Reebok 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

External and Industry

Opportunities

Favourable macroeconomic and

fiscal policy changes

Since we are a consumer goods com-

pany, consumer confidence and spend-

ing can impact our sales development.

Therefore, better than initially forecasted

macroeconomic developments and fiscal

policy changes which support increased

discretionary private consumption can

have a positive impact on our sales

and profitability. In addition, legislative

changes, e.g. with regard to the taxation

of corporate profits, can positively impact

Group profitability.

Growing importance of sports

to fight obesity

Governments are increasingly promoting

living an active lifestyle to fight obesity

and cardiovascular disease. According to

the World Health Organization, around

400 million people were considered

obese in 2005. A further 1.6 billion more

were estimated to be overweight. These

numbers are projected to increase to

700 million and 2.3 billion respectively

by 2015. Once considered a problem

only in affluent nations, obesity is also

becoming an issue in countries with

low per capita income. This develop-

ment has serious health consequences

and a dramatic effect on health care

expenditures. As a result, governments

and non- governmental organisations

are increasing their efforts to promote

a healthy lifestyle and encourage sports

participation. Given our strong market

position, in particular in categories

considered suitable for weight loss such

as training, running and swimming, we

expect to benefit from this trend.

Ongoing fusion of sport and lifestyle

The border between pure athletics

and lifestyle continues to blur as sport

becomes a more integral part in the lives

of more and more consumers. People

want to be fashionable when engaging in

sporting activities without compromis-

ing on quality or the latest technological

advances. At the same time, performance

features and styles are finding their way

into products meant for more leisure-

oriented use. We estimate the global

sports lifestyle market to be at least

three times larger than the performance

market. This development opens up addi-

tional opportunities for our Group and

our brands – which already enjoy strong

positions in this market.

Emerging markets as long-term

growth drivers

According to estimates by the United

Nations, the global population is pro-

jected to grow from currently 6.8 billion

to 7 billion by the end of 2012 and is

estimated to surpass 9 billion by 2050.

A large portion of this growth is being

driven by emerging economies. Rising

employment rates and real incomes

and a growing middle class are fuelling

these economies – and subsequently our

industry. Sports participation in most

of these countries has historically been

lower than in industrialised countries.

We expect sports participation rates

to increase over time with increasing

leisure time, investment in infrastructure

and the broadening of awareness of the

benefits of physical activity. In addition,

European and North American sporting

goods brands are often seen as easily

accessible, affordable luxury goods

which presents an additional growth

opportunity.

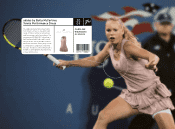

Women’s segment offers

long-term potential

In our opinion, the women’s sports

market is one of the most attractive

segments in the sporting goods industry

with women accounting for more than

a third of total spending on athletic

footwear. Our Group still generates the

majority of its revenues in men’s and

unisex categories. The adidas Group

will continue to invest in developing

women-specific product offerings in

both performance and lifestyle that

emphasise female individuality,

authenticity and style. Examples today

include adidas by Stella McCartney,

EasyTone™ footwear at Reebok, and the

Women’s Burner® 09 at TaylorMade.

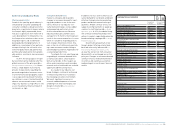

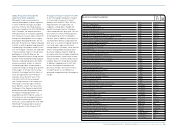

N

°-

06

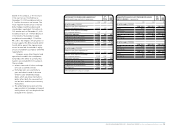

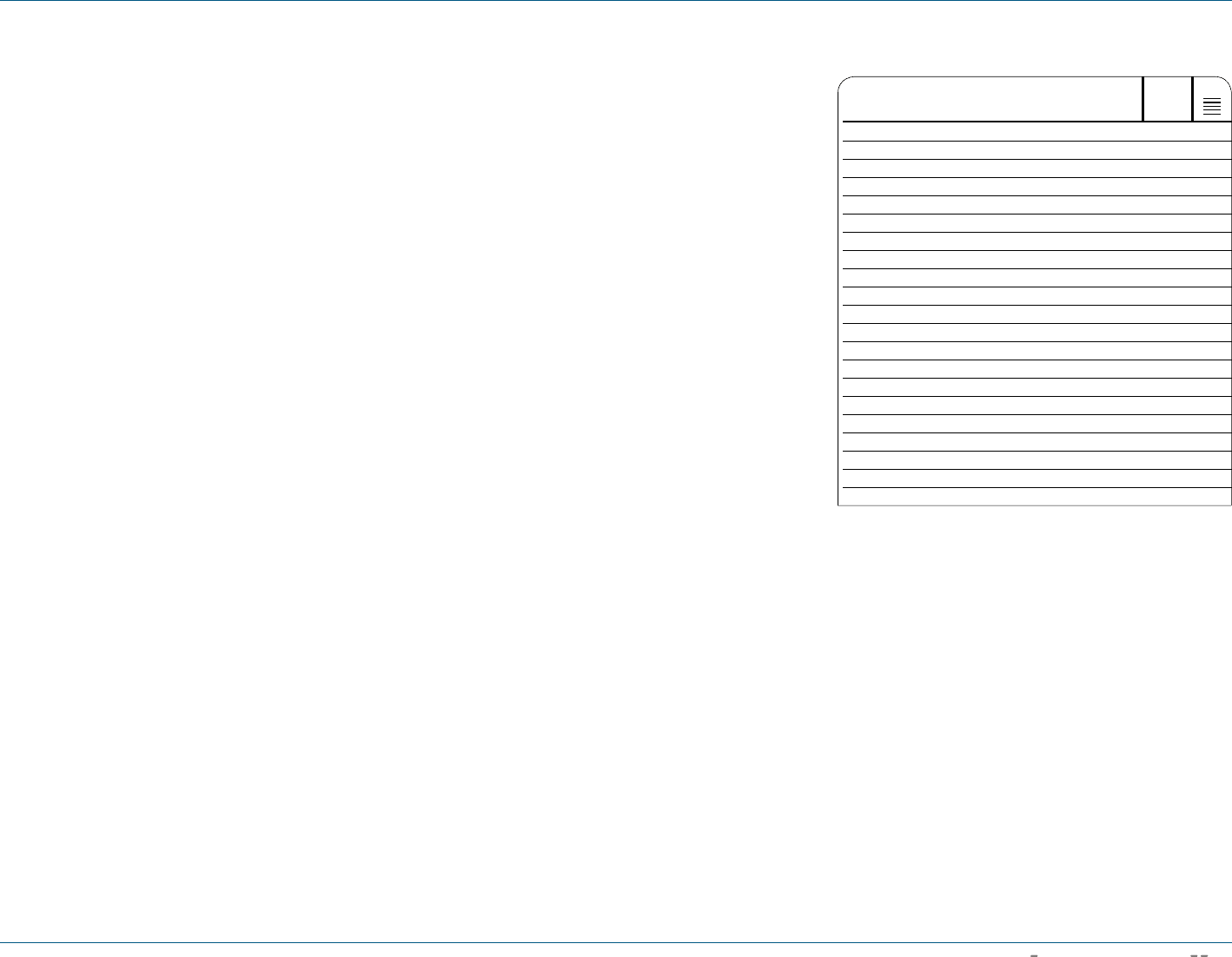

CORPORATE OPPORTUNITY OVERVIEW

External and industry opportunities

Favourable macroeconomic and fiscal policy changes

Growing importance of sports to fight obesity

Ongoing fusion of sport and lifestyle

Emerging markets as long-term growth drivers

Women’s segment offering long-term potential

Increasing consumer demand for functional apparel

Growing popularity of “green” products

Strategic and operational opportunities

Strong market positions worldwide

Multi-brand approach

Personalisation and customisation replacing mass wear

Exploiting potential of new and fast-growing sports categories

Breaking new ground in distribution

Cost optimisation drives profitability improvements

Financial opportunities

Favourable financial market changes

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Risk and Opportunity Report 153