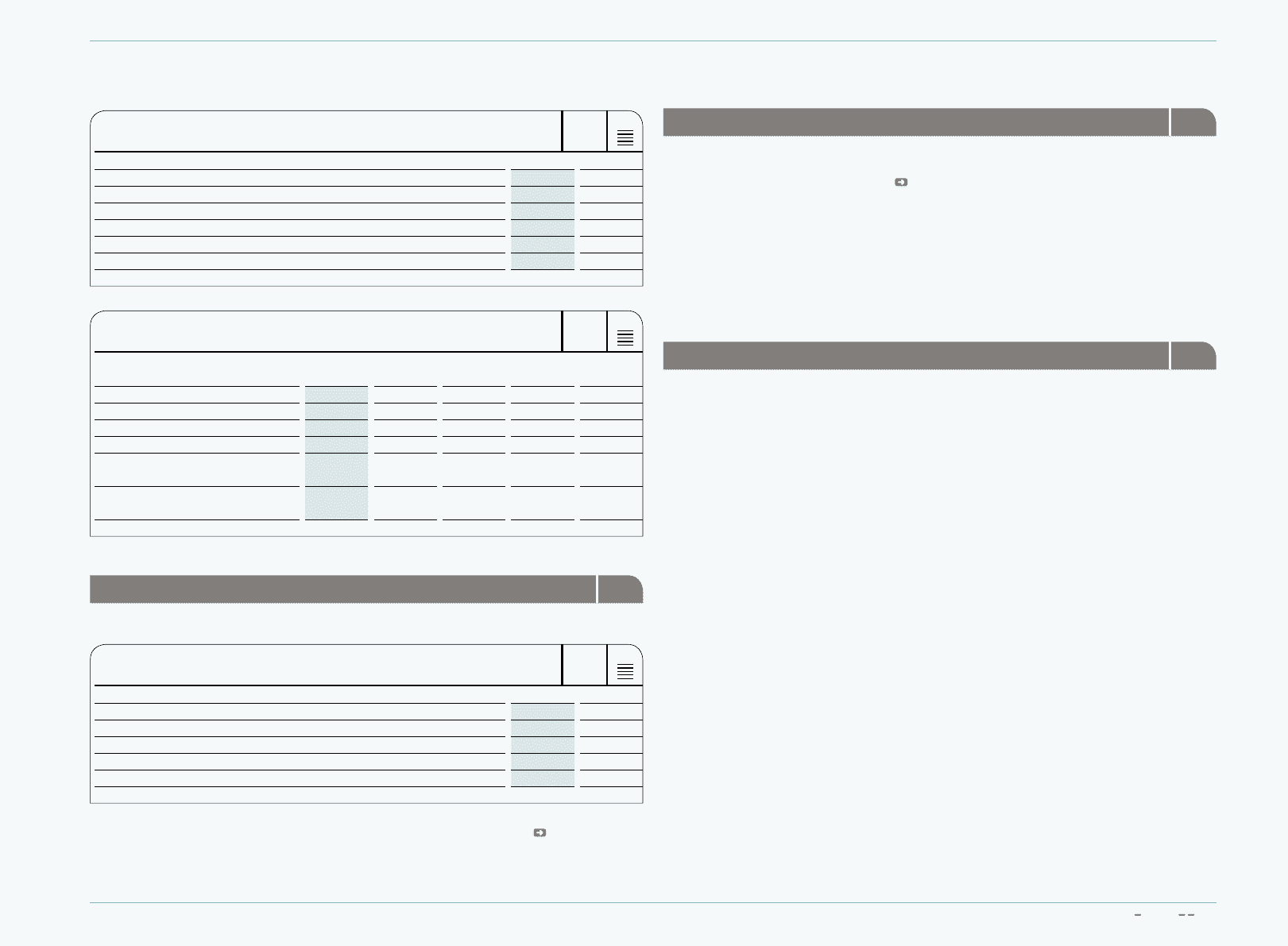

Other non-current liabilities 24

Other non-current liabilities consist of the following:

N

°-

24

OTHER NON-CURRENT LIABILITIES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Finance lease obligations 2 2

Liabilities due to personnel 7 10

Deferred income 17 17

Sundry 2 –

Other non-current liabilities 28 29

Information regarding finance lease obligations is also included in these Notes see Note 27.

Liabilities due after more than five years amounted to € 10 million at December 31, 2009

(2008: € 15 million).

Minority interests 25

This line item within equity comprises the equity of third parties in a number of our consolidated

companies. Minority interests are attributable to seven subsidiaries as at December 31, 2009 and

six subsidiaries as at December 31, 2008 see Shareholdings/Attachment II to these Notes.

These subsidiaries were partly acquired in connection with the acquisition of Reebok and

partly through purchases or foundations in the last two years.

In accordance with IAS 32, the following minority interests are not reported within minority

interests: GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG (Germany), as the

company is a limited partnership, and adidas Hellas A.E. (Greece) in 2008, as this minority was

held with a put option. The fair value of these minorities is shown within other liabilities. The

result for these minorities is reported within financial expenses.

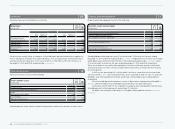

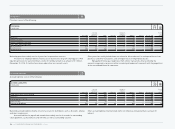

Shareholders’ equity 26

On December 31, 2008, the nominal capital of adidas AG (“the company”) amounted to

€ 193,515,512 divided into 193,515,512 no-par-value bearer shares (“shares”) and was fully

paid in.

As a result of the exercise of 4,100 share options in August 2009 and the issuance of 16,400

shares associated with the company’s Management Share Option Plan (MSOP) on October 5, 2009,

the nominal capital of adidas AG increased to an overall amount of € 193,531,912 and was divided

into 193,531,912 shares.

Furthermore, the nominal capital increased as a result of the exercise of all 7,999

outstanding convertible bonds with conversion rights issued by adidas International Finance

B.V. (formerly adidas-Salomon International Finance B.V.) in 2003 and guaranteed by adidas AG

(formerly adidas-Salomon AG), and the issuance of 15,684,274 new shares on November 9, 2009

to an overall amount of € 209,216,186 divided into 209,216,186 shares.

At the balance sheet date, the nominal capital of the company amounted to a total of

€ 209,216,186 and was divided into 209,216,186 shares. The nominal capital is fully paid in.

The corresponding adjustment to the amount of nominal capital resulting from the above

transactions up to and including December 31, 2009 was submitted for declaratory entry in the

commercial register on January 28, 2010.

Apart from the aforementioned, there were no changes to the nominal capital. Consequently,

on February 19, 2010, the nominal capital of adidas AG amounts to € 209,216,186 and is divided

into 209,216,186 shares.

Each share grants one vote and is entitled to dividends starting from the beginning of the

year it was issued. Treasury shares held directly or indirectly are not entitled to dividend payment

in accordance with § 71 b German Stock Corporation Act (Aktiengesetz – AktG). On February 19,

2010, the company did not hold treasury shares.