Reebok 2009 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

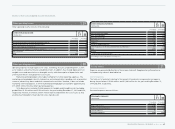

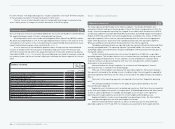

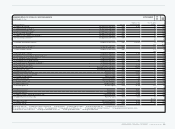

204 CONSOLIDATED FINANCIAL STATEMENTS Notes

For 2009, the line “non-deductible expenses” includes tax benefits of in total € 57 million related

to the favourable resolution of foreign tax disputes for prior years.

The line ”losses for which benefits were not recognisable and changes in valuation allow-

ances” mainly relates to changes in valuation allowances of the US tax group.

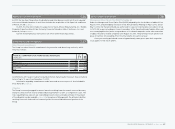

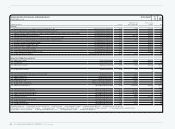

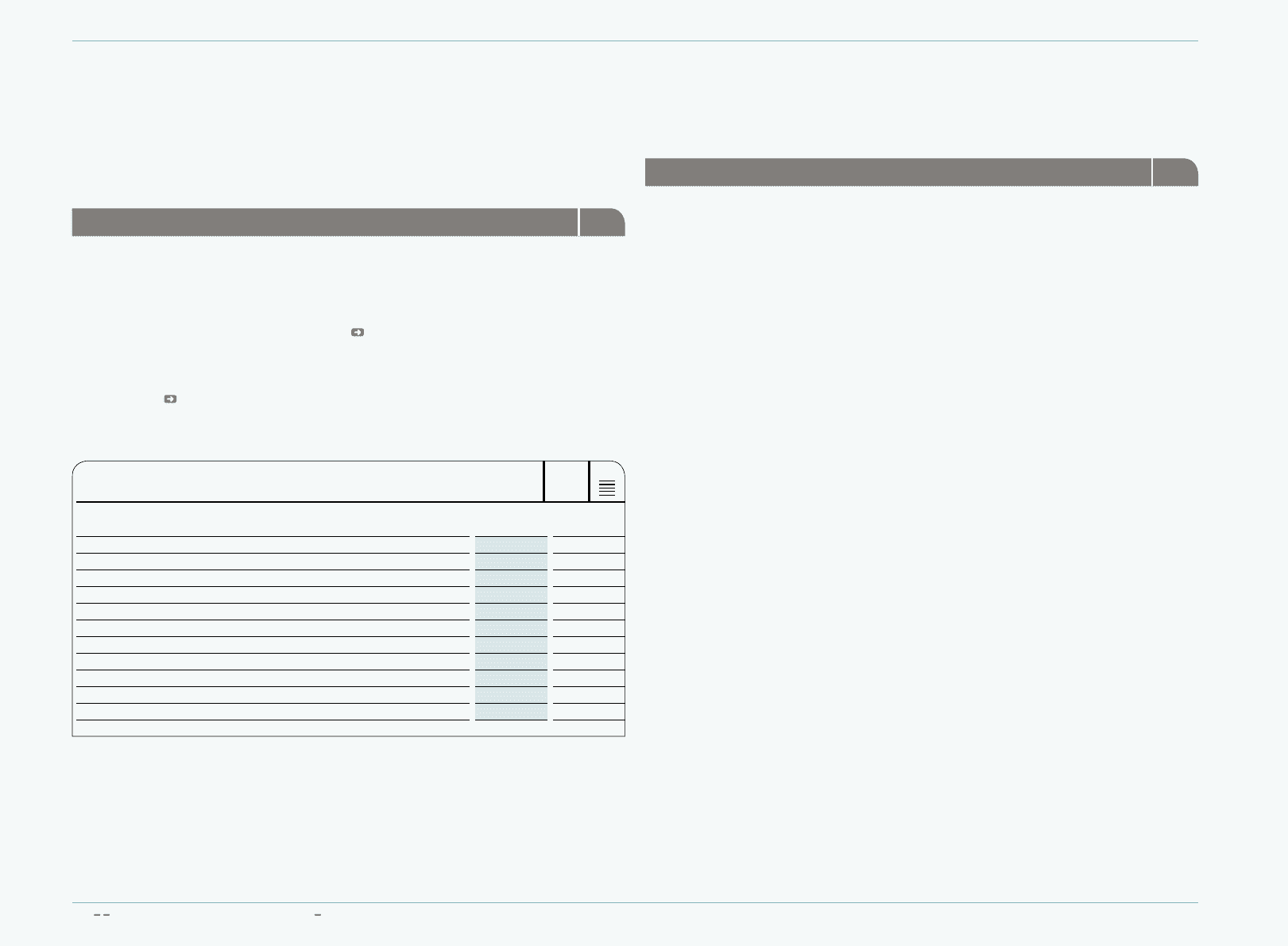

Earnings per share 34

Basic earnings per share are calculated by dividing the net income attributable to shareholders by

the weighted average number of shares outstanding during the year.

Dilutive potential shares arose under the Management Share Option Plan (MSOP) of adidas

AG, which was implemented in 1999. As the required performance criteria for the exercise of the

stock options of all tranches of the share option plan have been fulfilled, dilutive potential shares

impact the diluted earnings per share calculation see Note 38.

It is also necessary to include dilutive potential shares arising from the convertible bond

issuance in October 2003 in the calculation of diluted earnings per share of the financial year

2009 (until conversion) and 2008 as the required conversion criteria were fulfilled at the balance

sheet date 2008 see Note 17. As a result, the convertible bond is assumed to have been converted

into ordinary shares and the net income is adjusted to eliminate the interest expense less the tax

effect.

N

°-

34

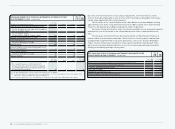

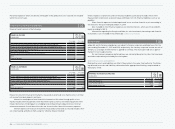

EARNINGS PER SHARE

Year ending

Dec. 31, 2009 Year ending

Dec. 31, 2008

Net income attributable to shareholders (€ in millions) 245 642

Weighted average number of shares 196,220,166 197,562,346

Basic earnings per share (in €) 1.25 3.25

Net income attributable to shareholders (€ in millions) 245 642

Interest expense on convertible bond, net of taxes (€ in millions) 10 13

Net income used to determine diluted earnings per share (€ in millions) 255 655

Weighted average number of shares 196,220,166 197,562,346

Weighted share options 34,369 86,542

Weighted assumed conversion convertible bond 12,983,564 15,684,315

Weighted average number of shares for diluted earnings per share 209,238,099 213,333,203

Diluted earnings per share (in €) 1.22 3.07

Notes – Additional InformationNotes – Additional Information

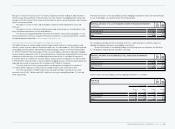

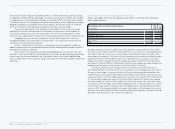

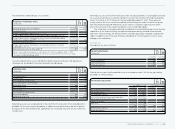

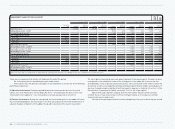

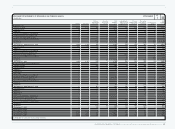

Segmental information 35

The Group operates predominately in one industry segment – the design, distribution and

marketing of athletic and sports lifestyle products. Due to the Group’s reorganisation in 2009, the

Group’s internal management reporting has changed. In accordance with the definition of IFRS 8,

six operating segments have been identified: Wholesale, Retail, TaylorMade-adidas Golf, Rockport,

Reebok-CCM Hockey and Other centrally managed brands. According to the criteria of IFRS 8 for

reportable segments, the first two are reported separately while the other four are aggregated

under “Other Businesses” due to their only subordinate materiality. The reportable segments

Wholesale and Retail correspond with the presentation in the internal reporting.

The adidas and Reebok brands are reported under the segments Wholesale, Retail and Other

centrally managed brands. The operating segment TaylorMade-adidas Golf contains the brands

TaylorMade, adidas Golf and Ashworth. Rockport and Reebok-CCM Hockey were formerly part of

the Reebok segment.

Certain centralised Group functions do not meet the definition of IFRS 8 for a reportable

operating segment. This includes functions such as central treasury, worldwide sourcing as well

as other headquarter departments. Assets, liabilities, income and expenses relating to these

corporate functions are presented together with other non-allocable items and intersegment

eliminations in the reconciliations.

Information about the Group’s segments, in accordance with Management’s internal

reporting structure, is outlined on the following page.

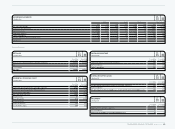

There are no intersegment sales between the reportable segments. Transactions between

the segments are based on the dealing-at-arm’s-length principle. Accounting policies applied for

reporting segmental information are the same as those used for the adidas Group as described in

Note 2.

The results of the operating segments are reported in the line item ”Segmental operating

profit”.

The chief operating decision maker for the adidas Group has been defined as the joint

Executive Board of adidas AG.

Segmental assets include accounts receivable and inventories. Only these items are reported

to the chief operating decision maker on a regular basis. Scheduled depreciation and amortisation

as well as capital expenditures for tangible and intangible assets are part of the segmental

reporting, even though segmental assets do not contain tangible and intangible assets.

Segmental liabilities contain accounts payable from operating activities. No other liability

items are reported regularly to the chief operating decision maker.

Interest income and interest expenses as well as income taxes are not allocated to the

reportable segments. In 2009 and 2008, no companies are accounted for by the equity method.