Reebok 2009 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

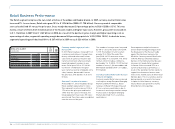

136 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW BUSINESS PERFORMANCE BY SEGMENT Retail Business Performance

N

°-

06

N

°-

07

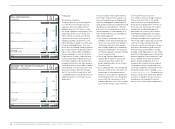

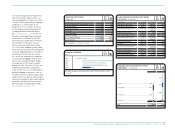

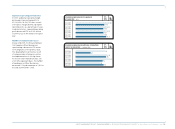

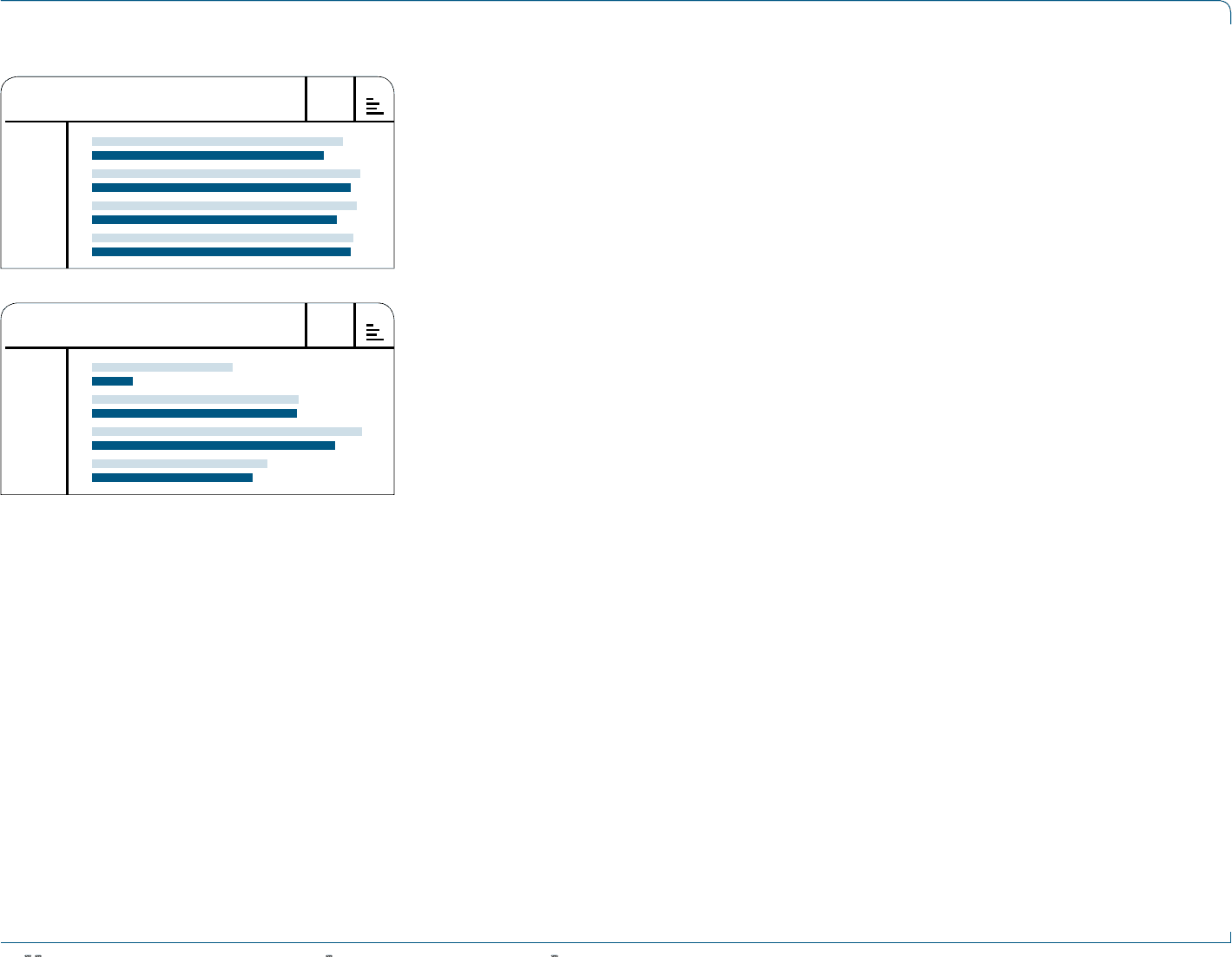

RETAIL GROSS MARGIN BY QUARTER

IN %

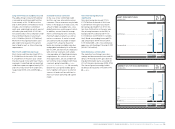

RETAIL OPERATING PROFIT BY QUARTER

€ IN MILLIONS

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

58.9

54.5

63.0

60.8

62.2

57.6

61.5

60.7

58

17

85

84

111

100

72

66

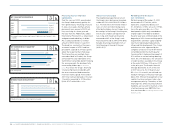

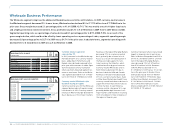

Currency-neutral sales from other

retail formats increase 28%

Revenues from other retail formats

include adidas and Reebok concession

corners and e-commerce operations.

In 2009, sales from other retail formats

increased 28% on a currency-neutral

basis. Growth was driven by improve-

ments in both concession corners and

e-commerce. In euro terms, revenues

from other retail formats increased 27%

to € 68 million in 2009 from € 54 million

in 2008. Currency-neutral comparable

sales from other formats increased 20%.

adidas and Reebok branded

Retail sales increase

In 2009, adidas Group Retail sales

increased at both adidas and Reebok.

Currency-neutral adidas Sport

Performance sales increased 5%.

Currency-neutral adidas Sport Style

revenues grew 20% in the period.

Currency-neutral Reebok sales were

7% higher compared to the prior year.

Comparable store sales at the adidas

brand declined at a high-single-

digit rate, whereas Reebok sales

decreased at a low-single-digit rate.

Currency translation effects positively

impacted revenues in euro terms.

adidas own-retail sales increased

10% to € 1.567 billion in 2009 from

€ 1.430 billion in 2008. Own-retail sales

of Reebok branded products also grew

10% to € 339 million in 2009 (2008:

€ 307 million).

Retail gross margin negatively

impacted by currency devaluation

effects

Gross margin in the Retail segment

decreased 2.9 percentage points to

58.6% in 2009 from 61.5% in 2008. This

was mainly due to effects from the

devaluation of the Russian rouble and

higher input costs. In Russia, sales were

negatively impacted by the devaluation

of the Russian rouble against the func-

tional currency, the US dollar, whereas

cost of goods sold remained largely

unaffected. The vast majority of these

costs are denominated in US dollars.

Gross margin declined across all store

formats. By brand, adidas gross margin

declined 2.7 percentage points to 60.9%

(2008: 63.6%) and Reebok’s gross margin

decreased 3.8 percentage points to 48.1%

(2008: 51.9%). As a result of the sales

increase, however, Retail gross profit

increased 4% to € 1.116 billion in 2009

from € 1.069 billion in 2008.

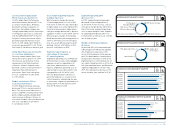

Segmental operating costs

as a percentage of sales up

1.8 percentage points

Segmental operating costs in Retail pri-

marily relate to personnel and logistics

expenses as well as the sales working

budget. Segmental operating costs as

a percentage of sales increased 1.8 per-

centage points to 44.5% (2008: 42.7%).

This was a result of the expansion of the

Group’s store base. In euro terms, seg-

mental operating costs increased 14% to

€ 849 million in 2009 from € 742 million

in 2008.

Segmental operating profit

decreases 18%

In 2009, segmental operating margin

decreased 4.8 percentage points to

14.0% (2008: 18.8%). This was a result

of the gross margin decline and higher

segmental operating costs as a percent-

age of sales. In absolute terms, segmen-

tal operating profit decreased 18% to

€ 267 million in 2009 versus € 326 mil-

lion in the prior year.

Retail employee base grows

On December 31, 2009, the Group

employed 19,599 people in Retail

operations. This represents an increase

of 11% versus 17,614 employees at the

end of the prior year. The increase in

the number of employees relates to the

expansion of the Group’s store base. The

vast majority of employees are employed

on a part-time basis. On a full-time

equivalent basis, the number of people

employed in Retail increased 1% to

15,252 at the end of 2009 (2008: 15,168).