Reebok 2009 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

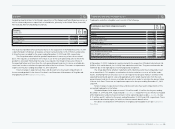

CONSOLIDATED FINANCIAL STATEMENTS Notes 183

Goodwill 12

Goodwill primarily relates to the Group’s acquisitions of the Reebok and TaylorMade businesses as

well as recent and previous acquisitions of subsidiaries, primarily in the United States, Australia/

New Zealand, Netherlands/Belgium and Italy.

N

°-

1 2

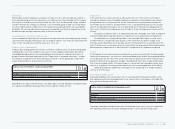

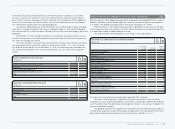

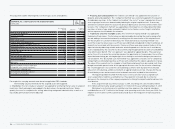

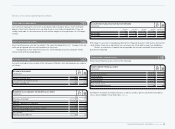

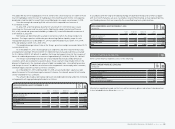

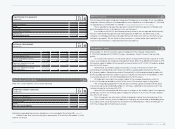

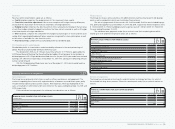

GOODWILL

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Goodwill, gross 1,478 1,499

Less: impairment — —

Goodwill, net 1,478 1,499

The majority of goodwill which primarily relates to the acquisition of the Reebok business in 2006

is denominated in US dollars. A negative currency translation effect of € 27 million and positive

€ 45 million was recorded for the years ending December 31, 2009 and 2008, respectively.

The Group determines whether goodwill impairment is necessary at least on an annual

basis. This requires an estimation of the value in use of the cash-generating units to which the

goodwill is allocated. Estimating the value in use requires the Group to make an estimate of

the expected future cash flows from the cash-generating unit and also to choose a suitable dis-

count rate in order to calculate the present value of those cash flows. There was no impairment

expense for the years ending December 31, 2009 and 2008.

Future changes in expected cash flows and discount rates may lead to impairments of

the accounted goodwill in the future. For details see Statement of Movements of Tangible and

Intangible Assets Attachment I to these Notes.

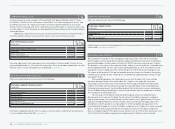

Trademarks and other intangible assets 13

Trademarks and other intangible assets consist of the following:

N

°-

1 3

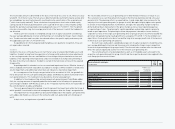

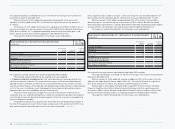

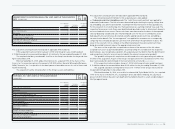

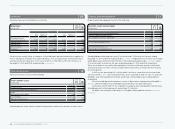

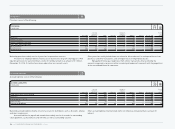

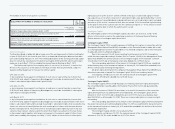

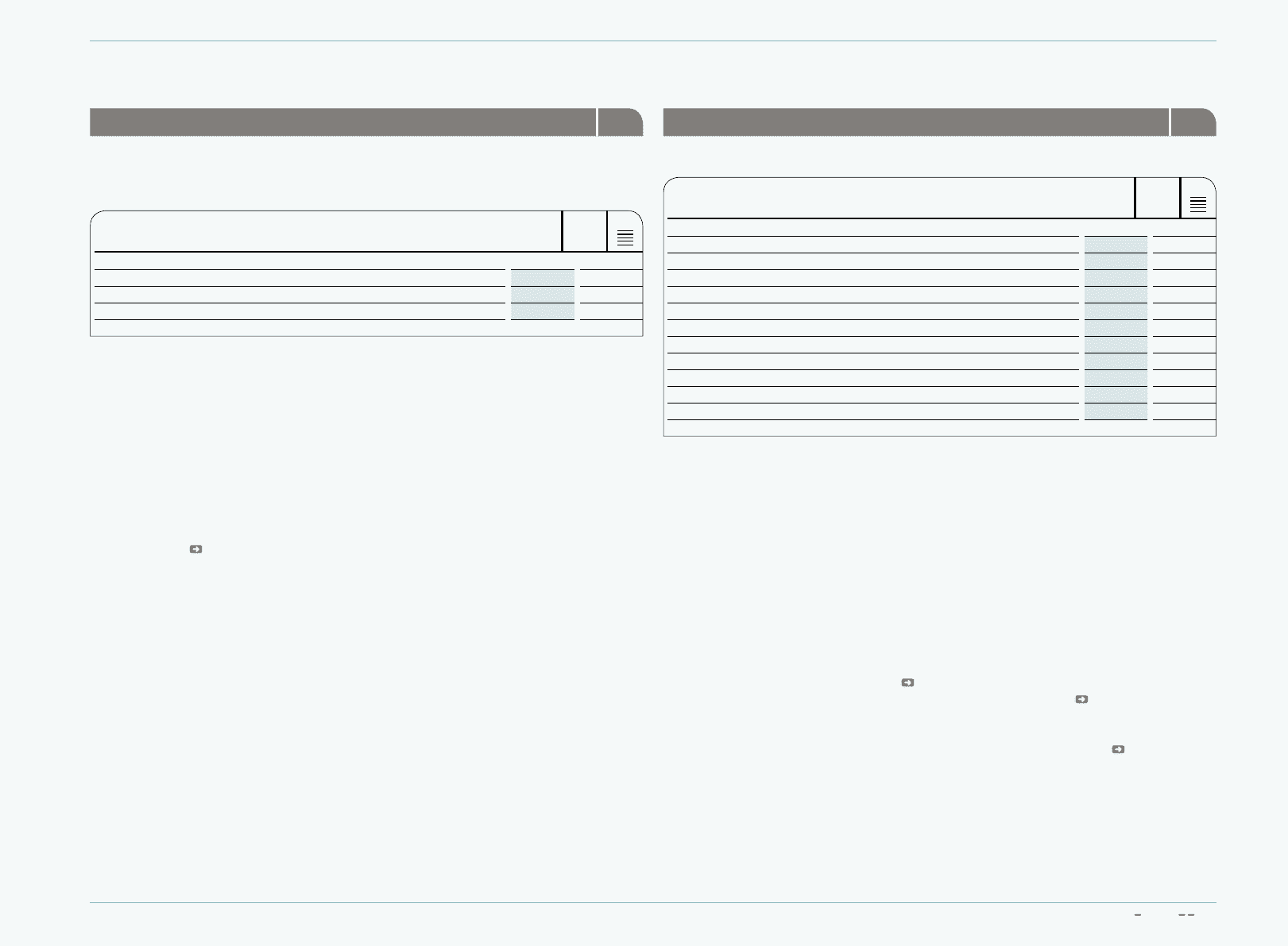

TRADEMARKS AND OTHER INTANGIBLE ASSETS

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Reebok 1,075 1,113

Rockport 152 157

Reebok-CCM Hockey 90 93

TaylorMade-adidas Golf 25 27

Trademarks, gross 1,342 1,390

Less: accumulated amortisation 0 0

Trademarks, net 1,342 1,390

Software, patents and concessions, gross 538 517

Less: accumulated amortisation 378 313

Other intangible assets, net 160 204

Trademarks and other intangible assets, net 1,502 1,594

At December 31, 2009, trademarks, mainly related to the acquisition of Reebok International Ltd.

(USA) in 2006 and Ashworth, Inc. in 2008, have indefinite useful lives. They were estimated to be

indefinite due to the high degree of continuing brand recognition.

The Group determines whether trademarks with indefinite useful life are impaired at least

on an annual basis. This requires an estimation of the fair value less costs to sell of the trade-

marks. Estimating the fair value less costs to sell requires the Group to make an estimate of the

expected future brand-specific sales and appropriate arm’s length royalty rates from the cash-

generating unit and also to choose a suitable discount rate in order to calculate the present value

of those cash flows. There was no impairment expense for the years ending December 31, 2009

and 2008.

Future changes in expected cash flows and discount rates may lead to impairments of the

accounted trademarks in the future.

Scheduled depreciation expenses were € 66 million and € 61 million for the years ending

December 31, 2009 and 2008, respectively see also Note 30. Impairment losses which are included

within depreciation and amortisation (shown in other operating expenses see also Note 30) were

€ 19 million and € 0 million for the years ending December 31, 2009 and 2008, respectively. These

are related to distribution rights, for which no future economic benefit exists.

For details see Statement of Movements of Tangible and Intangible Assets Attachment I to

these Notes.