Reebok 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

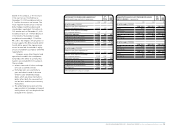

144 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Risk and Opportunity Report

Industry consolidation risks

The adidas Group is exposed to risks

from market consolidation and strate-

gic alliances amongst competitors and/

or retailers. This can result in a reduc-

tion of our bargaining power, or harmful

competitive behaviour such as price

wars. Abnormal product discounting and

reduced shelf space availability from

retailers are the most common potential

outcomes of these risks. Sustained pro-

motional pressure in one of the Group’s

key markets could threaten the Group’s

sales and profitability development.

To moderate this risk, we are com-

mitted to maintaining a regionally bal-

anced sales mix and continually adapting

the Group’s distribution strategy. The

negative real economy effects from the

economic downturn and the uncertain

outlook for 2010 are expected to put

further pressure on the sporting goods

industry to consolidate. Moreover, with

improving credit market conditions the

merger and acquisition environment

is expected to improve slightly. Many

retailers and competitor positions have

weakened due to declining sales and

earnings during the prior year. Therefore,

we continue to see risks from market

consolidation as having a high likelihood

of occurrence. We continue to view the

potential impact on both Group sales and

profitability as medium.

Political and regulatory risks

Political and regulatory risks include

potential losses from expropriation,

nationalisation, civil unrest, terrorism

and significant changes to trade policies.

In particular, the adidas Group faces

risks arising from sudden increases of

import restrictions, import tariffs and

duties that could compromise the free

flow of goods within the Group and from

suppliers.

To limit these risks, we proactively

utilise a regionally diversified supplier

base which establishes a certain protec-

tion against unforeseen changes in regu-

lations and also allows us to shift produc-

tion to other countries at an early stage if

necessary see Global Operations, p. 88.

At the end of 2008, nearly all

apparel-specific safeguard measures

against China expired based on the

World Trade Organization (WTO) acces-

sion agreements. However, various

governments sought protection against

footwear imports by applying trade

defence instruments, such as anti-

dumping measures, on a broader scale.

For example, Brazil and Argentina

recently introduced higher import duties

on footwear imports from China on a pre-

liminary basis. These duties are expected

to negatively impact our gross margin in

2010. Similarly, in December 2009, the

European Union extended the existing

anti-dumping measures against leather-

upper footwear from China and Vietnam

for a period of fifteen months.

As a result of heightened protectionist

activity by governments, we now

regard the risk of further political and

regulatory actions as having a medium

probability of occurrence versus a low

probability in our prior year assessment.

An unexpected significant change in the

political and regulatory environment

could have a medium potential financial

impact.

Legal risks

The adidas Group is exposed to the risk of

claims and litigation for infringement of

third-party trademark, patent and other

rights. To reduce this risk, new product

technologies, designs and names are

carefully researched to identify and avoid

potential conflicts with the rights of third

parties. We have further strengthened

our Intellectual Property department

resources to drive enhancements in our

patent portfolio, and in the reviewing and

analysis of third-party patents.

Due to the safeguards in place, we

believe there continues to be a low likeli-

hood of our Group infringing third-party

trademark or patent rights in a material

way. Nevertheless, we continue to believe

that litigation could have a medium finan-

cial impact on our Group.