Reebok 2009 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

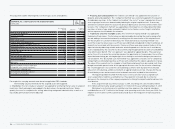

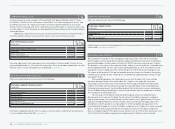

182 CONSOLIDATED FINANCIAL STATEMENTS Notes

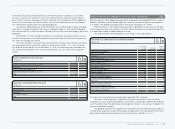

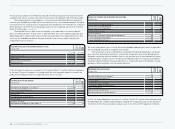

Inventories 09

Inventories by major classification are as follows:

N

°-

09

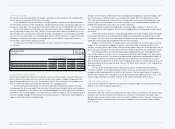

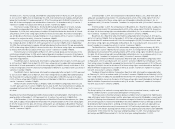

INVENTORIES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Gross

value Allowance for

obsolescence Net

value Gross

value Allowance for

obsolescence Net

value

Finished goods and

merchandise on hand 1,197 73 1,124 1,463 82 1,381

Goods in transit 317 — 317 566 — 566

Raw materials 26 2 24 40 2 38

Work in progress 6 — 6 10 — 10

Inventories 1,546 75 1,471 2,079 84 1,995

Goods in transit mainly relate to shipments of finished goods and merchandise from suppliers in

Asia to subsidiaries in Europe, Asia and the Americas. The carrying amount of inventories which

are measured at fair value less cost to sell amounts to € 355 million and € 407 million as at

December 31, 2009 and 2008, respectively see also Note 2.

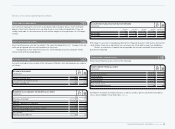

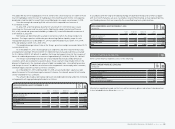

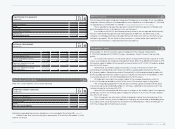

Other current assets 10

Other current assets consist of the following:

N

°-

1 0

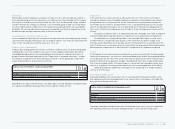

OTHER CURRENT ASSETS

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Prepaid expenses 208 292

Tax receivables other than income taxes 84 82

Sundry 72 130

Other current assets, gross 364 504

Less: allowance 4 2

Other current assets, net 360 502

Prepaid expenses relate mainly to promotion agreements and service contracts as well as rents.

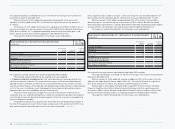

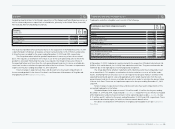

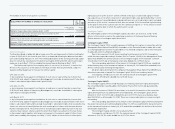

Property, plant and equipment 11

Property, plant and equipment consist of the following:

N

°-

1 1

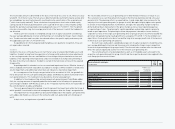

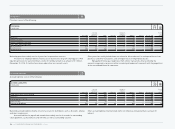

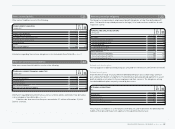

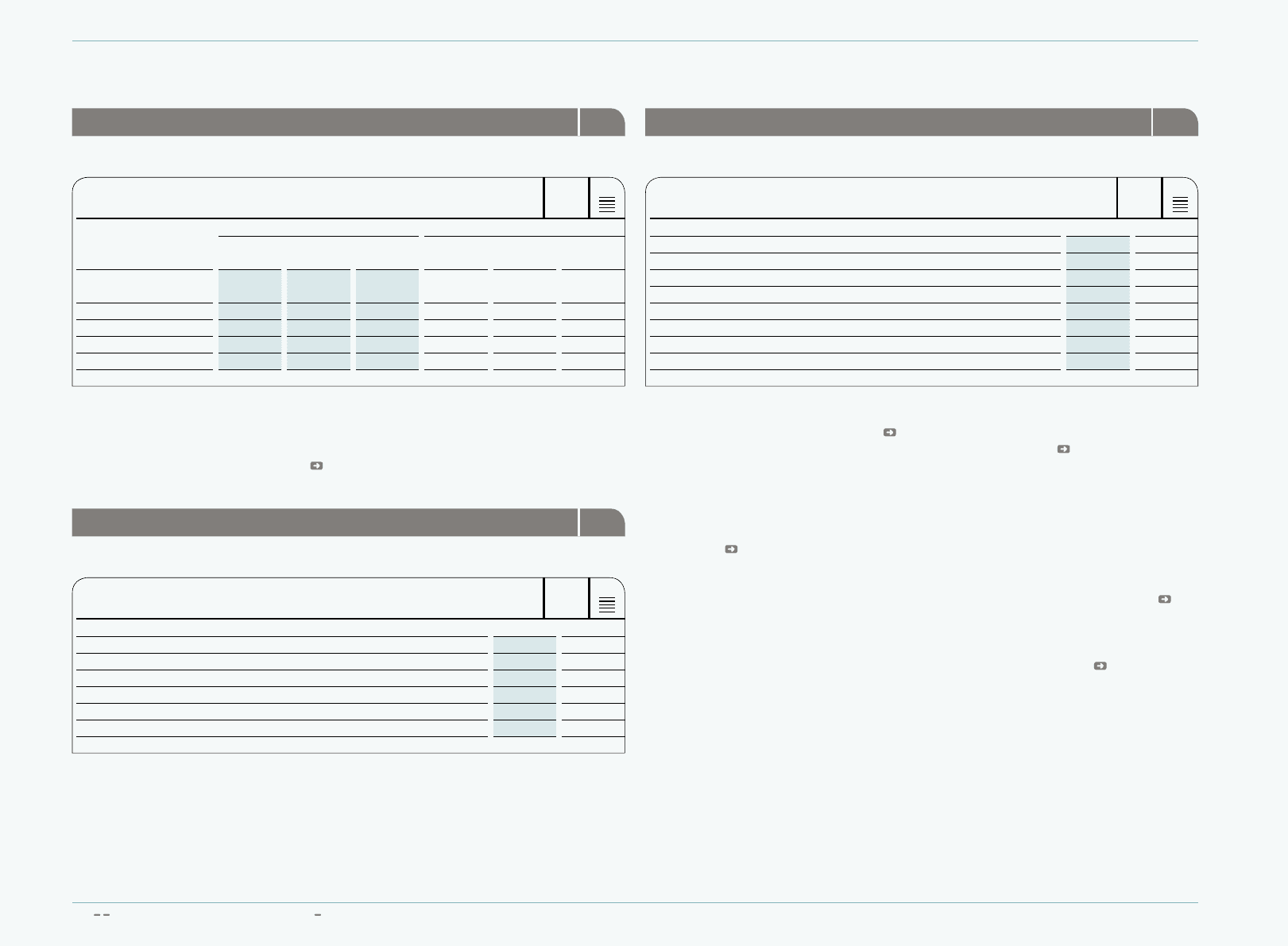

PROPERTY, PLANT AND EQUIPMENT

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Land and buildings/Leasehold improvements 380 489

Technical equipment and machinery 156 140

Other equipment, furniture and fittings 876 847

1,412 1,476

Less: accumulated depreciation 757 656

655 820

Construction in progress, net 68 66

Property, plant and equipment, net 723 886

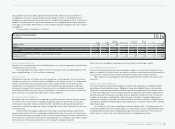

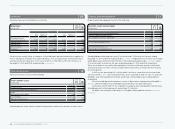

Scheduled depreciation expenses were € 198 million and € 165 million for the years ending

December 31, 2009 and 2008, respectively see also Note 30. Impairment losses which are included

within depreciation and amortisation (shown in other operating expenses see also Note 30) were

€ 16 million and € 6 million for the years ending December 31, 2009 and 2008, respectively.

These are related to assets within other equipment, furniture and fittings, mainly in the Group’s

own-retail activities, for which contrary to expectations there will be an insufficient flow of future

economic benefits.

In 2009, assets amounting to € 2 million and € 0 million in connection with the unrealised

sale of assets see Note 3 were transferred from “assets classified as held-for-sale” to “land and

buildings” and “other equipment, furniture and fittings” within property, plant and equipment,

respectively.

The reclassified depreciation expenses consist of depreciation subsequently reflected see

also Note 3 and the formerly reclassified depreciation which has now been taken back.

Contractual commitments for the acquisition of property, plant and equipment mainly relate

to building projects in Herzogenaurach amounting to € 68 million.

For details see Statement of Movements of Tangible and Intangible Assets Attachment I to

these Notes.