Reebok 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

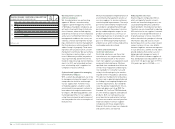

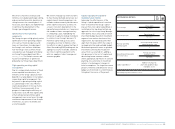

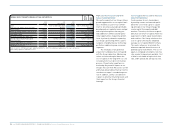

114 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Economic and Sector Development

N

°-

07

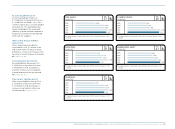

NET SALES

€ IN MILLIONS

2005 1 )

2006 2 )

2007

2008

2009

6,636

10,084

10,299

10,799

10,381

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

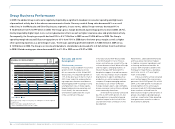

N

°-

08

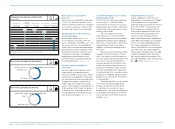

NET SALES BY QUARTER

€ IN MILLIONS

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

2,621

2,577

2,521

2,457

3,083

2,888

2,574

2,458

Sales in both the footwear and apparel

segments declined in Europe, albeit to a

different extent. We estimate that foot-

wear sales decreased at a low-single-

digit rate, whereas apparel sales were

probably down at a mid-single digit rate.

While selling volumes are expected to

be only slightly below prior year levels,

average selling prices declined consider-

ably. On a category basis, the European

market was positively impacted by growth

in the outdoor category, which, however,

could not offset lower sales in most other

categories.

North American sporting goods

industry suffers from tough retail

market

In the USA, sporting goods sales declined

due to the challenging retail environment

as retailers focused on keeping inven-

tory levels low amid lacklustre consumer

demand as well as store rationalisation.

While sales decreased in both footwear

and apparel, footwear sales were less

affected and are expected to have

declined at a low-single-digit rate. The

relative strength of this category was

mainly attributable to increasing average

selling prices, which partly offset lower

volumes. One of the contributors to

higher average selling prices was the

emerging toning category, which grew

at a strong double-digit rate during 2009.

According to our estimates, apparel

sales were down at a mid- single-digit

rate, as increasing demand for special

functional apparel such as compression

wear partly offset weakness in estab-

lished categories such as basketball and

lifestyle. Hardware sales, in particular

high price point equipment products such

as golf clubs, were negatively affected by

cautious consumer spending. Declining

average selling prices due to the highly

promotional retail environment added to

negative effects of lower volumes in this

category.

Growth of Asian sporting goods

industry slumps

The growth of the Asian sporting goods

industry decelerated compared to 2008,

primarily driven by considerably slower

expansion in emerging markets as well

as weak consumer spending in Japan.

In particular, sporting goods sales in

Greater China were negatively impacted

by the clearance of high excess inven-

tories accumulated in the aftermath of

the Olympic Games held in Beijing in

2008 and subdued consumer demand at

the beginning of the year. We assume that

sporting goods retail sales in China grew

at a mid-teens rate, which represents a

significant deceleration compared to the

prior year.

In Japan, industry sales were influ-

enced by the country’s steep economic

recession and its spillover effects on

consumer spending, especially in the

first half of the year. Weak private con-

sumption caused the overall industry to

decrease at a high-single-digit rate with

similar declines in footwear and apparel

sales.

Latin American sporting goods market

resilient against macroeconomic trend

In Latin America, according to our

estimates, the sporting goods industry

developed better than the general

economy. Even though growth momen-

tum slowed compared to the prior year,

sporting goods sales remained more

resilient against the downward trend in

the macro economic environment, with

growth in both footwear and apparel.

adidas Group and competitors suffer

from weak economic environment

adidas Group revenues as well as those

of many competitors and retailers

decreased in 2009. However, in some

regions sales of our Group and other

major sporting goods companies

declined more significantly than GDP.

Increasing unemployment rates and

subdued consumer spending contributed

to this development.